Surprise, surprise!

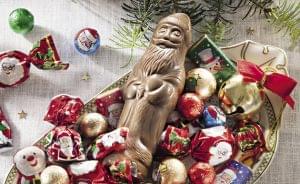

In 2021 Easter was a strong period for seasonal confectionery products, and value sales increased by double-digit numbers before Christmas too.

Lilla Kelemen

brand manager of seasonal products and pralines

Nestlé Hungária

Lilla Kelemen, Nestlé Hungária Kft.’s brand manager of seasonal products and pralines: “Sales of pack products and calendars grew the fastest. The latter segment underwent a premiumisation process, as sales shifted in the direction of more expensive products. Hollow chocolate figures – Easter bunny and Santa Clause – are the most popular by far. Milk chocolate products dominate, as the main target group are children, but recently more flavoured and enriched products have appeared in the market.”

Easter is likely to show the way

Easter 2022 brought 25% higher volume sales in comparison with 2021, but a new trend was that private label (PL) sales grew above the market average in almost every segment, as shoppers turned more price-sensitive. Ms Kelemen opines that it is quite possible that seasonal confectionery sales trends will be similar to the Easter trends at the end of the year.

Nikolett Jantász

junior brand manager of pralines and seasonals

Mondelēz

Nikolett Jantász, Mondelez Hungária Kft.’s junior brand manager of pralines and seasonals (Czech Republic, Hungary, Slovakia): “It is difficult to tell how shoppers will react to the sharp price increase of recent months. I think this is a rather atypical category, so consumers are willing to pay a higher price for products just to have a nice Christmas.”

Pál Molnár

sales manager

Szerencsi Bonbon

Pál Molnár, Szerencsi Bonbon Kft.’s sales manager: “The present situation has a multiplier effect on global demand and consumption. Global competition for the money of consumers is strengthening, while the purchasing power of national currencies is decreasing.” He added that luckily shoppers got to like affordable, high quality, stylish and traditional Christmas candies and other seasonal confectioneries.

Conscious brand building work pays off

Nestlé is building the KITKAT brand with great care, season after season, and this hard work is very well manifested in sales performance: before Christmas 2021 sales grew twice as fast in the seasonal category. Ms Kelemen called attention to the fact that KITKAT seasonal products are gluten-free. Last Christmas the company entered the Christmas candy segment with the BOCI brand. Nestlé is preparing for this winter holiday season with entering new segments with the SMARTIES brand. From BOCI new products can be expected in the hollow figure segment, but there will be new Christmas candy innovations as well.

Mondelez believes that the most important categories – Christmas candy, hollow figure, Advent calendar, selections, etc. – will continue to grow. The company comes out with new innovations every year. Mondelez will step into the Christmas candy segment with a new chocolate brand, surprising shoppers very much.

Quality adapted to the trends

For Szerencsi the top Christmas products are Christmas candy, desserts and chocolate tablets, in terms of both sales performance and innovation work. The premiumisation of the Szerencsi brand has continued, and the recent elevation of prices didn’t bring this process to a halt; on the contrary, it actually intensified, as basically it is impossible to find really cheap confectioneries in the shops these days.

With the COVID-threat blurring consumers do ever more long for quality pampering in a good sense

Szerencsi uses the best quality 40% milk chocolate and 70% dark chocolate in production. Their innovation work is in line with market trends (health trend, conscious shoppers, popular gluten-free products). The company feels that they need to demonstrate the traditional high quality of products with the higher consumer expectations of our days in mind.

Quality comes first in the Christmas candy segment

Mariann Rácsai

head of sales

Lissé Édességgyár

Lissé Édességgyár Kft.’s sales performance was 30% better in 2021 than in the previous year. Last year the company launched two filled Christmas candies (Poppy Seed Bread Pudding and Golden Dumplings), which are made without added sugar. Head of sales Marianna Rácsai: “Golden Dumplings was a huge success among shoppers, and the product finished second in the sugar-free category of the Christmas Candy of the Year competition, which is organised by the Association of Hungarian Confectionery Manufacturers. We are working on new Christmas candy innovations. All of our filled Christmas candies are gluten-free.”

Sándor Sánta

managing director

CHOCCO Garden

Chocco Garden Kft.’s jelly-filled Christmas candy won in the last 3 years in the jelly category of the competition mentioned above. CEO Sándor Sánta: “We are concentrating on the distribution of this product in 2022 too. Two thirds of Christmas candy sales are realised by jelly-filled products, so we are strengthening our portfolio: with two jelly-filled Christmas candies, and a banana mousse and a strawberry mousse product.” //

Growing demand for seasonal sweets

According to the NielsenIQ retail index, sales of seasonal (Christmas and Easter) confectioneries represented a value of nearly HUF 12bn in June 2021-May 2022. This value was 22% bigger than in the same period a year earlier. Volume sales were up 14% at almost 2,000 tonnes.

Guest writer:

Katalin Séra

senior analyst

NielsenIQ

Easter confectionery products were responsible for 54% of category sales, while Christmas sweets’ share was 46%. Branded products had an 82% share in value sales, but sales of private labels grew faster, at 26% (vs. 22% for branded confectioneries). Milk chocolate seasonal products realised 90% of sales. Size-wise 56-110g products were the most popular – they were responsible for one third of total sales. //

This article is available for reading on pp 28-31 of Trade magazin 2022.08-09.

Related news

KitKat F1 car icon

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >PURINA ONE HYDRALIFE

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

The Store of the Future opens again at the SIRHA Budapest exhibition! (Part 1)

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >