More than just “mash for babies”

Growing selection of organic products

NielsenIQ data reveal that in the last few years the baby food category had strengthened because of the pandemic, then in 2022 the market returned to the pre-2020 level.

Rita Bazsó

marketing manager

Univer Product

Rita Bazsó, marketing manager of Univer Product Zrt.:

“2022 was a balanced year for the Univer brand, as it remained market leader in spite of private labels strengthening their positions.”

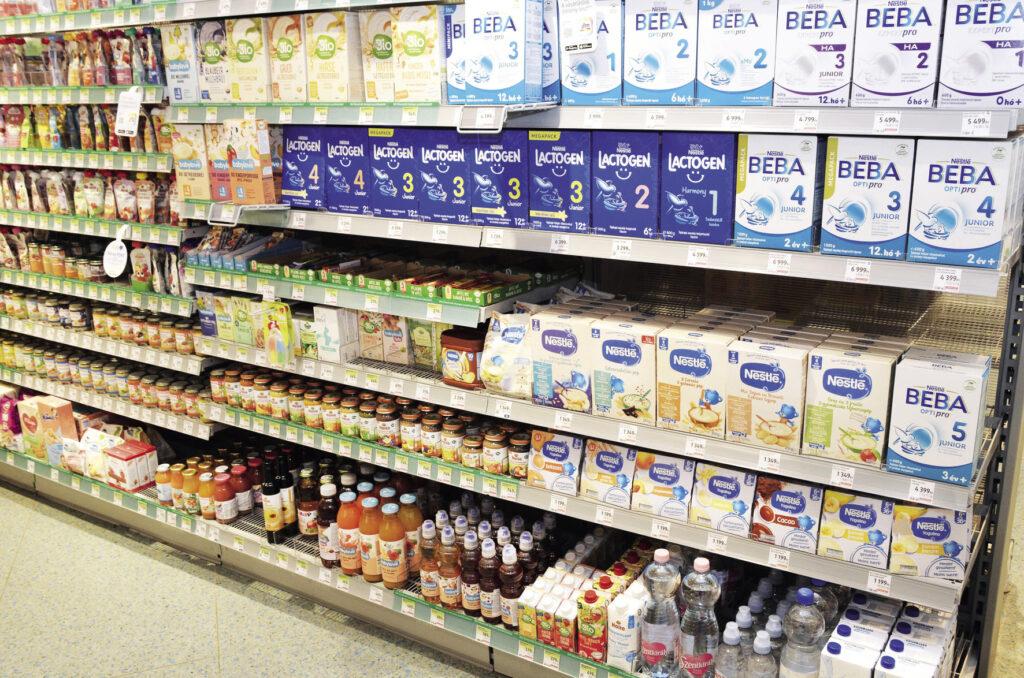

Hypermarkets lost some of their share in baby food sales, while drugstores managed to increase their sales share. Discount supermarkets are also important places for buying baby food. In packaging spout pouches are slowly conquering the category, but glass jars are still the most popular.

Fruit flavours are the most popular from Univer Product Zrt.’s baby foods, but the oatmeal containing foods that hit the shops last year are also selling well. Rita Bazsó revealed that Univer is now putting bigger emphasis on manufacturing organic products.

Spout pouches are slowly conquering the category, but glass jars are still the most popular

Fluctuating sales results

In early 2022 baby food sales jumped, in part thanks to people and charities buying more to help the families escaping from Ukraine. Then in the second half of the year high inflation and the diminishing real income of consumers had a negative influence on sales. On average baby food prices augmented by more than 18%.

Noémi Makai

marketing manager

Hipp

Noémi Makai, marketing manager of Hipp Termelő és Kereskedelmi Kft.:

“Hipp baby foods are well-known among mothers for their high quality, while Kecskeméti is a traditional baby food brand that is close to Hungarian mothers’ hearts, so both brands were able to hold on to their market share, even in these difficult conditions.”

New innovative products such as fruit purées in spout pouch packaging or tray menus for babies older than 1 year are the engines of sales growth – sales of these developed above the average. One of the most recent trends in other European countries is that not only fruit purées, but also baby menus, vegetable purées and foods with meat are sold in practical spout pouch packaging.

A rich source of nutrients

Discounters are slowly but steadily conquering the breakfast product category. Private label products are dominant in this segment.

Szilvia Hajduvári

marketing manager

Cerbona

Szilvia Hajduvári, marketing manager of Cerbona Élelmiszergyártó Zrt.:

“We are absolute market leaders in the muesli bar category, beating even the private label products.”

This spring two new Cerbona breakfast cereals appeared on store shelves, cocoa rice flakes and caramel corn flakes, plus the three already existing products in the segment got a new look. The marketing manager added that children really like muesli bars.

Baby water can be given to babies without boiling, and this is also very practical when mothers have to prepare baby formula or food.

András Palkó

marketing director

Coca-Cola HBC

Magyarország

András Palkó, marketing director of Coca-Cola HBC Magyarország:

“Baby water sales are steadily growing in the domestic natural mineral water market. Coca-Cola Magyarország entered the segment in 2022, with Naturaqua Babavíz.

“Adult” nutrition trends like lactose-free, vegetarian and plant-based, also infiltrate into the baby food segment

Balanced composition

Naturaqua Babavíz is mineral water for babies from a depth of 685m, exploited in Zalaszentgrót. It has a really pleasant taste, thanks to its balanced mineral composition; the water’s mineral content is 627mg/l. Babies and small children can drink Naturaqua Babavíz without boiling. The product is available in 1-litre size, in bigger supermarkets and Rossmann and Müller drugstores.

In early 2022 new legislation was passed, which specifies what criteria mineral waters must meet to be called baby water.

Tünde Csabai

senior brand manager

Szentkirályi Magyarország

Tünde Csabai, senior brand manager of Szentkirályi Magyarország:

“According to NielsenIQ data, because of the economic situation the baby water category contracted in 2022, so we consider it a big success that Szentkirályi Magyarország was able to grow with this product, in comparison with 2021.”

Szentkirályi Baba Mama still mineral water is one of the most popular baby water products. The company believes that educating consumers about the products for babies and small children is of utmost importance.

New design

Jana’s popularity is stable in the baby water category.

Anikó Mochnács

category manager

Orbico Hungary

Anikó Mochnács, category manager of Orbico Hungary Kft.:

“One-litre Jana baby water is getting a new packaging in 2023. From our portfolio 1-litre products are the most popular by far, but 0.33-litre waters in practical sports cap bottle packaging also sell very well.”

There is great potential in the steadily growing fruit juice, nectar and drink (FJND) category for children, where branded products make up more than 90% of the category.

Anna Kisházi

marketing manager

Sió-Eckes

Anna Kisházi, marketing manager of Sió-Eckes Kft.:

“What we see in both the total FJND category and the children’s products segment is that sales have shifted towards shops with a smaller floor space in the last few years.”

More than 50% of sales by products targeting children are fruit drinks, but 100% fruit purées are also popular: value sales of these increased by more than 40%.

The FJND segment shows a constantly rising tendency

Expanding portfolio

2022 was a milestone year for Sió, as after many years the company revamped and relaunched the Sió Vitatigris brand. Following the renewal a 40% sales growth occurred, thanks to which the market position of Sió Vitatigris remained the second strongest among branded FJND products for children. In 2023 the company continues building the Sió Vitatigris portfolio. They are getting ready to launch a new flavour, which will be available in 0.2-litre size. One of the most important FJND product characteristics is good taste, together with the diversity of flavours and formats. Sugar content is also something consumers pay special attention to. Vitamin content can be an added value and it can be decisive in which products shoppers choose to purchase.

New, innovative products like spout pouch fruit purees and menus for kids over one year keep gaining momentum

Fluorescent stickers

Kubu is the market leader in the category of branded children’s drinks, and sales increased in comparison with the previous year. Kubu Waterrr flavoured waters came up with the best performance.

Vilmos Várkonyi

group brand manager

Maspex Olympos

Vilmos Várkonyi, group brand manager of Maspex Olympos Kft.:

“This year’s new product from the brand is the watermelon flavour, which is very popular among children.”

Last year Kubu Püré fruit purées hit the shops in two new flavours, under the Tízórai name. Classic 0.3-litre Kubu products got a limited edition new label, under which there are space-themed fluorescent stickers in the first half of the year.

Rauch Hungária is present in the children’s fruit drink category with the Yippy brand. These fruits drinks are available in six flavours, in PET bottle packaging.

Anett Polyák

trade marketing

manager

Rauch Hungária

Anett Polyák, trade marketing manager of Rauch Hungária Kft.:

“Sales grew above the average last year and this proves that the brand is very popular among mothers and children alike.”

90 per cent of kids drinks are branded products

Recycling is a factor

Márton Vecsei

senior brand manager

SWISS LABORATORY

Márton Vecsei, senior brand manager of SWISS LABORATORY:

“Our observation is that small-sized products absolutely dominate in the children’s drink segment, and this creates a competitive edge for us. Sustainability and healthy ingredients are also decision-making factors for shoppers, further improving the positions of SWISS Laboratory, as our products are made of carefully selected ingredients, and they are available in infinitely recyclable aluminium cans.”

At the end of 2022 SWISS LABORATORY completely revamped the SWISS Laboratory brand, and the brand’s KIDS product was involved in this renewal. //

The article is available for reading Trade magazin 2023/4.

Related news

KSH: industrial production decreased by 0.2 percent in October

In October, the volume of industrial production fell by 0.2…

Read more >Nébih: Müller recalled organic poultry sausages

Due to the risk of deterioration before the expiration of…

Read more >Rossmann ended the year with charity

This year, Rossmann Hungary also provided support to many needy…

Read more >Related news

Recognition of Consumer Protection Excellence: Honoring the Best of 2024

This year’s outstanding consumer protection officers and special award recipients…

Read more >The Joy of Giving! – SPAR stores collect non-perishable food for people in need

The Hungarian Maltese Charity Service and SPAR Hungary have launched…

Read more >KSH: industrial production decreased by 0.2 percent in October

In October, the volume of industrial production fell by 0.2…

Read more >