Eternal elegance

This article is available for reading in Trade magazin 2024/12-01

Dávid Gábor Kovács

marketing director

Zwack

“According to NIQ retail data, the whisky category grew by approximately 5% in the last 12 months. Price competition is strong in the high-volume premium brand category and consumers are sensitive to promotions”,

analyses Dávid Gábor Kovács, marketing director of Zwack.

In the past 2-3 years American and Irish whiskies strengthened their positions, but this trend seems to be reversing this year, with Scotch whisky sales starting to pick up again. Zwack’s No.1 whisky brand is Johnnie Walker Blended Scotch, one of the world’s best-known and best-selling Scotch whiskies. Johnnie Walker is the 4th biggest whisky in the retail market, with a nearly 14% market share. Zwack distributes several special Scotch malt whiskies, such as Singleton of Dufftown, Talisker and Caol Ila.

According to NIQ retail data, the whisky category has grown by around 5% in the last 12 months

In the premium category: whisky > gin + vodka

Rita Hruska

marketing director

Pernod Ricard

“The rise of American and Irish whiskies has been happening for a long time, mainly because of their easy-to-drink flavours, which have made them relevant to a wider consumer base. Japanese whiskies are more in the super-premium category and their popularity has been growing intensively in recent years, but they still represent only a small proportion of the whisky market”,

says Rita Hruska, marketing director of Pernod Ricard.

Pernod Ricard is a big player in the global whisky market, with a large portfolio in all major segments, and the company is the second largest distributor in the Scotch category with its Ballantines and Chivas brands. Ballantine’s Finest is the second biggest premium whisky in terms of volume sales. In Hungary the premium whisky segment is still larger in value terms than premium vodka and gin combined.

Attila Piri

marketing director

Heinemann

“Premiumisation continues to be characteristic of the whisky category internationally. The number and presence of Japanese whisky brands is growing internationally. Our portfolio includes several standard and premium whiskey brands, with Jim Beam Bourbon whiskey being the largest of these in both volume and value. Our premium American Kentucky whisky is Maker’s Mark”,

informs Attila Piri, marketing director of Heinemann.

In Hungary the whisky market has been Scotch whisky-driven for a very long time, but in 2017 Jim Beam became the market leader for the first time.

Barrels, flavours, preconceptions

Dr. Csaba Pipei

co-owner

Premirum

“Premirum, which focuses primarily on rum, distributes the American whiskey brand RY3 because of its rum ties, as the producer ages several of its batches in rum casks. RY3 is a premium quality rye whiskey”,

says Dr Csaba Pipei, co-owner of Premirum.

Experienced whisky drinkers are open to premium cask strength batches – we can see this from the steady increase in RY3 sales – which are sold mainly in speciality shops and the company’s webshop.

Gábor Dávid Kovács adds: the fact that the brands they distribute don’t make flavoured versions doesn’t mean that there is a lack of innovation.

Diageo’s master distillers experiment with unique distillation and barrel ageing solutions. A good example of this is Diageo’s malt whisky series Special Release, with 6-8 special batches of different distillers released each year. In recent years the premiumisaton trend reached the Hungarian market, coupled with stagnating volume sales in the alcohol market. HoReCa’s role and sales share is traditionally smaller for whiskies than for other spirit categories.

Reaching consumers

Rita Hruska believes all brands need to innovate, because consumers want new innovations. Flavoured varieties account for 10% of the total whisky market and one of this segment’s target group is young adults. This idea has also been confirmed by the successful launch of the Ballantine’s Wild cherry-flavoured whisky last year. Consumers are price-sensitive but also loyal, and in many cases this price-sensitivity is reflected in choosing another size: instead of the classic 0.7-litre they more often opt for the 0.5-litre format.

Attila Piri points out that feedback from HoReCa outlets is that consumption of the standard category isn’t increasing. With flavoured whiskies they see that the share of flavours for a single brand can reach 15-20% of the volume sales of the base product. Strengthening premiumisation is a market feature, which may be associated with a drop in category sales: consumers are looking for premium products, but are enjoying less of these. //

Whisk(e)y and innovation

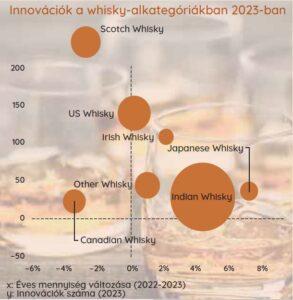

According to the IWSR Innovation Tracker, the spirits category is the place where the most new products are launched among alcoholic beverages, and Scotch whiskies are the absolute leaders in terms of number of innovations. Scotch whisky has been the subject of more than half of all global whisky innovations each year for the past decade, and it remained the most active category in 2023.

//

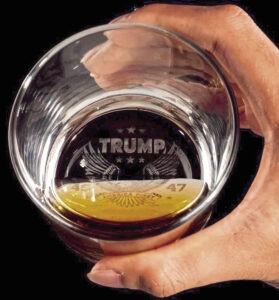

Presidential tariffs

According to trade magazine Drinks International, the news of Donald Trump’s re-election has sparked fears in the spirits industry, driven by the possibility of further tariffs. During Trump’s first term in office the president imposed punitive duties on Scotch whisky imports between October 2019 and March 2021, at an extra cost of GBP 600m, according to the Scotch Whisky Association. The next review of the duty rules is going to be in June 2026. //

//

Related news

World of spirits 2026

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Demand For No-Alcohol And Functional Drinks On The Rise, Says IWSR

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

(HU) METRO Gasztro Fesztivál a SIRHA Budapesten – Élmény, inspiráció és valódi megoldások a HoReCa-szakmának

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >