Going against the PRICE flow

Tünde Turcsán, GfK’s FMCG director gave a presentation at the Business Days conference on Wednesday.

Tünde Turcsán

FMCG-director

GfK

She told that there is no household in Hungary today that isn’t worried about the present situation. 95% are anxious because of the rising prices, 93% feel the same about the country’s economic situation, and 81% are concerned about the growing gas and electricity prices.

Economising and trying to buy smarter

At the end of May 92% of Hungarian households said they would economise in the next 1-2 months. What is good news for the FMCG sector is that this product category isn’t the first in which consumers are trying to spend less – that is eating in restaurants, going to the cinema and holidays; number two is clothing, and the third one is home renovation. Only 25% of respondents said they would try to save money on groceries and drug products. In general households monitor their spending more closely than before (96%), and 50% said they replaced some products on their shopping list with cheaper ones. Shoppers are also trying to buy smarter, 92% purchase products in promotion more often and 68% compare prices.

GfK Consumer Panel monitors the shopping data of more than 4,000 households, and GfK supplemented this with a special questionnaire survey in mid-October 2022. The study that comprises the results will tell what is on the minds of consumers in the present crisis situation, and what the attitudes of shoppers are. It puts households into three categories, such as “affected” (11%), “worrying” (59%) and “resistant” (30%). //

Price matters more than taste and freshness

For many years taste and freshness were the top product choice factors from the 25 that GfK audits, but recently price has become much more important in buying decisions – 78% of respondents said so. Promotions also strengthened their positions, plus one third of consumers pay more attention to products made from natural ingredients, and to choosing eco-friendly and Hungarian-made groceries (30%).

In the last few months spending by households grew below the level of the inflation. However, shopping frequency started to grow again in the last 3-4 months, and spending per shopping was also up, although the double-digit growth in this respect was driven by soaring prices (24% increase in the total FMCG market). In July 2022 like-for-like sales increased by 14.5%, shopping frequency grew and spending per shopping occasion was 12% more than one year earlier, but it remained below the inflation.

Discounters and baskets

The structure of retail is transforming: discounters continue their expansion. It must be noted that only discount supermarkets, supermarkets and drugstores were able to increase sales by more than the 14.5% average value sales growth in the FMCG sector. As for the shopping mission, it can be seen clearly that the proportion of large baskets dropped and there are more and more small baskets (21.7% of shopping trips instead of last year’s 20%). We go shopping more often, and we don’t just buy less but also fewer product categories.

Analysing the volume of products bought at category level, what we see is that in May-July 2022 two thirds of categories produced lower volume sales than one year earlier. It is even worse news that 22% of categories (33 from the 147 audited by Gfk) suffered a double-digit volume sales loss this year.

It depends on the category

For food essentials, the major price increase was accompanied by volume growth, mainly because of the sales performance of groceries with a price cap on them; but at the same time a downtiering has also occurred, which didn’t have the same influence on the different categories, e.g. pet food sales hardly decreased and there was no major downtiering either in this category; what is more, in the alcoholic drink category actually there is an uptiering process going on. //

Related news

Aldi targets 20 new store locations across the UK

Aldi has unveiled an updated list of priority locations across…

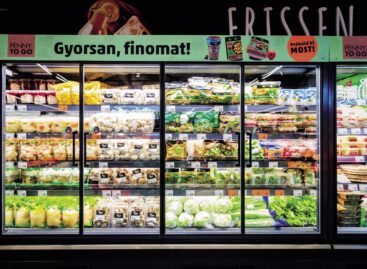

Read more >Customer experience and sustainable solutions: PENNY’s successful year

In 2024 PENNY Magyarország focused on preserving customer trust by…

Read more >Lidl holds on to its market leader position – they celebrated 20 years in Hungary last year

Last year Lidl celebrated 20 years in Hungary by investing…

Read more >Related news

Dr Tamás Kozák: “High inflation casts a long shadow”

Our magazine asked Dr Tamás Kozák, general secretary of the…

Read more >Retail trade walking on a new path

Bence Gerlaki, state secretary for taxation, consumer protection and trade…

Read more >A turnaround in promotions – brands are returning, but only with a discount?

At the April meeting of the Trade Marketing Club (TMK)…

Read more >