Business Days 2017: focusing on the channels (Part 2)

István Matus

Zsuzsanna Hermann

On Thursday Trade TV continued the broadcast, but before work started in the macroeconomic section, Trade magazin’s editor-in-chief Zsuzsanna Hermann and István Matus, member of Chain Bridge Club’s board of trustees took the floor. They introduced the ‘Join us and be the mentor of a secondary school student with us!’ programme.

Sándor Baja

Following this Sándor Baja, managing director or Randstad in Hungary, Czech Republic and Romania grabbed the microphone as the moderator of the morning section. He started out with a presentation about the reasons of the workforce shortage and outlined a few possible solutions to the problem. He thinks that there are still people in the below 24 and above 50 age groups who can be brought back to the labour market. Salaries can only be increased in Hungary if work efficiency also improves. The managing director stressed that the employer brand needs to be filled with real content, which requires knowing one’s employees very well!

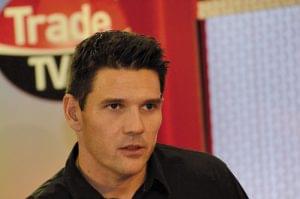

Aleksandre Tutberidze

Aleksandre Tutberidze, research analyst of Euromonitor International spoke about global consumer and retail trends. He revealed that since 2008 more than 50 percent of the GDP has been produced by the developing countries; Western Europe and North America have been unable to realise significant economic growth. The research analyst also introduced the so-called fickle consumer, who isn’t loyal to brands anymore and is less influenced by ads.

Kateryna Edelshtein

Kateryna Edelshtein, managing director of AC Nielsen analysed the situation of hypermarkets and drugstores. She told that shoppers arrive with a list. Hypermarkets are the place where the focus is on taking care of the family, and it isn’t about the food only: ‘I can buy everything I need in the same shop.’ As for drugstores, they are the place where customers care about themselves.

Erik Vágyi

Erik Vágyi, research director of Kantar-Hoffmann spoke about the brand equity and image perception of hypermarkets. He explained that shoppers know much more than we would think. They know exactly what are the strengths and weaknesses of different retail chains. Mr Vágyi believes that the good communication strategy for hypermarkets is building emotional ties with customers and targeting them with consistent messages.

Zoltán Fekete

Zoltán Fekete, general secretary of Branded Goods Association Hungary differentiated between facts and ‘alternative facts’ when talking about the topic of double standards and differences in quality. He told that it could often be heard this year in Hungary that multinational food companies are selling their products in worse quality in Central and Eastern Europe. He explained why this isn’t true and used the results of comparative tests to illustrate his opinion. The difference in product ingredients has to do with the taste preferences of consumers in a given region. Mr Fekete opined that the food industry needs to act together and tell consumers: multinational companies don’t bring ‘poor quality’ here, on the contrary, they take ‘high quality’ abroad, by exporting products made from Hungarian ingredients.

Anita Mekler

Anita Mekler, a PricewaterhouseCoopers partner gave a presentation about where young Hungarians would like to work, and about the different factors that make them join a certain company. She told that PwC conducted an employer branding survey (2016-2017) in Hungary, with 13,000 respondents from the 16-26 age group. They used the results to build an interactive database, which companies can use to word more precise employer brand messages and to develop new recruitment and HR strategies.

Dr. Ágnes Fábián és Ottó Németh

Following the lunch break Mr Fekete returned as the moderator of the roundtable discussion, the topic of which was innovation as an important element of manufacturer brands. Dr Ágnes Fábián, managing director and president of Henkel Magyarország and Ottó Németh, the company’s marketing director spoke about the role of innovation in Henkel’s strategy. They told that the company’s spends 2-3 percent of its sales revenue on research and development. Henkel operates 22 research centres worldwide and all of them specialise in a different field. Jean Grünenwald, former managing director of Nestlé Hungária sent a video message to the participants of the conference: he said good bye after three years in Hungary; he moved on to work for the company overseas.

György Sóskuti

After this György Sóskuti, sales director of Nestlé shared the company’s credo with the audience: Good food, good life. Nestlé has more than 2,000 brands all over the world and sells 1 billion products every day. He stressed that in Hungary – just like in other markets – they can reach consumers if they team up with partners.

Péter Szautner

Péter Szautner, CEO of FrieslandCampina and Ferenc Szecskó, the company’s marketing director shed light on some interesting facts and trends in the dairy sector.

Ferenc Szecskó

They told that in the last 5-6 years milk production augmented by 18 percent in Hungary. Unfortunately, sales of dairy products didn’t follow this dynamics. In Hungary per capita dairy product consumption is 170kg a year, while in Europe it is 215kg, so there is room for improvement.

György Galántai

László Niklós, managing director of the Coca-Cola Company and György Galántai, sales director of Coca-Cola HBC introduced the brand’s new-type communication strategy.

László Niklós

They do brand building at every level, working together with vloggers who have 60,000-70,000 views per video. The company gives each product its individual image, a very good example of this is the new Fanta bottle. They have a team which only deals with online communication.

Zoltán Poór

A brief commercial break came next in the programme of Trade TV, which was followed by a debate show, moderated by Chain Bridge Club member Zoltán Poór. Rossmann managing director László Flórián told in his presentation that they realised a two-digit sales growth this year. He underlined the fact that despite being a multinational company, in Hungary they were successful with basically local marketing.

László Flórián

They concentrated on four areas: simplifying the product selection, positioning the chain higher, communicating the drugstore’s strengths and modernising shops.

Dávid Donkó

Product of the Year research director Dávid Donkó spoke about how winning the prize influences product sales and consumer opinion. They teamed up with GfK to find the answer to these questions: a follow-up survey revealed that a bigger proportion of those shoppers who had noticed winning the prize tried and regularly purchased the product; what is more, more of these consumers thought that the winner product was innovative than those who didn’t notice that it had won Product of the Year.

Dr. Péter Boros

Laurel managing director Dr Péter Boros brought a few examples to illustrate how efficiency can be increased in the checkout zones of stores. He told that they are very proud of their innovative communication system: when it was introduced in a 400m² store in the United Kingdom, store staff had to walk 45km less in just one month! Demand is also growing for self-service checkouts, as it is more and more difficult to recruit workers these days.

Szilárd Szelei

Szilárd Szelei, CEO of JCDecaux talked about the future of offline advertising. JCDecaux, the world’s market leading out-of-home advertising company is present in 76 countries of 5 continents. He reckons that the share of online advertising will grow, but offline marketing tools are also ahead of great development, in terms of both quantity and technology. Advertisements placed on the street are capable of brand building, they reach masses of people and carry emotional messages.

Mariann Józsa

After the excellent presentations it was time for a roundtable discussion. Mariann Józsa, managing director of dm told: they had a very good year and sales grew by two-digit numbers. The drugstore chain’s ‘active beauty’ loyalty programme now boasts 1.4 million card holders.

István Korbély

István Korbély, owner of EuroFamily and Napcsillag revealed that they realise a two-digit sales growth every year; in 2017 sales were up 20 percent.

Le Thanh Huyen

Le Thanh Huyen, owner of Azúr Drogéria informed that they had started in wholesale in 1991 and entered the retail market in 2014. She also reported a two-digit sales growth.

Gergő Tőkei

Gergő Tőkei, store manager of AUCHAN shared the news that last year they had started their home delivery service and from this year the service is available all over Budapest. In the autumn Auchan opened its first Hungarian supermarket in Szekszárd.

In the evening talk show host Szilvia Krizsó welcomed real celebrity guests and asked them about their relationships with companies, in connection with advertising campaigns. Claudia Liptai told: she knows that she is difficult to sell, because her personal brand is strong. Her cooperation with Milka is a real labour of love. Attila Árpa added that he had said no to many campaigns. He said that Rossmann was special because in the first television commercial he was featured together with his daughter. Attila Till joked that he was still waiting for his first major advertising campaign. He told that working with Mastercard was very successful – it is the kind of brand he likes, a major company with style that doesn’t do large-scale campaigns, they focus on YouTube instead.

Szilvia Krizsó, Attila Till, Claudia Liptai, Attila Árpa

György Jaksity

Friday morning’s Trade TV news roundup was focusing on e-commerce and the discount supermarket channel. But first György Jaksity, president of Concorde gave a presentation about the problems that make it very difficult for Hungary’s economy to become more competitive. The country has left the 2008 recession behind by now and even produced some growth. Mr Jaksity pointed it out that tax and social security contributions are the highest in the region and the third highest if all OECD countries are considered – for both employers and employees – and there is the 27-percent VAT, which is also very high.

Bálint Zsinkó

The next speaker was Bálint Zsinkó, managing director of HD GROUP Communication Agency and member of the Chain Bridge Club was the host of the morning news programme. He told that e-commerce and the discount supermarket channel are the two most dynamically developing and the most innovative channels. Both channels need fewer workers than others and the recession of recent years did smaller damage to them than to other channels.

Rita Csillag-Vella

Rita Csillag-Vella, client service director of GfK analysed how the digital revolution influences retail trade. According to a study by Retail Planet, sales growth in e-commerce will be 18-percent per year until 2021. What is more, in their forecast discount supermarkets is the second most dynamically growing channel. The online channel’s share in FMCG retail is between 4 and 5 percent at global level.

Kálmán Majtényi

Kálmán Majtényi, deputy CEO of Hungarian Post gave a presentation about innovative solutions in parcel delivery. He explained that the 10-15 percent annual growth in online sales drives the development of logistic service providers. International trends show that the last kilometre is the crucial stage in parcel delivery, when the package is handed over to the buyer. In Hungary the proportion of parcel pick-up points is 28 percent. The deputy CEO talked about innovative solutions, e.g. how the Swiss Post uses robots that can deliver parcels up to 10kg within a distance of 6km.

Iván Rédey

In the near future Hungarian Post will install more parcel vending machines.Iván Rédey, member of the Association for E-commerce and managing director of Mall.hu used interesting data to illustrate how virtual and physical stores are in the midst of a kind of merger process. He told that the value of the full e-commerce market is HUF 427 billion. The channel’s share in total retail sales is 5.2 percent – smaller than in Western Europe. 4.6 million Hungarian consumers above the age of 18 have already bought something online. 84 percent of regular internet users have made an online purchase. The basket value is much higher online than in physical stores, on average HUF 13,000, but it varies across categories. 75 percent of consumers start the shopping process at price comparison websites or use one of the web search engines.

Tünde Turcsán

Tünde Turcsán, business development manager of GfK called attention to the new development direction of discount supermarkets. Aldi and Lidl have remained the most influential market players. With its expansion in Europe and the USA, Lidl is likely to become the world’s biggest discounter. Discounters keep realising development projects in order to increase their penetration level, primarily by expanding the trading area of stores and by enlarging their product assortment. The last programme aired on Trade TV in 2017 was a debate: a channel-specific roundtable discussing the state of play in FMCG e-commerce. Mall.hu managing director Iván Rédey informed that FMCG sales make up for only 14 percent of total online sales. Growth is smaller in this segment that in the total e-commerce sector. The most popular product categories are ‘beauty and health products’ and 80 percent of buyers still only pay for the goods when they are delivered. Laurel’s Dr Péter Boros was the moderator of the roundtable discussion. He underlined the fact that online sales only represent 0.5 percent of t FMCG stores’ total sales. He asked participants why and what kind of efforts are they making to improve online FMCG sales.

László Flórián, managing director of Rossmann told: they started online trading five years ago. About 15,000 different products – the drugstore chain’s total product selection – are available online too, with nationwide delivery.

Márk Szomolányi

Márk Szomolányi, digital and e-commerce director of Auchan added that they had launched their FMCG home delivery service last November. Since July 2017 they have been delivering everywhere in and around Budapest, with the company’s 100-lorry fleet.

Sándor Nagy

G’Roby managing director Sándor Nagy recalled how they had started out with one discount supermarket in 1992 and how they were forced to change their business model in 1998 when the big retailers entered the Hungarian market. They reacted to the new situation by starting their home delivery service.

Dr. Károly Práth

Dr Károly Práth, business development director of Online Príma spoke about how they updated their online shops and services one year ago. At the moment they deliver in Budapest and in about 60 towns and villages around the capital city. Approximately 7,000 different products are sold in the online shop.

Andrea Rácz-Fodor

Andrea Rácz-Fodor, online operations manager of TESCO shared their international experiences too. TESCO opened its first Hungarian online shop four and a half years ago. Presently they use 500 delivery lorries in Europe and can cope with 40,000-60,000 orders at a European level. Demand for the service has been great from day one. Mall.hu managing director Iván Rédey told: they have been present in the Hungarian market since 2005 as a member of a regional group. They have a 6,000m² warehouse in Budapest; the 60,000m² central automated warehouse is in the Czech Republic.

Péter Kurucz

The day’s programme ended with a presentation by Péter Kurucz, head of retail verticals at Nielsen and Krisztina Vatai, business development director of GS1 Hungary. They spoke about how important data quality is in retail. They produce quality content that is necessary for selling products online, transmitting it to the websites of retailers via a databank service. Retailers asked the company to add B2B data to this basically B2C service (product photos and descriptions), so they created a databank solution to satisfy this need. After this presentation Trade TV went off air, but the Business Days conference will return next year with a new theme. //

Superbrands Awards

Related news

Home or parcel machine? It’s been revealed how Hungarians order and what they fear most about delivery

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >A one-kilogram chocolate bunny, premium hams, cake specialties: this is what Easter will be like on the shelves of Auchan!

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Lightning-fast Auchan shopping with foodora!

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Amikor a megszámlálhatatlan megszámlálhatóvá válik

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >We took you on a flight! (Part 2)

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >