Unbeatable top 3 – The 2022 ranking of FMCG retailers is out now

Both the economy and the FMCG sector had an eventful past few years. New measures, a transformed market environment, and constantly changing shopper reactions…There wasn’t much we could get used to in 2022 – except for the continuous changes and the instability. It was in this business environment that the retail chains had to perform last year, and as a matter of fact they performed quite well. This year’s ranking has some surprises, but not in the top 3…

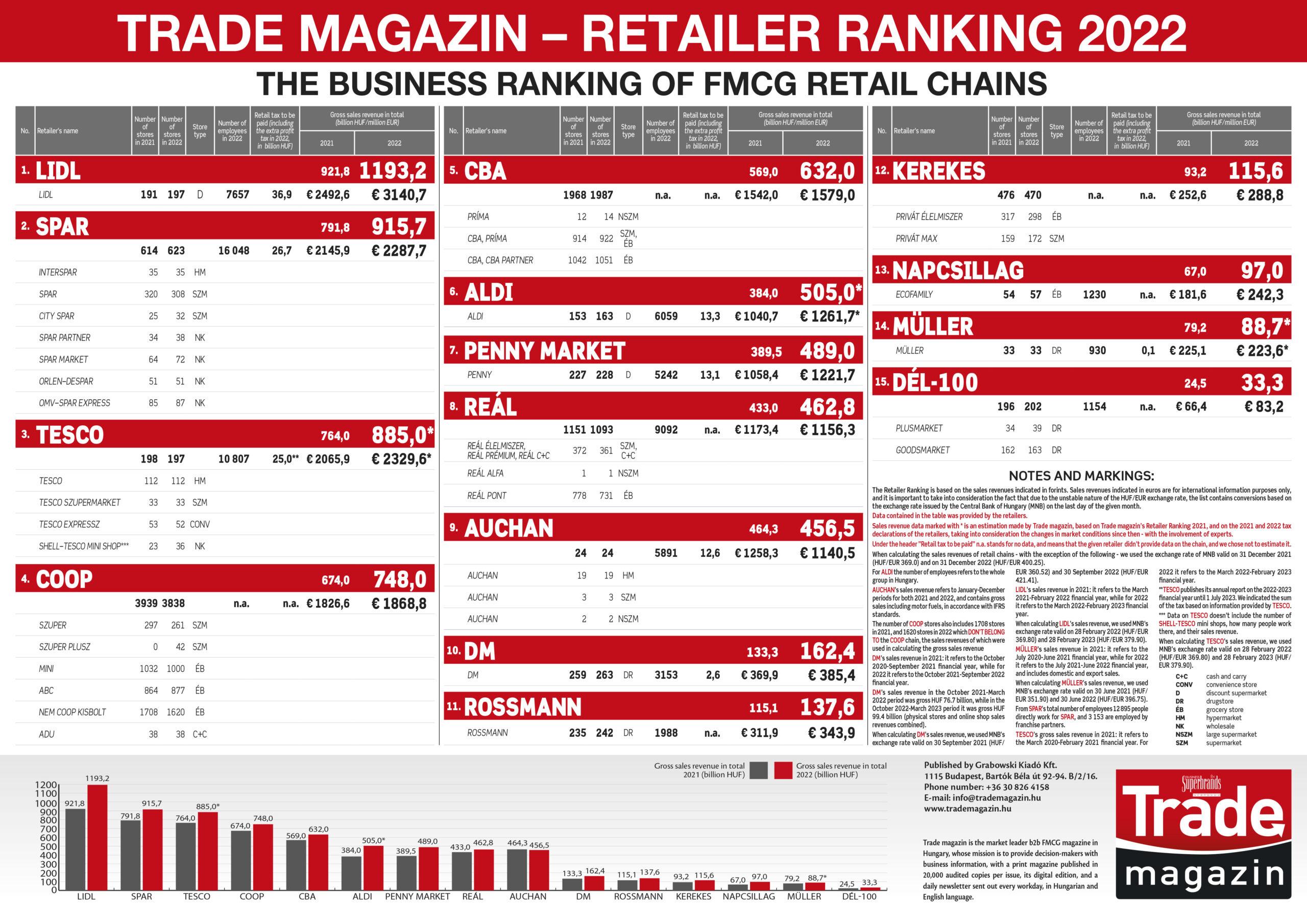

2022 was yet another year when discounters continued their superb performance. This is why it isn’t surprising at all that Lidl held on to the No.1 spot with a comfortable advantage. However, in the past the discounter trio of Lidl, Penny and Aldi used to finish the “race” in this order, but this time Aldi jumped from the 9th spot to the 6th position in the ranking, with an approximately 30% sales growth that was similar in size to Lidl’s. Thanks to this, Aldi has overtaken Penny, and even though the sales revenues are about the same, their store numbers differ significantly. It must be noted that Penny didn’t waste its time either, as the chain also took a step up and finished 7th in the ranking.

“This year our magazine ranked 15 retailers, more than in the previous years, as more and more firms reach the sales revenue that qualifies them for making it to the list” – says Zsuzsanna Hermann, CEO and editor-in-chief of Trade magazine, the publisher of the annual FMCG retailer ranking. “New players such as Kerekes, Napcsillag and Dél-100 had unprecedented years in terms of business success. If we take a close look at the sales growth of these “small” chains, what we see is stunning! This is true even if we are aware of the fact that high inflation boosted the sales revenues of every retail chain” – adds the editor-in-chief.

Let’s not forget that you can see gross sales revenues in the table – they are a far cry from the actual results, the profit and even from the net sales revenue! Looking at things from a business perspective, not only the sales prices have increased, but the different types of costs (operations, wages, purchasing prices, taxes…) too.

From the hypermarkets it was SPAR and Tesco who managed to keep their positions, and even if Auchan dropped from the 6th to the 9th place, we can’t argue with the fact that based on sales revenue and store number, Auchan proved to be the most efficient form all the retailers in the ranking.

Analysing the drugstores on the list a little, we are witness to a sales growth developing just as expected, and some of them stand out with a spectacular performance, such as the smallest chain Dél-100, which put the company on the list this year.

There has been no change in the “trinity” of the biggest Hungarian retail chains, so their order is the same as before, they all produced a double-digit sales growth too, but it is also true that this growth didn’t reach the level of the inflation. Probably the growth of the smaller Hungarian chains surprises everyone, as their numbers suggest there is an exceptionally successful business strategy in the background.

Zsuzsanna Hermann, Trade magazin’s CEO and editor-in-chief

“This year there are two new columns in the table” – informs Trade magazin’s CEO. “One of them shows the number of employees, with which we would like to call attention to the importance of how many people are working in the sector, as this is an issue that the Central Statistical Office (KSH) puts in the spotlight every year. The table reveals that multinational retailers alone were employing nearly 58,000 people last year” – explains Zsuzsanna Hermann. The other new column is for the retail tax – the importance of this needs no explanation. Data in the table informs that the tax contribution of multinational retail chains surpassed HUF 130 billion in 2022!

Let’s see the market research data

Many people have already told in many forums about 2022 that the Hungarian consumer confidence index kept worsening throughout the year, and the gap between Hungary and the European average is growing. As regards purchasing power, a Hungarian household has EUR 8,700 to spend, and this only makes the country 30th in the European ranking. Meanwhile the level of the food inflation climbed from 10% at the beginning of the year to 45% at the end of the year.

In 2022 the value of FMCG purchases by households was up 16.8%. Due to the rising prices, the main shopping influencing factor became the product price. This trend entailed a more important role for promotions too, especially in the last few months of the year. Shoppers focusing on the price has put discounters in an even better situation than before, with GfK data indicating further growth in their market share.

For the approximately 20,000 SKUs available in Hungarian grocery stores on a permanent basis in 2021-2022, the price hike was 54% – informed RetailZoom. Compared with 2020, this represents a 73% price increase. In this environment consumers resort to various saving strategies all the time. Last year they switched to bigger product formats, bought less per occasion but went shopping more often, and replaced their usual products with cheaper – for instance private label – products.

According to NIQ data, the market share of private labels climbed 2 percentage points to 30%. These products have a stronger than 60% presence in discount supermarkets, and their share is 10-15% in the other retail channels.

Data by RetailZoom reveal that the share of private labels jumped 61 percentage points in Hungarian retail chains from one year to another, rising from 9% to 14%.

We also need to discuss the growing distance between Budapest and the country, and mention that in absolute value, the price increases affected the rural areas much more than the capital city – informs the 2022 RetailZoom report. In Budapest the proportion of large basket shoppers was 15.6% as opposed to the 6.4% in the country. Plus in the capital city the average large basket value was around HUF 29,100 vs. HUF 13,650 in the countryside, and this 130% difference continues to grow.

Obviously the transformation of market conditions results in the constantly changing shopping habits of households. In the offline channels the weight of large baskets dropped, while small baskets increased their significance. On the contrary, the proportion of big baskets with lots of different items grew in the online channel. In physical stores the basket value was around HUF 16,000, but in the online segment this sum reached the HUF 24,000-25,000 level for big baskets. Data by GfK show that online FMCG sales have a 2.3% value share in the total market, paired with a stable 22% penetration level, and the per capita spending continues to rise. This means that in the online channel the same number of shoppers spends more, and they do this more often.

In Hungary 32% of households buy FMCG products online, but only 5% do it several times a month. Last year online FMCG sales augmented by more than 30%.

Data published recently by GKID-Mastercard reveal that online sales of FMCG, drug and household products reached gross HUF 141 billion in 2022. From this the TOP 10 retailers (kifli.hu, Tesco, Auchan, Rossmann, dm, Pelenka.hu, SPAR, iDrinks, foodora, Wolt) realised HUF 99.5 billion, which meant a 70.4% share.

Where are we now?

“Eight from 10 households say they must strongly cut back their spending and GfK data justify this, and unlike in the past, this already manifests in their shopping habits. 63% of households can’t afford purchasing the same items as before. In early 2023 prices were still 40% higher than one year earlier, and the situation isn’t any better in the middle of the year, in spite of the different measures. We are spending less, visiting stores more often, and putting fewer products in our baskets…One year from now we will tell you where all of this led in 2023, and where we are going to be then” – concludes Trade magazin’s owner, Zsuzsanna Hermann.

If you would like to read more about the FMCG sector’s performance in 2022, about the market research data, and about what the different retailers have to say as regards the last year and their plans for this year, all you need to do is open Trade magazine’s 2023/6-7 issue, which is available from 12 June, both online at www.tradeagazin.hu and in print version.

Methodology:

The Retailer Ranking is based on the sales revenues indicated in forints. Sales revenues indicated in euros are for international information purposes only, and it is important to take into account the fact that due to the unstable nature of the HUF/EUR exchange rate, the list contains conversions based on the exchange rate issued by the Central Bank of Hungary (MNB) on the last day of the month in which the retailer closed its financial year.

Data contained in the table was provided by the retailers.

Sales revenue data marked with* is an estimation made by Trade magazin, based on Trade magazin’s Retailer Ranking 2021, and on the 2021 and 2022 tax declarations of the retailers, taking into consideration the changes in market conditions since then, with the involvement of experts.

About Trade magazin:

Trade magazin is the market leader FMCG magazine in Hungary. It is the only audited trade magazine for the FMCG sector, and every issue is printed in 20,000 copies to provide decision-makers in the retailer, supplier and HoReCa sectors with business information.

Trade magazin’s extended digital edition is available at www.trademagazin.hu, and a daily newsletter is sent out every workday, in Hungarian and English language.

Related news

SPAR Austria Advances Sugar Reduction In Own-Brand Products

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >SPAR spent nearly 220 million forints on social initiatives in 2025

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Schwarz Group Gets Approval For Acquisition Of La Cocoș In Romania

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

By maintaining the margin freeze for too long, the government overshot the target, but the harmful effects are now becoming more pronounced.

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >KSH: in February, consumer prices exceeded the values of the same month of the previous year by an average of 1.4 percent

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >GVH: The Price Watchdog also keeps food prices under control

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >