European overview – Nielsen 2020

In 2020 European FMCG market grew 8,3% so far. Brands outgrew private labels both in the traditional and online channels, by Nielsen presentation at PLMA online show.

The Nielsen presentation of the latest FMCG and private label trends can be watched on a video on the PLMA online platform.

Learnings of past and present

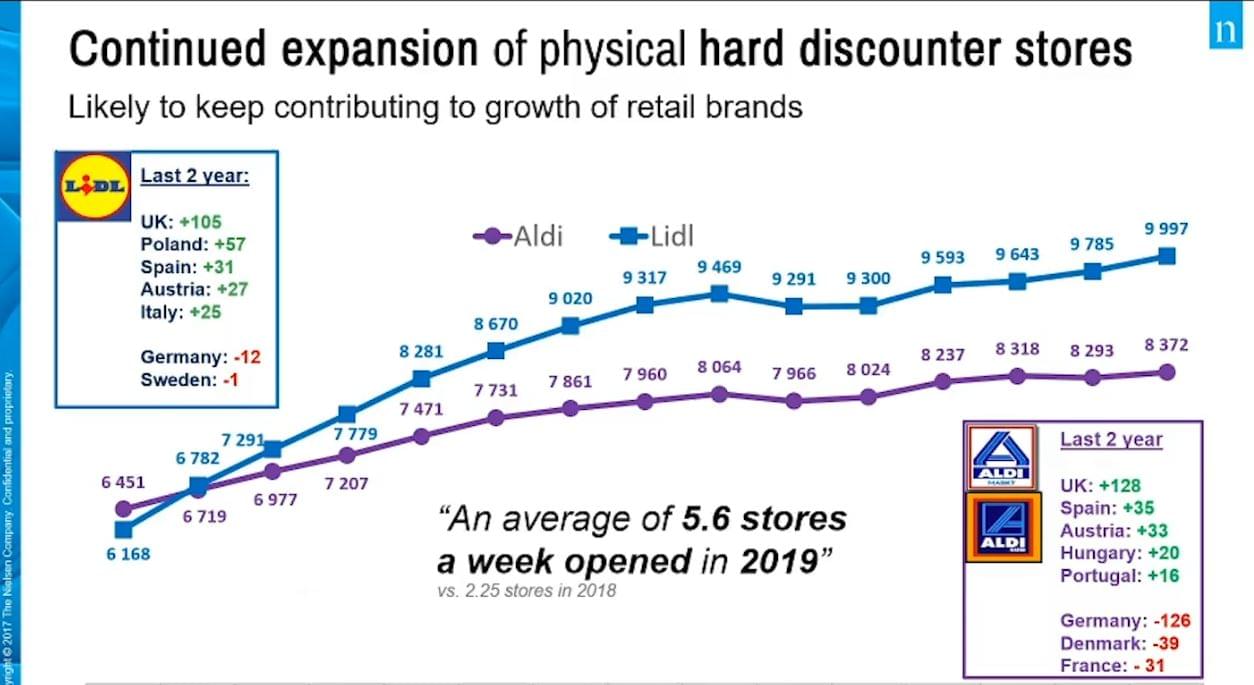

Tom Penninckx, Nielsen business partner, located in Belgium, together with his collegaue Sebastiaan Buchholtz give an update how FMCG evolved in this remarkable year 2020. Which was of course not expected, unpercedented and disruptive in different ways. In 2020 private label is still on a growth path, Private label share increased globally in 2019, gaining 0,2 pp on a global level. Only a slight decrease in Asia-Pacific was seen. General market share of private label is 16,3%. Europe is the highest with 31,7% share, then comes North America with 17,9% share. Elsewhere still a lot of growing opportunities. In Europe the biggest growth is in Spain and Portugal. Whithin hard discounters A- Brands drive 60% of growth last 2 years. Aldi and Lidl try to attract new consumers by extending their range with A-Brands.

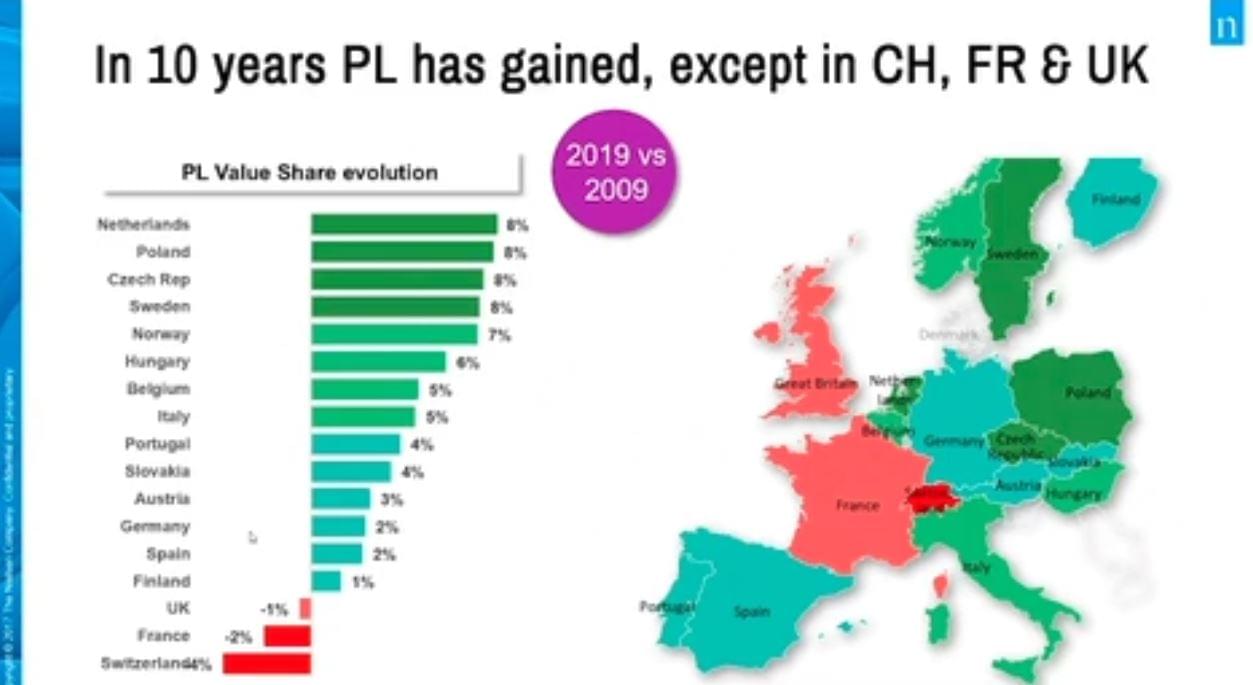

In 10 year outlook, comparing 2009-2019, Private label is still increasing in a massiv way except for UK (-1%), France (-2%) and Switzerland (-4%) where tha Private label market share is well above 40% in value and above 50% in volume. Maybe a saturation point is reached at 40%. The growth in countries where private label market share was bellow 15% ten years ago is significant as they grew well above 25% and still a lot of growing potential. There is a very strong progress in Poland and Hungary. It’s the same situation in Norway, one of the richest countries. Private label is growing in 44% and declining in 16% of the categories. 40% of the private label categories remain stable in 2019. But the growth is slowing down. Global brands are suffering but local brands gain share, increase their importance. The health crisis accelerated consumer preference for these local brands.

In 10 year outlook, comparing 2009-2019, Private label is still increasing in a massiv way except for UK (-1%), France (-2%) and Switzerland (-4%) where tha Private label market share is well above 40% in value and above 50% in volume. Maybe a saturation point is reached at 40%. The growth in countries where private label market share was bellow 15% ten years ago is significant as they grew well above 25% and still a lot of growing potential. There is a very strong progress in Poland and Hungary. It’s the same situation in Norway, one of the richest countries. Private label is growing in 44% and declining in 16% of the categories. 40% of the private label categories remain stable in 2019. But the growth is slowing down. Global brands are suffering but local brands gain share, increase their importance. The health crisis accelerated consumer preference for these local brands.

New habits, homebody economy

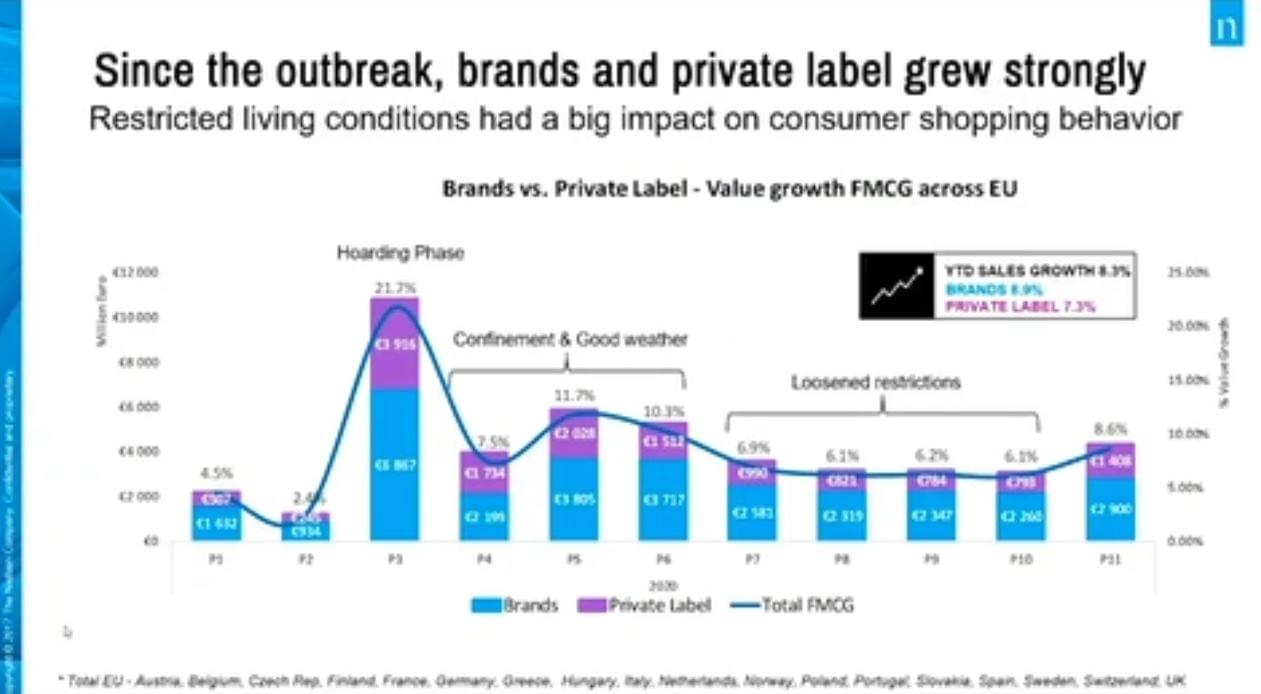

Most important changes in consumer behaviour started with stockpiling in March, then increased consumption due to the confinement and good weather. Since the outbreak, brands and Private label grew strongly. Restricted living conditions had a big impact on consumer shopping behavior. Over all growth is 8,3% in Europe so far, brands generated 8,9%, Private label 7,3%.Consumers habits difined by minimalising the risk of contacts. On the other hand baskets became a lot bigger, prefering big sizes and familiar brands. Online shopping busts this year. Promotion level was extremly low. Consumption shifts from out of home to home in this homebody economy. Meat ((+13,2%), vegs (+12,6%), fish (+9,4%), home cooking like flour, rice, pasta, sugar (19,7%), hand sanitizer (+535%). Families increase spent on the most revived, new categories. Some cooks were born this year. Consumers locked at home try to make the most of it. This provides opportunities for degustation moments at home instead of out of home, while on the go definetely suffered. The result is that 40% of FMCG categories could double digit grow in 2020. Total FMCG Europe sales growth is 8,3%, 47 000 000 000 Euros private labelus compared to last year. Categories like beer, cheese, meat and wine benefit the most. Cleaning homes becam a popular activity resulting 26% growth in household cleaners. Biggest winner of course is hand sanitizer which became five times bigger.

Most important changes in consumer behaviour started with stockpiling in March, then increased consumption due to the confinement and good weather. Since the outbreak, brands and Private label grew strongly. Restricted living conditions had a big impact on consumer shopping behavior. Over all growth is 8,3% in Europe so far, brands generated 8,9%, Private label 7,3%.Consumers habits difined by minimalising the risk of contacts. On the other hand baskets became a lot bigger, prefering big sizes and familiar brands. Online shopping busts this year. Promotion level was extremly low. Consumption shifts from out of home to home in this homebody economy. Meat ((+13,2%), vegs (+12,6%), fish (+9,4%), home cooking like flour, rice, pasta, sugar (19,7%), hand sanitizer (+535%). Families increase spent on the most revived, new categories. Some cooks were born this year. Consumers locked at home try to make the most of it. This provides opportunities for degustation moments at home instead of out of home, while on the go definetely suffered. The result is that 40% of FMCG categories could double digit grow in 2020. Total FMCG Europe sales growth is 8,3%, 47 000 000 000 Euros private labelus compared to last year. Categories like beer, cheese, meat and wine benefit the most. Cleaning homes becam a popular activity resulting 26% growth in household cleaners. Biggest winner of course is hand sanitizer which became five times bigger.

Product groups related to appearance and beauty and on-the-go lost. This is a clear sign that consumers spend less time outdoors interacting with others. All together 22% of product groups lost.

Where to go on private label

Year to date Private label gained 15 000 000 000 Euros this year but still, after stockpiling brands outgrow Private label. As consumers look for familiar brands and shelf-treatment during crisis. The market share of private label is under pressure, altogether -0,3%. Taking a closer look at the supergroups in Europe shows that Private label lose share in almost all super groups except for frozen food and confectionary and snacks. Private label lose most share in booming product groups like hand sanitizer, bleach, flours.

Smaller shoptypes are more popular

Consumer preference on shoptype changed. Hypermarkets lost relevance during confinement. Consumers shop closer to home as travel distance is minimized. Overall smaller shop types gain share in 2020 and it also include hard discounters. There has been a strong growth in e-commerce sales. E-com boomed with Covid-19, with their weight growing around 50% in Spain (+71%), France (+41%) and the Netherlands (+52%). It is not only retailers, who can be found online, manufacturers also increase their online presence. Direct-to-consumer initiatives and webshops help to accelerate online growth. The drivers for online growth are safety&precaution and availability. Online consumers also prefer brands over Private label. Brands grew online by 57% and Private label grew 49%.

Insulated consumers – FMCG growth drivers

The future of Private label depends on connecting with constrained and insulated spenders. The pandemic in Europe is expected to end in mid 2021 which will allow people to social interact again. At the same time the economic consequences as a result of the pandemic might start to refill themselves. Difficult economic times can actually help private label improve performance. Main drivers and challenges for future growth of Private label: Macro-economic climate affecting consumers’ wallet spend, Staying relevant as online growth accelerates, Continued expansion of physical hard discounter stores, Lower price with high quality perception. OECD expects that unemprivate labeloyment rise above 12% or even further with a double hit scenario in the Euro area in 2021 and also GDP is expected to decline by 7,9% by 2022. With above EU unemprivate labeloyment and low Private label share there is Private label potential growth for countries like Italy and Greece.

Those who lose their jobs or have limited financial resources due to the pandemic might constraine their spending. They will shop more at high discounters, focus more on promotions and price-offs and rely on charitable support to survive. On the other hand we also have insulated consumers. They might shift their consumption to find alternatives to their regular consumption behaviour, such as food delivery, meal boxes or degustation moments via premium products.

The importance of e-commerce is expected to go further, the growth rate might be the highest around the world in Europe, but Europe is still behind regions like Asia-Pacific or North America. Private label has a stong challenge to keep up growth and get online presence. The presence of physical stores remain important. Hard discounters will keep contributing the growth of private label. In 2019 an average of 5,6 stores a week opend by hard discounters in Europe. This is expected to continue. Quality and value for money are the most important factors to choose Private label.

Consumer confidence was negatively affected since the ourbreak of the pandemic. Only a valide vaccine will increase the level again. In the 2 last economic declines in 2009 and 2013 private label share increased.

Related news

Premium FMCG products starting to sell in tobacco shops

This article is available for reading in Trade magazin 2024/11…

Read more >PLMA 2024 Trade Show: ambitious manufacturers and retailers

Held at the end of May in the RAI Conference…

Read more >Private labels are enjoying unprecedented popularity

According to EY’s latest Future Consumer Index, inflationary pressure and…

Read more >Related news

Recognition of Consumer Protection Excellence: Honoring the Best of 2024

This year’s outstanding consumer protection officers and special award recipients…

Read more >The Joy of Giving! – SPAR stores collect non-perishable food for people in need

The Hungarian Maltese Charity Service and SPAR Hungary have launched…

Read more >KSH: industrial production decreased by 0.2 percent in October

In October, the volume of industrial production fell by 0.2…

Read more >