Online shopping trends: How to stay in the race?

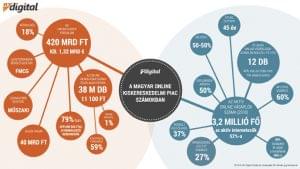

In March GKI Digital published the sales results of Hungary’s online retail trade sector in 2018: total online sales surpassed HUF 420 billion, which was 17 percent more than in 2017.

According to the numbers from GKI Digital, the growth rate of the number of active online buyers is getting smaller from one year to another (there were about 3.2 million in early 2019). This means that the expansion of the sector now mainly depends on the average basket size and the frequency of orders.

In 2018 the number of per capita online purchases was 12 in Hungary and the average spending approached HUF 133,000. Just for comparison: the same sum is more than HUF 230,000 in the Czech Republic (where there are more online purchases as well). By the end of 2018 the average basket value exceeded HUF 11,000 in Hungary’s online retail trade. Retailers can use FMCG products to increase the number of online orders and customer returning frequency, while the basket value can be kept high, too.

Food is the biggest segment of the online FMCG market. In addition to the first online FMCG retailer G’Roby, Tesco and Auchan were also completing in the world of online retail in 2018. As for buying household chemicals and cosmetics online, Rossmann gets an ever-bigger slice of the FMCG cake, and last year dm also launched its online shop. It can be seen that big players are slowly but steadily conquering the online FMCG market, and in this environment – where the buyer base is limited and the number of orders is relatively low – a lot depends on using marketing tools effectively.

From the various types of promotions used by online shops, the most popular are those tied to free delivery and price reductions. What will be the most important trends of 2019? It is best if the online retailer has an offline background. Shoppers like to order from those online shops more that have physical stores or at least pick-up points. Nearly 80 percent of total online sales is realised by companies that also have some kind of offline unit. Delivery is a very important part of the customer experience: Hungarian consumers don’t care much about same-day delivery, but they want the day and time slot of the delivery to be easy to plan. Some things are only changing slowly: people paid for more than 70 percent of the products they had bought online only upon delivery, and from these payments the proportion of cash was still more than 50 percent.

It is clear that the kind of behaviour where online retailers are only following market trends will hardly be enough to realise sales growth in 2019. Those market players will be able to keep customers – and increase customer returning and sales frequency – that provide shoppers with high-quality customer experience. //

Related news

Nestlé cuts jobs at Czech factory amid falling demand for plant-based meat

Nestlé is to cut 80 jobs from its Krupka plant…

Read more >Auchan Placc refilled – fresh offer and affordable prices on EFOTT!

Auchan Placc is opening its doors at EFOTT for the…

Read more >Auchan Romania Rolls Out Bulk Collection For Deposit Return System

Auchan Romania has introduced a new bulk collection system at…

Read more >Related news

Drought, technological competition and collaboration: the domestic melon season has begun

The 2025 Hungarian melon season starts amidst serious challenges: the…

Read more >Leadership change at Fornetti: Nándor Szabó is the new Managing Director

Nándor Szabó will take on the role of CEO of…

Read more >Change in Zwack management: Csaba Belovai is the new CEO of Zwack Unicum Plc.

According to the decision of the owners of Zwack Unicum…

Read more >