Vodka – the new faces of colourless

Vodka is still the most popular spirit in Hungary. The category is dominated by domestic brands, but the owners of major international brands also play a big role in the segment’s success and momentum.

Vodka had a good year in 2024, achieving double-digit growth and the positive trend is likely to continue this year.

The place of consumption

Attila Piri

marketing director

Heinemann Testvérek

“Vodka is the dominant category on the domestic market, accounting for one-sixth of the total spirits category. In percentage terms the premium plus segments continue to show the strongest growth, confirming that premiumisation remains an important factor in the vodka category”,

reports Attila Piri, marketing director of Heinemann.

In Europe – similar to Hungary – home consumption is growing, accompanied by a decline in the HoReCa channel. The company distributes Beluga, Three Sixty and Haku vodka.

Dávid Gábor Kovács

marketing director

Zwack

“In the premium and premium plus categories there is growing consumer interest, especially among younger, more conscious target groups”,

says Dávid Gábor Kovács, marketing director of Zwack.

Zwack Unicum Nyrt. is a leading player on the Hungarian vodka market. Its own brand, Kalinka is strong in the value-for-money segment, mainly in retail chains. The company also distributes three premium international brands: the classic Smirnoff, the Dutch craft brand Ketel One and the premium plus category grape-based CÎROC. Flavoured vodkas – mainly with fruity and botanical flavours – are popular worldwide and demand for these is also strong in Hungary, especially in the summer.

Consumer consciousness, consumer preferences

Gábor Árok

premium spirit manager

Coca-Cola HBC

Magyarország

“The domestic market is currently characterised not by volume growth but by restructuring and it is following European premiumisation trends. Consumers are making increasingly conscious decisions: while the lower price segment has remained stable despite economic challenges, the value growth of premium vodkas clearly signals a shift towards quality”,

we learn from Gábor Árok, premium spirit manager of Coca-Cola HBC Magyarország.

The company’s premium portfolio includes two leading brands, Finlandia and Grey Goose.

Judit Tömpe

senior brand manager

Roust Hungary

Judit Tömpe, senior brand manager of Roust Hungary:

“The most popular and biggest spirit category in Hungary continued to grow last year, thanks to the expansion of the standard and premium segments: many people are choosing vodka over other categories”.

Roust’s portfolio focuses on traditional vodka brands, Romanoff and Russian Standard. With vodka we can talk about distinctive flavours, as the quality of the raw materials and the production processes – especially the distillation method – determine the final taste profile of the drink.

Neutral or distinctive

Zoárd Trömböczky

senior brand manager

Maspex Olympos

Zoárd Trömböczky, senior brand manager of Maspex Olympos Kft.:

“In the case of vodka the price categories are different from those of other spirits, but the trend is similar: consumption is growing more in the standard and premium plus categories”.

In 2025 the company’s portfolio includes vodkas in every category, from standard (Royal, Żubrówka) to premium (Bols Marine, Żubrówka Bison Grass) and super premium (Reyka vodka). Royal Vodka is Hungary’s number one vodka and it is the biggest spirit brand as well.

András Tripolszky

commercial director

Dunapro

“Vodka consumption is growing nicely. Perhaps the most dynamic growth has occurred in the super-premium vodka segment, which is dominated almost exclusively by international brands”,

reveals András Tripolszky, commercial director of Dunapro.

They distribute NEFT and Skyy vodkas in the super-premium and premium categories across all sales channels. Flavoured vodkas are popular in every price category. One of the most important trends on the vodka market is the shift from “neutral” flavours to “flavour forward” – products with unique characteristics and flavours

Flavours, mixes and proportions

Attila Piri says the trend of flavoured products and lower-alcohol drinks suggests that these categories will continue to grow. They have come out with three Three Sixty RTDs for the season: Espresso Martini with 10% alcohol content in 0.25-litre bottles, and Lemon and Energy mixes with 10% alcohol content in 0.33-litre bottles.

Gábor Árok thinks premiumisation doesn’t necessarily go hand in hand with a unique character. Finlandia has become a favourite among bartenders and quality-conscious consumers precisely because of its silky smooth, neutral flavour profile.

Dávid Gábor Kovács explains that vodka-based RTD drinks are typically pre-mixed, low-alcohol, easy-to-drink beverages in can packaging. Their spreading in Hungary is currently hampered by tax regulations and price competition, but in the longer term the convenience needs of younger generations and health consciousness may give a boost to this category.

Growing categories

Judit Tömpe says fruity flavours continue to top the popularity list, but dessert-like variants such as vanilla are also in demand. Last year they launched the Romanoff liqueur portfolio and one of the most popular flavours is lemon. They think vodka-based RTD products are still in their infancy.

Várkonyi Vilmos

senior brand manager

Maspex Olympos

Vilmos Várkonyi, senior brand manager of Maspex Olympos Kft.:

“The RTD market is clearly the next trend, thanks to the emergence of premium-quality cocktails that can be enjoyed anywhere, anytime. This category hasn’t become famous primarily for vodka-based drinks, but rather for special cocktails, but we are also preparing innovations for the near future”.

Eszter Radványi

brand manager

Dunapro

Eszter Radványi, brand manager of Dunapro:

“The RTD market is constantly evolving. Manufacturers are coming up with increasingly unique flavours. Four of the MIX cocktails are vodka-based: Mojito, Vodka & Watermelon, Vodka & Lime and Vodka & Forest Fruits”.

One of the biggest advantages of MIX cocktails is that they have screw caps, making them a practical choice in the summer heat.

Growing demand for large-sized vodkas

In Hungary the market size of the vodka category is HUF 48bn annually.

Guest writer:

Judit Hegedüs

senior analytic insight

associate

NIQ

The category’s value increased by 2% in the period between June 2024 and May 2025 compared to the previous year, while vodka volume sales decreased by 1%. Manufacturer brands continue to dominate, maintaining a stable 86% share in value. There has been some restructuring in terms of bottle size: the value share of bottles smaller than 0.5 litre has remained stable at 41%. As for the value share of 0.5-litre vodkas – which generate the biggest sales – it decreased from 37% to 36%. The market position of the 0.7-litre size is stable, with a 16% share in value. The value share of 1-litre products grew from 6% to 7%.

The rise of premium vodka

The premium and super-premium vodka categories are growing dynamically all over the world.

The segment has entered a new era

According to a report by the IMARC Group, the global vodka market was worth USD 50.28bn in 2024 and is forecast to reach USD 81bn by 2033. The premiumisation trend is driven by millennial and Gen Z consumers. The development of cocktail culture and the popularity of RTD drinks have a strong influence on the premium vodka market. In Europe demand for premium vodka is boosted by the rise of craft brands, the growing importance of sustainability values and the desire for special taste experiences.

Vodka market in the shadow of war

In recent years the vodka industry has been facing unprecedented challenges. The Russia-Ukraine war that broke out in February 2022 reshaped the industry, affecting the two most important producing countries, while international boycotts, embargoes and supply chain problems transformed the market. In 2024 – despite a 6.5% sales drop on the international market – Smirnoff maintained its leading position with nearly 220 million litres sold, ahead of Absolut and Tito’s Handmade. The list of the fastest-growing vodka brands currently includes seven Russian-owned brands. However, several Ukrainian brands have achieved spectacular growth through conscious repositioning and international marketing campaigns.

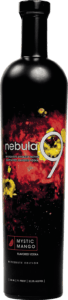

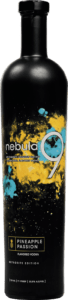

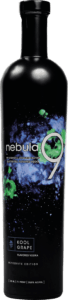

Functional vodka!

Portland-based Nebula9 Vodka takes a new approach to the world of alcoholic beverages, combining traditional potato vodka with functional, health-promoting ingredients. What makes the brand special is its use of organic apple cider vinegar and antioxidant-rich fruit flavours, such as pomegranate and blueberry, which not only give the drink a distinctive taste but also make it more health-conscious.

Creative playground

Vodka is a true master of transformation in the world of spirits: its neutral character allows producers to either stick to traditional purity or experiment with new flavours.

Modern trends are going in the latter direction, using new, natural ingredients to shape the character of the drink. Terroir is also becoming important in product communication. Manufacturers are taking a holistic approach, using special ingredients such as peas, rice, wheat and grapes. For instance British vodka Pod Pea is made from peas, which take a particularly long time to ferment due to their low sugar content. The resulting drink has strong vegetal and salty notes. Cocktail culture has a growing influence on vodka use. In contrast to traditional, neutral vodkas, premium bars prefer vodkas with character that can stand on their own.

Related news

Monster Viking Berry

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >New Sales Director at Coca-Cola HBC Hungary

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Festival buzz at the 60th anniversary EuroShop trade fair

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >No matter how much you save, food and gadgets always take the money

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Historic price reduction at ALDI

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >