Tag "hitelezés"

Changes are coming to corporate loans – banks are scrutinizing companies due to sustainability risks

Date: 2024-01-30 12:17:23

Starting this year, fundamental changes have come into effect in the field of corporate obligations related to sustainability, i.e. ESG, which will affect all domestic companies in some way. While...

Read more

The new subsidized loan program starting in July will be popular

Date: 2022-06-29 11:28:49

The Széchényi MAX program, which will be launched in July, will be a great help to micro, small and medium-sized enterprises, as it will provide financing at a better interest...

Read more

A zero-percentage SME loan can be applied for at MFB again

Date: 2022-06-27 11:25:49

SMEs outside the Central Hungarian region can re-apply for a zero percent loan to maintain their financial stability at the Hungarian Development Bank, MFB informed MTI on Monday. The communication...

Read more

Ministry of Agriculture: another tool will make it easier for the food sector to access credit

Date: 2022-06-21 11:22:38

For the first time in Hungary, a new, preferential guarantee is available for agriculture, the food industry, food retail and wholesale, as well as for enterprises and primary producers connected...

Read more

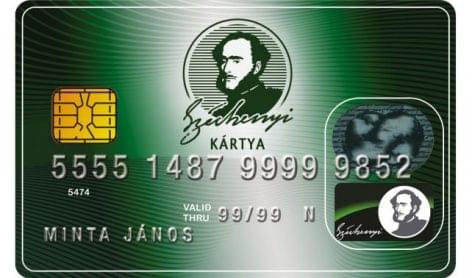

The Széchenyi card program is renewed

Date: 2022-06-20 11:25:15

At its meeting on 16 June 2022, the government reviewed the situation of the SME credit market in the light of the economic situation of the war, examined the achievements...

Read more

Erste Bank: credit demand for small and medium-sized businesses may fall

Date: 2022-06-08 11:20:32

Demand for credit from small and medium-sized enterprises (SMEs) may fall significantly in the third quarter, Erste Bank told MTI on Wednesday. The financial institution’s SME business performed outstandingly in...

Read more

MNB: credit dynamics in corporate and retail lending were outstanding last year

Date: 2022-03-10 11:52:19

Last year, the loan portfolio of companies was almost 11 percent higher, while the loan portfolio of SMEs was nearly 17 percent higher than a year earlier. The retail loan...

Read more

Takarékbank puts agricultural investments at the forefront of its lending policy

Date: 2021-12-09 11:25:36

Takarékbank’s lending policy prioritises higher value-added agricultural investments in order to support the strategic sector of the national economy, the financial institution operating as part of the Magyar Bankholding, the...

Read more

The members of Magyar Bankholding help the agricultural sector with huge loans

Date: 2021-10-07 11:30:44

The member banks of Magyar Bankholding, Budapest Bank, MKB Bank and Takarékbank, have a total loan and leasing portfolio of almost 500 billion HUF in the agricultural sector, which together...

Read more

Takarékbank: personal loan lending may increase to fivefold by the end of the year

Date: 2021-05-05 11:20:53

After the pandemic subsides, the demand for personal loans may increase, the volume of 5 billion HUF placed with Takarékbank by the middle of April may jump fivefold by the...

Read more

MNB: MKB Bank can also offer consumer-friendly personal loans

Date: 2021-03-24 11:18:09

MKB Bank can start distributing its qualified consumer-friendly personal loan (MSZH) after the Magyar Nemzeti Bank (MNB) has approved the product’s rating – the central bank told MTI on Wednesday....

Read more

MNB: credit dynamics were at the forefront of the EU last year

Date: 2021-03-16 11:29:01

Despite the coronavirus pandemic, the credit market performed outstandingly last year, and Hungary is at the forefront of the EU in terms of both corporate and retail credit dynamics, an...

Read more

EXIM will launch a fixed interest investment loan for the exporting SME sector

Date: 2021-03-08 11:20:47

In order to facilitate the restart of the economy and to provide long-term financing for the micro, small and medium-sized enterprise segment, which accounts for 99 percent of the Hungarian...

Read more

Consumer-friendly personal loans to come

Date: 2021-01-18 11:30:25

New personal loans can be taken out for a maximum term of 7 years, and banks need to decide quickly on disbursement, which also maximizes fees and loan interest. Although...

Read more

Retail indebtedness is growing

Date: 2020-09-11 11:30:45

Sales of loans fell, but repayments were also lower in the second quarter, with barely a third of personal loans being paid in than in the first quarter – napi.hu...

Read more

MNB: only solution is lending now

Date: 2020-04-21 11:30:54

The only rational solution on the part of banks in the current epidemic situation is lending, Nagy Márton, Vice President of the Magyar Nemzeti Bank (MNB) said at the Portfolio’s...

Read more

Go For It Growth Loan Program

Date: 2020-04-20 11:55:47

The nhp hajrá (Go For It Growth Loan Program) for micro, small and medium-sized enterprises will be available from Monday – 24.hu wrote. The 1,500 billion HUF fixed-rate funds available...

Read more

Hungarians in Europe are the least indebted compared to to their income

Date: 2020-02-21 11:16:27

The total debt of the Hungarian population compared to income is the lowest in Europe, but it is often difficult to pay the bills, according to a European survey by...

Read more

New head of marketing communications at Cofidis

Date: 2020-02-20 11:08:56

As of December 1, 2019, Marianna Nád-Kántor holds the position of Brand and Marketing Communications Manager at the Hungarian Branch of Cofidis. Previously she was responsible for marketing and communications...

Read more

Expert: significant growth can be seen on the personal loans market

Date: 2019-10-28 11:12:34

Low interest rates have seen significant growth in the personal loans market for years – Trencsán Erika, financial expert of money.hu told M1 news channel. Over the past period, personal...

Read more

Kavosz: the Széchenyi Card Program is an economic strategy and a rewarding business support

Date: 2019-10-21 11:30:47

The Széchenyi Card Program, which finances small and medium-sized enterprises with favorable terms and short-term loans, is not only an economically strategically important product, but also a state-subsidized enterprise support...

Read more

Companies’ willingness to lend increased to record levels

Date: 2019-10-14 11:35:42

Lending to Hungarian companies reached a record. It was 20 percent higher than a year before, according to Atradius Credit Insurance. According to a study, made with the involvement of...

Read more

Július 1-jével új korszak köszönt a hazai vállalatokra

Date: 2019-06-11 11:12:27

Teljesen átalakíthatja a cégek forrásbevonási szerkezetét a napokon belül induló Növekedési Kötvényprogram (NKP) – hívta fel rá a figyelmet Lóga Máté, a Magyar Nemzeti Bank főosztályvezetője az EY konferenciáján. Az...

Read more

Growth credit program: at K&H agricultural and food companies are the most active

Date: 2019-05-29 11:30:52

In the first four months, K&H concluded 17 billion HUF worth NHP fixed loan and leasing contracts with nearly 40 percent already disbursed. The majority of the applicants are rural...

Read more

Erste is working with winemakers

Date: 2019-05-16 11:16:07

Erste Bank has signed a cooperation agreement with the representatives of the Szekszárd Wine Region for the development of the wine region. At Erste, the financing of agricultural and food...

Read more

Retail loans have made a record

Date: 2019-03-12 11:15:47

The year started very powerful in the retail credit market, which was expanding dynamically last year – piacesprofit.hu wrote. In January, banks lent personal loans and home loans in a...

Read more

The new program of the MNB calls for environmentally conscious banking

Date: 2019-02-19 11:05:34

The Green Program of the Hungarian National Bank (MNB) encourages environmentally conscious “Banking” – Binder István, MNB’s spokesman told M1 news channel on Tuesday. He added that the MNB would...

Read more

Hungarian companies are still crediting their customers at a record level

Date: 2018-10-01 11:20:27

The proportion of deferred payments in domestic commerce (B2B) decreased, however, while the duration for invoicing and the number of bad debts increased. According to the Atradius Credit Provider’s Barometer...

Read more

Századvég: fixed-rate loans give SMEs financial stability

Date: 2018-09-20 11:19:12

The central bank’s fixed interest rate loan for small and medium-sized companies will provide financial stability and will have a stimulating effect on economy – Regős Gábor, economist at Századvég...

Read more

MNB: turnaround in corporate and retail lending

Date: 2018-09-04 11:15:20

A turnaround in corporate and retail lending occurred in 2015, after the crisis – Nagy Tamás, head of department of the Hungarian National Bank (MNB) told M1 news channel. He...

Read more