Tag "Fidelity"

Fidelity: 2025 is not the year of artificial intelligence yet

Date: 2025-03-03 12:09:59

The latest Fidelity Analyst Survey finds that AI will have only a minimal impact on corporate profitability in 2025, and its full potential will be years away. But big tech...

Read more

Fidelity: What can we expect after Trump’s first days?

Date: 2025-01-23 12:23:00

President Trump’s first day in office was in line with his campaign promises, and he addressed several issues that are important to his base of voters, including immigration control, reducing...

Read more

Fidelity Outlook 2025: The US is ready for reflation

Date: 2025-01-10 14:29:46

The Republicans’ landslide victory in the November election has significantly changed the economic outlook for 2025. For much of 2024, we considered a soft landing in the US as our...

Read more

Fidelity Outlook 2025: New paths for stocks

Date: 2024-12-12 11:27:55

As we approach 2025, it is clear that the macroeconomic and monetary policy environment overall offers a positive backdrop for equity markets. In 2025, the business cycle enters a new...

Read more

China’s economic recovery – investors are missing the point

Date: 2024-10-18 11:53:22

The sentiment surrounding commodity markets took a decisive turn in September when China announced a coordinated package of monetary and fiscal stimulus measures. At the subsequent press conference of the...

Read more

Fidelity: Three themes shaping investments in Q3

Date: 2024-07-16 12:54:08

Has the post-epidemic normalization that we have been waiting for arrived? Economic activity has been lively throughout the year so far, while consumer demand and labor markets have also found...

Read more

2024 Q2 Investment Outlook: Timing matters

Date: 2024-04-22 12:49:05

Positive momentum is building. The outlook for 2024 has brightened, but we caution that it won’t take much to spill over.We came into 2024 believing that a cyclical recession, featuring...

Read more

Fidelity Analyst Survey 2024 – Nobody’s Talking About Inflation Anymore

Date: 2024-02-22 12:09:25

The past two years have been marked by the fear of how severe the first sustained economic slowdown since 2008 will be. Based on Fidelity International’s annual survey, it appears...

Read more

Fidelity: What will drive ESG development in 2024?

Date: 2024-01-16 12:16:28

Systemic care, in which investors cooperate with a wide range of stakeholders to implement sustainability tasks, will be one of the main drivers of the ESG agenda in 2024. Fidelity’s...

Read more

Fidelity: Eyes of Asia on Japan and India

Date: 2024-01-05 11:01:47

China’s future development is the biggest uncertainty factor in the region, but it is far from the only economy that will move Asian markets in the coming year. Japanese stocks...

Read more

Fidelity’s big outlook for 2024: China is the big question mark in the Asian region

Date: 2023-12-19 11:46:39

The performance of the U.S. dollar and the wavering of investor optimism about China’s recovery have broken the strong growth story of many Asian economies over the past year. According...

Read more

2024 Outlook: Next year is about a cyclical recession, according to Fidelity’s base case scenario

Date: 2023-12-12 12:35:49

Most of the surprises for central bank officials and the financial markets in 2023 stemmed from the fact that we do not yet understand the deeper economic effects on households...

Read more

Resilience, refinancing and recession risk – this is expected in the fourth quarter

Date: 2023-10-13 12:22:59

Markets have so far proved resilient to the prospect of a recession, but whether this will continue to be the case is far from certain. The last quarter of the...

Read more

Fidelity: What emerging markets can bring

Date: 2023-08-07 13:55:45

In periods characterized by market volatility, it is easy to forget about the attractiveness of emerging markets. However, now, when valuations are at a low point not seen for several...

Read more

Fidelity: Net zero in 2030 seems unrealistic for most companies

Date: 2023-07-20 13:15:56

A survey of Fidelity ESG analysts questions whether companies’ net-zero plans are sufficient. The answer is: not yet, and a greater concerted effort is needed. Additional funding, technological innovation and...

Read more

Fidelity: Who will be the AI winners?

Date: 2023-07-05 13:54:55

It’s all about generative artificial intelligence these days. It has the potential to truly transform the world around us, but like several other recent technological innovations – electric vehicles, renewable...

Read more

Fidelity: Rapid reopening is underway in China, geopolitical fears persist

Date: 2023-03-13 11:08:16

Since the amendment of the Covid regulations last year, we have witnessed a sudden and rapid reopening in China. High-frequency indicators, such as the frequency of traffic jams, ticket office...

Read more

Fidelity Analyst Survey 2023: Inflation may be easing

Date: 2023-02-23 11:27:28

Consumer inflation is already past its peak, but the debate about the long-term effects of the price increase experienced last year – unprecedented in thirty years – will continue for...

Read more

Fidelity: There may be a light at the end of the tunnel for companies

Date: 2023-02-08 10:50:14

Companies faced one of the toughest years in the past period in 2022, as the global economy was hit by several shocks coming at the same time. Now, at the...

Read more

Fidelity: The future is in the hands of the Fed

Date: 2022-12-19 11:06:22

As we approach the year 2023, the world economy faces a combination of challenges, from persistently high inflation and aggressive global policy tightening (led by the Federal Reserve), to the...

Read more

Fidelity: Hungary will be less sensitive to pressure towards further devaluation of the forint

Date: 2022-08-11 12:09:26

Inflation, central bank interest rates, energy prices – the countries of Central and Eastern Europe are reacting to the changes at a high pace, and the experts of Fidelity International...

Read more

(HU) Fidelity: Az oroszországi kivonulás költségei

Date: 2022-06-09 10:41:09

Sorry, this entry is only available in HU....

Read more

Fidelity: Ukraine conflict strikes new blow to global supply chains

Date: 2022-04-13 11:56:52

Sorry, this entry is only available in HU....

Read more

Fidelity: Three reasons why China could roar in the year of the tiger

Date: 2022-02-02 10:08:37

Tuesday 1 February marks the Chinese New Year, where millions of people around the globe will celebrate the year of the tiger. With inflation fears, talk of tapering and an...

Read more

Fidelity: Three things to watch out for in the Chinese market

Date: 2022-01-27 11:38:38

In China, slowing growth and an increasingly tight regulatory environment are worsening investor sentiment. By the dawn of 2022, some of the most important risks that could affect Asian investment...

Read more

Fidelity: will inflation or growth come in 2022?

Date: 2021-11-30 09:04:40

In 2021, the much-anticipated recovery came, the shops could open, commuters could sit back in their offices, and even the boldest ones went on holiday. But in the midst of...

Read more

(HU) A műholdas megfigyelés lehet a megoldás a pálmaolaj problémára

Date: 2021-11-24 10:58:54

Sorry, this entry is only available in HU....

Read more

Fidelity: What we expect from the fourth quarter

Date: 2021-10-27 09:55:14

Global growth has slowed slightly. The most important hindrances were China, inflation and the US debt ceiling. • Monetary policy is increasingly sensitive to inflation dynamics. As inflation in the...

Read more

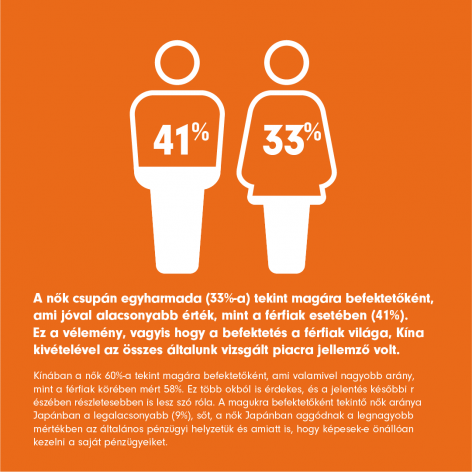

Fidelity: Women’s place in the economy is becoming more stable, but the epidemic has hit them harder

Date: 2021-09-09 10:31:34

In 2030, 100 million more women are projected to be active earners than they are now. Globally, women currently earn 23% less than men and are still more likely to...

Read more

(HU) Fidelity: ESG, tehenek, metángáz és a klímaválság

Date: 2021-08-23 10:59:33

Sorry, this entry is only available in HU....

Read more