Fidelity: Three things to watch out for in the Chinese market

In China, slowing growth and an increasingly tight regulatory environment are worsening investor sentiment. By the dawn of 2022, some of the most important risks that could affect Asian investment grade bonds could be detected, and short-term market volatility could be a very good market entry opportunity for investors. According to Fidelity International, fed decisions, china’s real estate market and ESG aspirations are worth keeping an eye on.

Related news

Fidelity Outlook 2025: New paths for stocks

As we approach 2025, it is clear that the macroeconomic…

Read more >Chinese retailers see AI as the future of boosting sales

According to a new survey by Bain & Company, the…

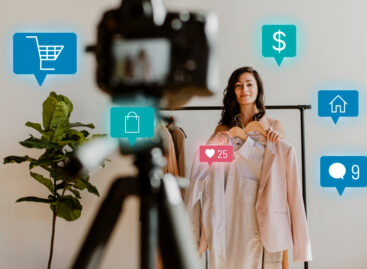

Read more >Social commerce predicted to reach $1 trillion by 2028

A new study forecasts skyrocketing growth for the social commerce…

Read more >Related news

Most major grocery chains will keep their stores open until noon on December 24th

Most of the large grocery chains will keep their stores…

Read more >Recognition of Consumer Protection Excellence: Honoring the Best of 2024

This year’s outstanding consumer protection officers and special award recipients…

Read more >KSH: industrial production decreased by 0.2 percent in October

In October, the volume of industrial production fell by 0.2…

Read more >