RetailZoom: Private Label on the rise in Domestic Chains

Although the extraordinary surge in stock-up syndrome experienced in the midst of March has been smoothed by the end of the month, Local Chain shops have been successful in keeping the momentum and increasing their value sales in April as well (vs 2019). Interestingly though they have featured only a small decline in the overall number of customer baskets (-2,9%) and thus transactions. However, despite transactions being stable, the number of products put in the baskets have fallen by double-digit (-14%) versus year ago. Nearly 11% out of the 14% decline is a straight result of small basket disappearance. However, switching to bigger pack sizes and the dissolving of the impulse baskets have together offset this and have driven the Local Chain shops to an average value growth of 9%. Bigger pack sizes and the disappearing impulse baskets are expected to stay and continue to shape customer behavior for long months ahead.

Andreas Christou

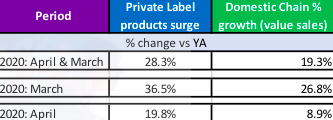

While the performance of the manufacturer brands has been quite diverse, Private Label products altogether have constantly outperformed the overall growth dynamics of the chains in the last two months. In March, they have outgrown the markets by 7%, while in April, they did even better, outperforming overall Domestic sales growth by nearly 11%. Looming economic conditions and the massive amount of people losing their job securities have together resulted in more shoppers turning towards large numbers to the Private Label offers.

Pasta category has seen the biggest expansion of Private Label products with the whole category being propelled by this growth, while the fresh segments (Dairy products and Meats – being traditionally strong in Local Chain shops) have also contributed significantly to a staggering 20% overall growth of the Private Label portfolio. Although it is almost impossible to make predictions about the future under current conditions, it seems relatively safe to assume that the longer the quarantine period and economic uncertainties will remain the more people we will see who will be looking for value for money propositions and choose private label as a result.

Related news

There is a slice for everyone

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >There is light at the end of the tunnel

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Tobacco shops: fewer products, concentrated sales and new growth paths

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Lidl guarantees fairer prices for cocoa farmers

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >