(HU) Magazin: Öt rész vodka, egy rész COVID!

Vodka is the best-selling spirit in the world in terms of quantity, but recently sales have been declining until 2019, when this negative trend seemed to come to a halt. Then son the Covid-19 crisis hit and changed everything, from marketing to consumption. Still, vodka has remained a dynamically developing category, which easily adapts to the new trends.

The market

Dénes Szántó

senior brand manager

Brown-Forman

We learned from Dénes Szántó, Brown-Forman’s senior brand manager that premium vodka sales surged by 22 percent in the off-trade channel in 2020. He added that the popularity of flavoured spirits is growing. The company is market leader in premium vodka sales, for instance Finlandia sales were up 24 percent in the off-trade channel.

Sára Palcsó, marketing director of Zwack informed that vodka is the second best-selling spirit in volume in the domestic market, behind bitters. Zwack is the manufacturer of Kalinka – this 10-times filtered vodka is one of the top products in the VFM category. Plus Zwack is the distributor of three premium vodkas: Smirnoff, Ciroc and Ketel One.

Temporary or long-term

Annamária Benke, category brand manager of Roust Hungary talked to Trade magazin about the transformation of the market. Their sales fell in the HoReCa channel but off-trade sales compensated for this. The company is market leader in the vodka market. They distribute Hungary’s No.1 mainstream spirit Royal vodka and Zubrówka Biala. Their premium products are Bols, Russian Standard and Zubrówka Bison Grass, while their superpremium vodkas are Kauffmann and Russian Standard Imperia.

In contrast to 2019, the premium category grew by 22 per cent in retail last year

Molnár Viktor

Bacardí-Martini portfolio

brand manager

Dunapro

Viktor Molnár, group brand manager of Bacardí-Martini Portfolio revealed: cheap and standard vodkas probably sold well during the pandemic, and the premiumisation process hasn’t slowed down either. From the company’s products Eristoff is a premium vodka at affordable price, while Grey Goose is competing in the ultra-premium category.

Csaba Mosonyi, marketing director of Pernod Ricard broke the news that sales of Absolut vodka dropped, because premium vodka sales are primarily realised in the HoReCa channel and these units were forced to close by the pandemic. Despite this fact Absolut is one of the top brands in the market.

Communication

Annamária Benke

category brand manager

Roust Hungary

Annamária Benke: ‘There has been no major change in marketing communication. However, BTL activities suffered, as various festivals and programmes were cancelled, just like in-store activities.’

Sára Palcsó

marketing director

Zwack Unicum

Sára Palcsó: ‘It is of utmost importance for vodka brands to differentiate themselves from competitors. With our premium vodkas we are focusing on top gastronomy. At the moment we can reach the most people in e-commerce.’

Dénes Szántó: ‘ATL and digital communication are increasingly important in our brand strategy. We celebrated our 50th birthday in 2020, so a campaign was built on this and on our Finnish traditions.’

Viktor Molnár: ‘From the two brands the emphasis was more on Grey Goose in the pre-pandemic period. Since this product targets the HoReCa channel, we had to switch to online activities when the pandemic broke out.’

Csaba Mosonyi: ‘We are building the Absolut brand in bars and restaurants, at events and in digital media. We also cooperate with groups of artists and influencers.’

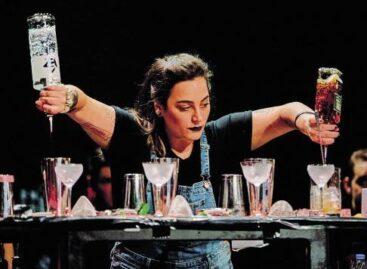

Vodka will not vanish from the scene after the reopening of the HoReCa and will be used as a popular cocktail ingredient

//

Evolution

In the last 20-25 years vodka was the playground of innovators. First they were distilling the spirit umpteen times, then came the flavouring era. Consumers who like flavoured vodkas are searching for a bold, but natural taste experience.

The flavouring trend has gained momentum again

In most cases the market decides relatively quickly which flavour combination will be successful. According to another vodka direction, the spirit needs to preserve its neutral taste and this taste alone should be the basis of the drink experience.

One of the recently most dynamically developing brands has been Tito’s Handmade

21st-century experiences

Just like basically all food and drink trends, the latest vodka trends are related to quality, health and sustainability. In the United States craft vodkas have a share of the market that would have been unimaginable a few years ago.

Svedka Pure Infusions are made by soaking on fruits, it has an alcohol content of 30%, and 5 cl contains only 80 calories

Health trends are also present in innovation work. Manufacturers are proud of the fact that there is no glycerine and citrus oil in their product. There are organic vodkas available, too. It also belongs to the health trend that distilleries are making vodkas with lower alcohol content.

Alternative packaging solutions

Alternative packaging solutions are often identified with lower quality, but consumers from the less conservative generations Y and Z are receptive to these, as these packaging designs are often produced and transported more sustainably, and they can also be recycled more easily. One of the most exciting vodka innovation directions is RTD cocktails: they are eco-friendly, easy to handle and youthful. Spirits are now also available in bag-in-box format and you can buy vodka in pouch-up bags too.

Alternative packaging formats are also gaining ground in the vodka industry

//

Related news

Beyond cocktail competitions

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >István Nagy: 2026 will be the year of construction in Hungarian agriculture

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >2026 will be the year of construction in Hungarian agriculture

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

The Hungarian Food Book is 50 years old

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >NKFH: inspections focus on discount prices and customer deception

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >