The 2024 FMCG Retailer Ranking is out now

Everything remains the same: Lidl, SPAR and Tesco are the top three!

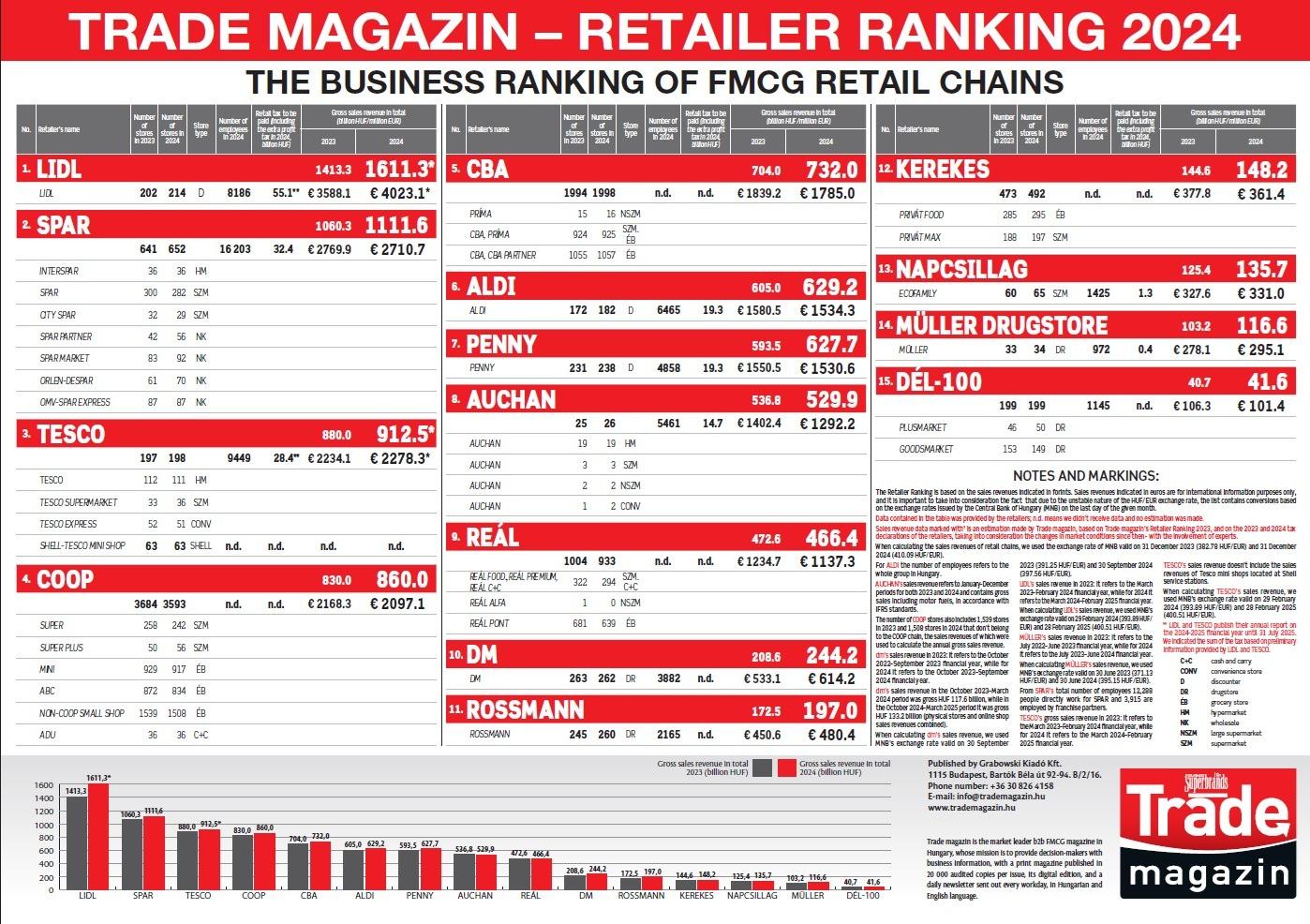

Since 2020 every year has brought serious difficulties for the economy, which also hampered the functioning of the FMCG market – and 2024 was no exception. The combined sales performance of the 15 retail chains in the FMCG Retail Top List approached HUF 8,400 billion in 2024, after a rounded gross turnover of HUF 7,900 billion in 2023. Unfortunately, even this 6% increase isn’t enough to make anyone happy, taking price rises and cost increases into consideration.

Trade magazin publishes the FMCG Retailer Ranking on the first working day of June every year, and this is also the case this year.

Once again there is no change on the winner’s podium. In 2024 it was clear that no one could threaten Lidl’s first place and the discounter remained unbeatable this year too. In fact, with a sales growth of nearly 15%, Lidl was already HUF 500 billion forints ahead of the second-placed SPAR, whose growth was unfortunately only about a third of its 2023 growth at around 5%. Tesco maintains its third place with a sales growth below the average for the Top List, but it should be noted that this progress is much more impressive than in 2023, when the company’s gross turnover remained unchanged compared to the previous year.

The rest of the Top List rankings are the same as in the Retailer Ranking published for 2023. At the same time it is striking that among discounters – whose market share is already 40% – only Lidl was able to maintain double-digit growth, with the other players in the channel tending to grow at or below the market average. Drugstores are holding on to their double-digit growth, which meant plus 12-14-17% (Müller-Rossmann-dm) for them last year. However, when compared to their previous years of sales growth over 20%, the change is significant. Hungarian-owned retail chains grew below average, but we can also see negative growth, as it is the case with sales by Auchan.

Results off the winner’s podium

“DM, Rossmann and Lidl can be proud of the biggest sales growth in 2024 with 17-14%, followed closely by the very successful Napcsillag ecofamily chain with an 8% growth. Although compared to the 30% growth achieved in 2023, last year’s figure is significantly lower than that – approximately one-third of that performance – but it is still worth highlighting the chain’s good position behind the large international players”, underlined Zsuzsanna Hermann, editor-in-chief of Trade magazin, the compiler of the FMCG Retailer Ranking.

Zsuzsanna Hermann, CEO and editor-in-chief of Trade magazin

From the trio of large Hungarian-owned chains COOP and CBA performed similarly, while Reál closed 2024 with a small decline, and all three suffered a noticeable drop in the number of stores. Smaller Hungarian chains such as Kerekes and Dél-100 performed below the market average.

This year ALDI published its own data for the first time. Still, ALDI in the 6th place and PENNY in 7th place have never been so close to each other in the Top List.

Market environment

According to market research data, although there was a visible improvement on the market in the first half of 2024 compared to 2023, consumers began to curb their spending again due to renewed price hikes. Consequently, saving strategies continued to hamper retail sales growth in 2024: watching prices (63%), using leftovers (54%), trying to keep the value of the shopping basket low (61%), cooking at home more (44%), switching to cheaper brands (50%) and cheaper shops (45%), buying local products (31%) or stockpiling (21%). According to YouGov data, the share of promotions in sales continued to grow to reach 32.2%.

Consumers have adapted to market changes, according to a NIQ survey: more people have switched to cheaper alternatives, are shopping more in discount supermarkets and have become more open to using online retail channels. Consumers remain price-sensitive and this is also driving changes in their shopping habits: between 2021 and 2024 the price of FMCG products increased by 50%, which is exceptionally high even at European level. It is therefore not surprising that the majority of the population – nine out of ten people – have noticed a steady rise in prices. It can’t be denied that two-thirds of consumers are open to online shopping, which could become one of the main growth areas in the future.

Retail Zoom data also confirms that inflation hasn’t only hit consumer wallets, but also the viability of shops. Since 2022 more than 2,000 shops have closed in Hungary, the vast

majority of which were small independent shops. This is no coincidence, as four distinct phases have emerged in shopping patterns in recent years: panic buying and stockpiling were followed by “top-up shopping” and an increase in the frequency of store visits, then came downshifting and finally rationalisation became the dominant consumer strategy. All this has dramatically transformed shopping baskets and given rise to “selective shopping”. As a result of hyperinflation, consumers have been buying smaller quantities, shopping more frequently and making consciously compiled lists of what they need to buy. The value of the shopping basket has changed not only in terms of content, but also in terms of the shopper intention.

“Taking into account market activities, economic data and regulatory changes, the FMCG Retailer Ranking for 2024 doesn’t come as a big surprise. However, it is important to note that retail results reflect the general market situation, highlighting consumption problems and challenges, as well as the difficulties facing the economy. Let’s hope that there will still be opportunities for consumption to grow in 2025, and with it business success, although the experiences of the first five months of the year and the measures introduced are dampening hopes for now”, said Zsuzsanna Hermann, assessing the results of retail chains.

For more information on the FMCG market’s performance in 2024, detailed market research data, company summaries about last year and their plans for this year see Trade magazin 2025/6–7, available in a digital format from 10 June at www.trademagazin.hu and in print version.

Methodology:

The Retailer Ranking is compiled based on results expressed in Hungarian forints. Values indicated in euros are for international reference purposes, but due to the instability of the euro’s exchange rate, it is important to note that all conversions are based on the exchange rate published by the Central Bank of Hungary (MNB) on the closing date of the financial year of the company concerned.

The data in the table are based on the own reports of companies.

Sales figures marked with * are estimates by Trade magazin, which were calculated with the involvement of experts based on Trade magazin’s retailer rankings for 2023 and the tax returns of companies for 2023 and 2024, as well as changes in market conditions during the period in question.

Related news

dm’s Together for Babies program continues this year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Lidl guarantees fairer prices for cocoa farmers

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

NAK President: more than 120 thousand people signed the agricultural petition in one month

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >EY Businessman of the Year: Tibor Veres is the grand prize winner, six special awards were also given out

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The government is supporting dairy farmers with a new measure

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >