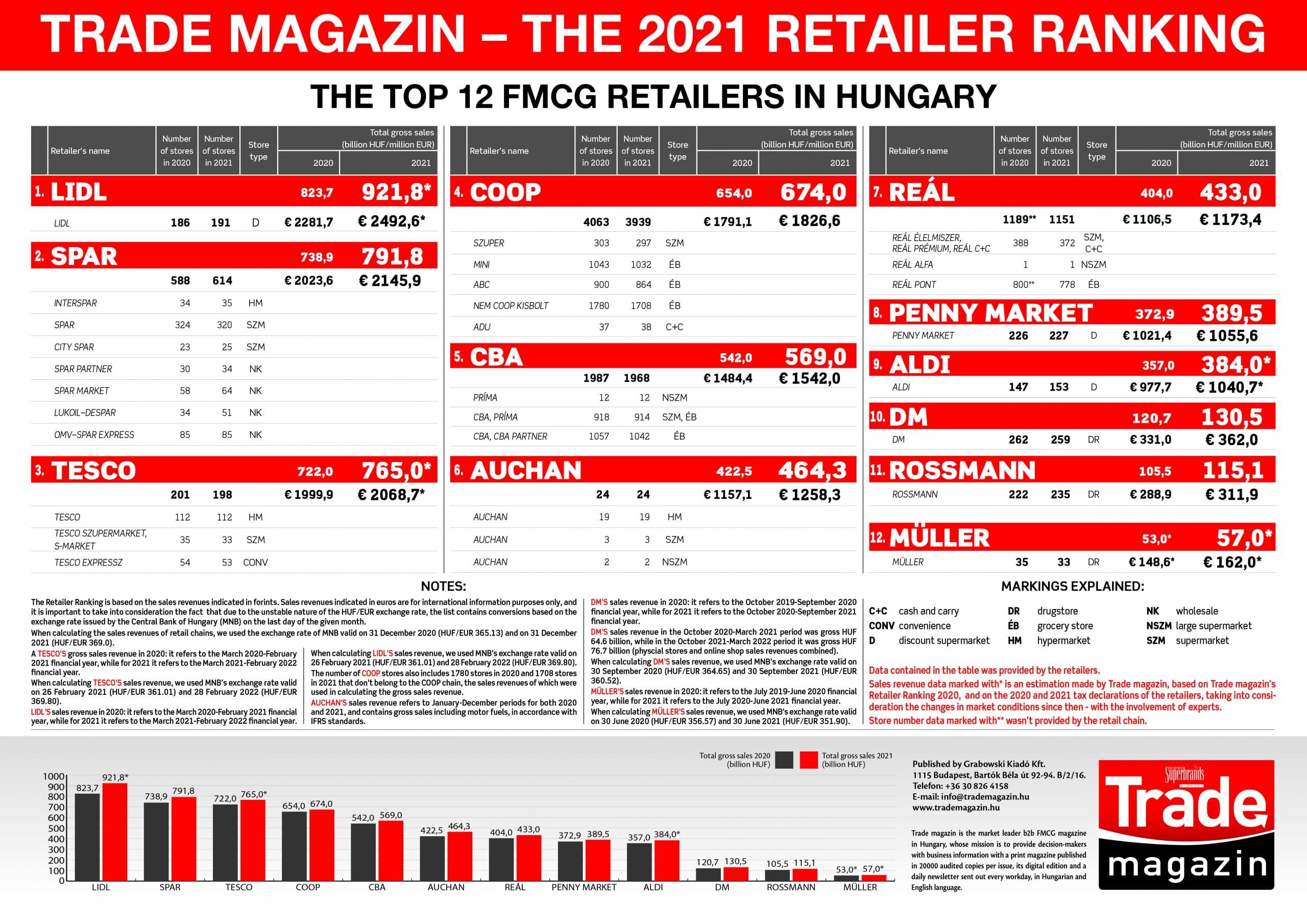

The 2021 ranking of FMCG retailers is out now – no change on the top: Lidl, SPAR, Tesco

In the last two years there were great changes in our lives, and daily shopping was no exception. The changes in our buying decisions had an impact on the annual ranking of FCMG retailers, which is published in early June every year. Last year there was a new No.1 and one of this year’s big questions was: could Lidl hold on to its leading position in 2021? Well, the answer to this question is a big yes – the discounter kept flying high by bettering last year’s performance by a sales revenue of approximately HUF 100 billion.

Changes in the ranking…

There are three important changes in this year’s retailer ranking. Perhaps the most important one is that Acuhan moved one place up and it is 6th now. The other is that instead of the 11 retailers of former years, there are now 12 of them on the list – thanks to its dynamic expansion, the drugstore chain Müller is now also one of the “big players”. Our third novelty is that from this year, the store numbers of the retailers aren’t only indicated for the year in question, but also for the previous year, as in part this can explain changes in sales revenues and the overall results as well.

Lidl is undisputedly the No.1 FMCG retailer in Hungary, and in 2021 the distance between the discounter and the steady runner-up, SPAR, became even bigger, as Lidl’s sales revenue grew by just as much as the gross annual sales of the best-performing drugstore chain. Lidl’s sales revenue increased the most from all the retailers on the list, and this isn’t surprising at all if we consider the fact that discount supermarkets produced the biggest growth last year, and according to GfK, the channel’s market share has already reached 31%. It is also discounters who have the highest penetration level at 96%, and the buying frequency is the highest in this channel, with 69 occasions/household in a year. No wonder that each and every discount supermarket chain was able to increase its store number in 2021.

For the FMCG sector, last year’s “post-Covid” syndrome was surging energy, ingredient and packaging material prices, and growing logistics costs, plus at the same time the inflation started rising in Hungary, too – in this business environment it was guaranteed that every retail channel, where products were offered at very good prices for a longer period, would strengthen its positions.

SPAR opened the most new stores last year. Being present in the market with different store formats made the retail chain’s No.2 position even more stable. SPAR is more and more involved in food production too, and they built a new hypermarket in 2021. Opening various types of smaller SPAR stores, such as those operated in a franchise system or the service station shops, also produced good results.

Tesco managed to hold on to its 2020 position and the retailer is making nice progress. Auchan also performed better than in the previous year, and this year it was the only one in the ranking to move one place up. It must be mentioned that despite the fact that lately hypermarkets haven’t been performing as well as before, their average basket values were still the biggest at almost HUF 6,000 (Source: GfK Household Panel) in 2021, what is more, this sum is able to grow further on a regular basis.

Discounters and drugstores were the two most successful channels in 2021, producing the best results, as their sales revenue and basket size growth was only surpassed by those in e-commerce. Lidl, Aldi and Penny had a superb year, just like the dm, Rossmann and Müller trio. The latter made it to the list for the first time, with its gross sales revenue lastingly going above the HUF 50 billion entry threshold.

Just like in former years, Hungarian-owned retail chains also produced some kind of growth. It is true that Auchan was able to break the formerly solid unit of Coop, CBA and Reál in the ranking, but in the light of the fact that the store numbers of all Hungarian retail chains decreased, their improved sales performance is really good news. Although they don’t have as big budgets for modernisation and technological development as their multinational competitors, they do whatever they can, and it seems that the Covid-induced trend of shoppers preferring neighbourhood shops is more lasting than originally predicted – Hungarian-owned retail chains can profit from this as well.

It isn’t indicated in the ranking, but we must mention the online leg of FMCG retailers, as in one way or another each retailer featured in the ranking sells online too. Even more so as FMCG sales in e-commerce increased by nearly 54% in 2021 in comparison with 2020, to reach HUF 118 billion; this performance was better than any other sector’s, according to data from GKID.

…and changes in the market

As a conclusion we can say that there were great changes in our lives in the last two years, and daily shopping was no exception. The changes in our buying decisions manifested in the annual ranking of FCMG retailers.

Spending more time in our homes rearranged everything. This, together with more of us staying at home, led to purchasing more products per occasion when visiting a grocery store, even if the number of store visits reduced. This trend had started in 2020 and continued in 2021, although it weakened a little, especially after life slowly returned to normal from the middle of last year. According to data from GfK, shopping frequency has been dropping in the last two years, falling 5% in 2020 and reducing by another 4% in 2021 – and this trend also affected the essential product categories. Basket value has been going in the different direction, but the growth here wasn’t big enough to compensate for the inflation, so even though retail sales were up, this meant no real expansion.

Zsuzsanna Hermann, Trade magazin’s managing director and editor-in-chief

“The last two years were really special for FMCG retailers. By reacting rapidly to the changes, they were able to cope with the difficulties, solving one new problem after the other” – told Zsuzsanna Hermann, managing director and editor-in-chief of Trade magazine. “Not only the sales performances of retailers improved, but their expenses got bigger too – and this caused a headache for quite a few of them. From the many factors influencing retail trade, it stands out that in many cases retailers were able to come up with such excellent performances with several hundred workers missing from their teams per chain, and obviously this made their work even more difficult. The permanent hardships experienced in the supply chain will stay with us for some time, and we already know that the situation is going to become worse in 2022. Costs were skyrocketing, currency exchange rates were volatile, there was an inflationary pressure and the financial situation of consumers got worse – these things made life harder for retailers in the last few years, and unfortunately this year isn’t likely to bring positive changes in this respect either. It very much seems that the carefree years lasting up until 2019 are over for a while. Let’s hope that we don’t need to wait another 5 years until things turn better. Numerous changes are likely to occur in 2022, in both offline and online FMCG retail, but we will only know more about the details one year from now” – added the editor-in-chief.

If you would like to read more about the FMCG sector’s performance in 2021, and you are interested in what the different retailers have to say about the last year and their plans for this year, all you need to do is open Trade magazine’s 2022/6-7 issue, which is available from 10 June, both online at www.trademagazin.hu and in print version.

***

Methodology:

The Retailer Ranking is based on the sales revenues indicated in forints. Sales revenues indicated in euros are for international information purposes only, and it is important to take into account the fact that due to the unstable nature of the HUF/EUR exchange rate, the list contains conversions based on the exchange rate issued by the Central Bank of Hungary (MNB) on the last day of the month in which the retailer closed its financial year.

Data contained in the table was provided by the retailers.

Sales revenue data marked with* is an estimation made by Trade magazin, based on Trade magazin’s Retailer Ranking 2020, and on the 2020 and 2021 tax declarations of the retailers, taking into consideration the changes in market conditions since then – with the involvement of experts.

***

About Trade magazin:

Trade magazin is the market leader FMCG magazine in Hungary. It is the only audited trade magazine for the FMCG sector, and every issue is printed in 20,000 copies to provide decision-makers in the retailer, supplier and HoReCa sectors with business information.

Trade magazine’s extended digital edition is available at www.trademagazin.hu, and a daily newsletter is sent out every workday, in Hungarian and English language.

Related news

Lidl has published its 3rd sustainability report

Lidl Hungary’s sustainability report for the 2022/2023 business years has…

Read more >TikTok conqueror: Dubai chocolate craze at Lidl

As the Christmas holidays approach, there is an increasing demand…

Read more >Lidl offers many products cheaper than last year

Lidl Hungary offered more than 600 products cheaper in November…

Read more >Related news

Penny’s ‘Markthalle’ discount concept in Germany

Penny’s marketplace concept in Germany is an evolutionary step towards…

Read more >The majority of Hungarians spend less than 50 thousand forints on Christmas gifts, sustainability is an important aspect, but not the primary one

Gift-giving is an essential holiday tradition, but what really matters…

Read more >Rossmann ended the year with charity

This year, Rossmann Hungary also provided support to many needy…

Read more >