Strengthening Hungarian chains in the FMCG market

Guest writer:

Andreas Christou

managing director

RetailZoom

In March-April 2020, during the first wave of the coronavirus pandemic when the panic-buying started, FMCG sales by Hungarian-owned retail chains skyrocketed – the like-for-like sales growth was 45 percent. In the same period sales of impulse products dropped 50 percent, while shoppers switched to bigger sizes in almost every category. These trends considerably strengthened the positions of Hungarian chains. What they offer to shoppers is proximity and a large product selection – especially from fresh products such as meat, fruits and vegetables. Hungarian chains perform very well in these categories, which make up for nearly 15 percent of their total sales.

Bigger growth for smaller chains

Sales of Hungarian chains continue to grow, but the growth rate is getting smaller. The sales growth was the biggest in ‘other’ or ‘independent’ shops. It must be noted that the majority of these aren’t independent but organised into chains such as Kerekes Group, EcoFamily, Next Unio, Dél-100 or Tom Market; National Tobacco Shops also belong to this category, there are more than 4,900 of these and they generated HUF 135 billion sales in FMCG categories (actually in 10 so-called super-categories). These chains realised HUF 2.3 trillion sales in 2020 and their growth rate was nearly 4 percent. For some of them the engine of growth was that new stores joined the chain, others acquired many new customers and there was a chain which improved its performance via expanding the assortment of fresh products.

Scissors effect and the return of impulse buying

Another trend that affected all shoppers was the scissors effect. If we examine basket sizes and compositions, what we can see is that price-sensitive and premium baskets grew the most. Sales of private label products grew by 22 percent, twice as much as the market average. In the same period premium product sales jumped 46 percent in value and soared by 42 percent in volume. Basket sizes grew in terms of both value and product quantity. Pre-COVID the average basket value in Hungarian chains was approximately HUF 2,700. This doubled to HUF 5,400 in 2020 and then reduced to HUF 4,780 in 2021. On average shoppers put 15 products in their baskets (back in 2019 this number was 9). It is interesting that the small decline in basket value wasn’t entailed by the disappearance of high-value baskets, as these keep growing and their average value has increased from HUF 11,300 to 16,700. The drop in average value has been caused by the return of impulse baskets.

Conclusions

As a conclusion, we can say that we shouldn’t use the terms ‘other’ and ‘independent’ for the shops of these Hungarian chain anymore, as most of them are already organised into chains. These chains have proved that they are strong and capable of adapting to the new conditions, acquiring a considerable share of the FMCG market. Hungarian chains were forced by the pandemic and the temporary stock shortages to optimise their product selections and focus on the availability of products. //

The above article has also been published in Issue 2021/12-01 of Trade magazin.

Related news

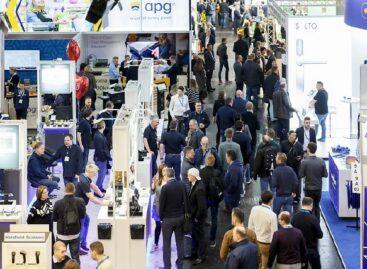

EuroCIS 2025: Serious interest in the retail technology trade fair

Amazon and TikTok recently signed an agreement that will allow…

Read more >KSH: retail turnover exceeded the same period of the previous year by 3.6 percent and the previous month by 1.2 percent

In October, the volume of retail trade turnover exceeded the…

Read more >One of the main drivers of domestic retail is the pharmaceutical trade

The pharmaceutical industry is a very important industry in the…

Read more >Related news

Recognition of Consumer Protection Excellence: Honoring the Best of 2024

This year’s outstanding consumer protection officers and special award recipients…

Read more >The Joy of Giving! – SPAR stores collect non-perishable food for people in need

The Hungarian Maltese Charity Service and SPAR Hungary have launched…

Read more >KSH: industrial production decreased by 0.2 percent in October

In October, the volume of industrial production fell by 0.2…

Read more >