Hungarian shoppers have a greater sense of purpose in the new situation

Growing financial challenges and increasing price-sensitiveness

Guest author:

Tünde Turcsán

FMCG director

GfK

One of the many effects of the coronavirus pandemic is that households are facing serious financial challenges these days, and this influences both their willingness to buy and their shopping habits. According to a GfK survey from Q4 2020, 38 percent of Hungarian households think their financial situation worsened and 37 percent believe that there will be no improvement in this in the year the come. When McKinsey did an international survey on food buying factors in 2020-2021 among retail executives, they found that managers reckon: the No.1 factor is increasing price-sensitiveness. They said one of the main trends will be downgrading.

Strengthening private labels and cancelled promotions

Last year FMCG value sales increased greatly everywhere, as people were spending most of their time in their homes. In this light it isn’t surprising at all that the FMCG spending of households was up 12.8 percent in 2020 and this trend continued in 2021 (value sales grew by 11 percent in January and by 3 percent in February). Shopping frequency was down 5.3 percent in 2020, but shoppers spent 19.1 percent more per buying occasion. Sales of private label products grew by 12.8 percent. At the same time the share of sales in promotion dropped, as many promotions had to be cancelled because shoppers spent much less time in grocery stores.

Discounters keep going strong

Discounters kept increasing their market share, while other store formats more or less managed to hold on to their shares – only hypermarkets saw their market share reduce. In the countryside discount supermarkets have become something like a hypermarket destination: shoppers are willing to travel more to shop there and leave with bigger-size baskets.

GfK has examined whether the only reason for the growing sales of private labels is the strengthening of discounters. It turned out that in 2021 total FMCG sales grew by 12.8 percent, while private label sales expanded by approximately 14 percent. In spite of the discounter channel developing the fastest, proportionately private labels strengthened more in hypermarkets and in small shops organised into chains.

Purpose, balance, planning…trends in 2021

As our lives are transforming, new factors have become important when we are shopping.

1. Purpose: the younger generation focuses less on prices, instead they make their buying decisions relying on various values. They don’t just satisfy functional needs, they consciously purchase what they need.

2. Findability: shoppers visit stores less often and also spend less time there. They are searching for the products they want to buy with bigger focus. In this situation the role of reliable brands has become more important.

3. Fluidtiy: since our lives are changing, our days are characterised by variety and flexibility. We need to adapt to everything and time seems to be melting away. We can’t plan forward as much as we used to.

4. Balance: we worry about many things every day and this anxiety is strengthened further by the fact that we spend little time outside of our homes. As a reaction we are longing for everything that is natural or has to do with nature or health.

5. Budgeteering: financial possibilities are becoming limited, especially in Hungary, so households need to make more detailed budgetary plans. For instance younger consumers are now buying private labels more often than before. //

Related news

Aldi Nord Expands European Footprint With Opening Of 5,555th Store

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Penny Czechia Seeks Growth With €112m Investment In 2026

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

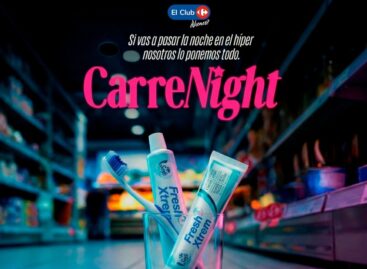

Read more >Carrefour wants to make the hypermarket hip again with a sleepover party

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Sentix: investor sentiment in the eurozone deteriorated in March

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Research: Coupons don’t determine which brands we stay loyal to

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >New trend in online shopping: Hungarians pay later

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >