Amazon and Walmart’s head-to-head competition is changing retail

The evolution of the two shows that being a retail giant means more than selling merchandise. Two of the biggest retailers are raising the bar for what it means to be a true one-stop-shop.

While some companies have downsized their inventories and closed physical locations, retail giants, namely Amazon and Walmart, are giving customers a broader array of both products and services, according to RetailDive’s weekender publication.

Different roots, similar aims

Walmart reigns supreme in brick-and-mortar retail, while Amazon dominates e-commerce. Both retailers set themselves apart by doing more than selling merchandise. They also generate revenue from categories like financial and clinical services, third-party sellers and subscriptions.

“Both Walmart and Amazon have gotten to such a point where they’re both, not only credible, but they have developed a huge amount of trust, amongst their followers and their consumers,” said Arthur Dong, teaching professor of strategy and economics at Georgetown University’s McDonough School of Business. “I think they’re just scratching the surface now.”

Amazon and Walmart have increasingly produced revenue streams outside of their core businesses. In recent years, both companies have been building out their ecosystem designed to win more of their consumers’ spending dollars. Their membership programs, Amazon Prime and Walmart+ are very similar too.

More and deeper services

Walmart opened a “Walmart Health center” in its Dallas then in Calhoun, Georgia store, now there are 7 open and 15 more planned. About 100 in-store veterinary clinics in 2019. And just last month, the Bentonville, Arkansas-based retailer announced plans to launch a fintech startup in partnership with Ribbit Capital. Bloomberg recently reported that Walmart hired two senior bankers from Goldman Sachs to operate the startup, moving the retailer closer to becoming a financial service provider.

Meanwhile, Amazon, which started as an online bookstore, now sells almost everything and more. It’s also a cloud provider, has a collection of subscription services and collects commission from third-party sellers.

“You have to consider the fact that both companies are huge data companies, and that we all know that the future of retail is the fact that you have information on all your consumers [and] what their buying preferences are,” Dong said about Walmart and Amazon. “That is the, in a sense, the oil and gold in the decades to come.”

Similar revenue structures

The pandemic has altered where and how retailers invest their money. Dong said some retailers have now entered the service space due to its low operation cost.

Even so, Dong said the retail sector will continue to drive consumer purchases, citing that personal consumption expenditures still account for about two-thirds of the U.S. economy. And based on Amazon and Walmart’s financial reports, that seems to be the case.

Amazon has significantly expanded its business over the last couple of years. Its latest annual report shows that online store sales remain the bedrock of Amazon’s business with about $197.35 billion in net revenue by the end of 2020 — that’s a little over half (51.1%) of its total sales. Its physical stores earned the lowest in 2020 at $16.23 billion or 4.2%.

Its cloud computing business, Amazon Web Service, led previously by soon-to-be Amazon CEO Andy Jassy, was responsible for over $13.53 billion or 59.1% of its operating income in 2020. With $45.37 billion in annual revenue, AWS has a year-over-year growth of about 30%.

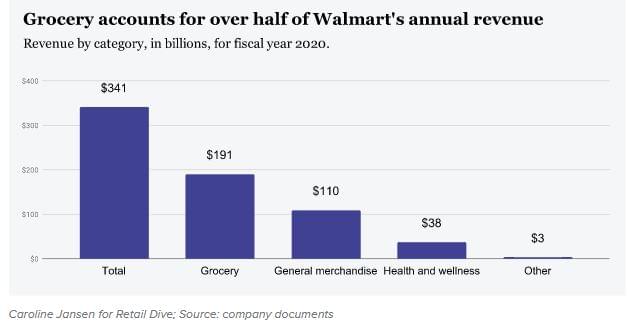

On the other hand for fiscal 2020, Walmart’s grocery and general merchandise categories were still the foundation of its net sales at $190.55 billion (55.9%) and $109.60 billion (32.1%), respectively. Meanwhile, its health and wellness category — which includes its pharmacy, optical and clinical services — drove $37.51 billion in net sales in the same year.

Trendsetters

The pandemic has proven that firms need to re-evaluate some retail concepts and strategies, experts say.

Because they have more financial wiggle room and a larger consumer base, retail giants are able to experiment and potentially set trends for their smaller counterparts.

Diversifying away from their core retail business naturally starts with larger retailers but others may soon do the same in some way. Smaller brands likely won’t operate on the same scale as industry giants, but the bottom line is to get a higher share of their customers’ wallets. It’s really about valuing your customer base, understanding and knowing them.

That alone is enough of a challenge. A recent survey from Forrester showed that only a few brands can anticipate and effectively respond to their customers’ needs. The report found that too many brands still rely on manual data collection methods, and in most cases, they don’t update that customer data in real time.

To create an effective ecosystem, retailers must establish an effective team to gather data and market research, said Tim Derdenger, associate professor of marketing and strategy at Carnegie Mellon University, who believes that data is the number one driver of what enables the ecosystem and platforms to scale, and to provide value back to the end users.

Related news

Related news

Getir pulls out of the US but says FreshDirect will keep operating

The quick-delivery company said it is redirecting its capital to…

Read more >The calm before the storm?

The first returnable plastic, aluminium and glass drink containers have…

Read more >(HU) Az ember birka, amerről a kolomp szól, arra megy – Puskás Tamás színész, rendező a FutureTalks podcastban

Sorry, this entry is only available in HU.

Read more >