There is light at the end of the tunnel

Andreas Christou, managing director of RetailZoom gave a presentation on the current situation of the Hungarian retail market and changes in consumer habits at this year’s Business Days conference.

This article is available for reading in Trade magazin 2025/11.

Domestic chains aren’t in a tragic situation

Andreas Christou

managing director

RetailZoom

Due to price caps, promotions, innovations and “pure” inflation that doesn’t include non-comparable products, there has been an average price hike of 8.1% since 2021. Over the past four years – especially during the period of hyperinflation – many stores have closed: in 2022-2023 around 1,000 stores (99% of which were independent) shut down for good and in the following year another 961 stores closed, taking the number of retail outlets below 20,000. In spite of everything, last year wasn’t a bad one for the three major domestic chains, as they achieved an average turnover growth of around 3% – the problem is the 5.4% decline in volume sales. The number of transactions was 7.2% higher and the average spending per basket was up 12.1%. Average basket value has been around HUF 5,000 for years.

Loyalty card holders are important

Loyalty card holders spend an average of nearly HUF 19,000 per store visit, which significantly exceeds the spending of unregistered customers. Due to their shopping habits, these customers are nearly four times more valuable from a business perspective than those who don’t have loyalty cards and only visit the store occasionally. Shoppers with loyalty cards also shop more frequently, e.g. in 2022 they visited stores 2.6 times on average and now they do it 4.5 times. While back in 2020 impulse shopping baskets containing 1-3 products accounted for nearly one-third (30%) of all shopping baskets, their share fell below 20% for the first time in the first half of 2025. Contrary to appearances, they haven’t diminished but have begun to transform into refill baskets, so that today they contain 4, 5 or even 6 products. The share of private labels in Hungarian convenience store chains has grown from 13% to 26% in four years, but in 2025 this trend slowed down a bit.

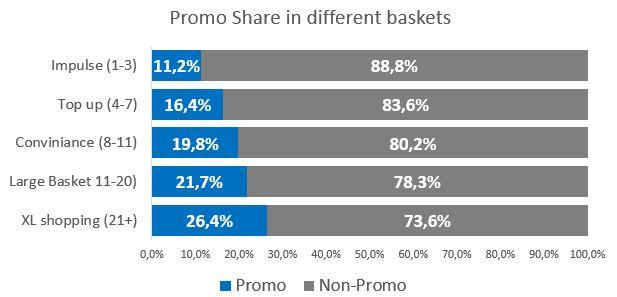

The bigger the basket, the more popular the promotion

Data clearly indicate that price sensitivity increases with the size of the basket. Impulse basket shoppers are very difficult to motivate with a good promotion – in their case the promotional share is only 11%. In large and extra-large baskets (which can contain up to 20 products per purchase) the share of promotional products is 21.7% and 26.4%, respectively. There is therefore a very large difference between the smallest and largest baskets: promotional items are 2.5 times more likely to be included in XL baskets than in impulse baskets. Promotions currently account for 23.7% of total sales, which represents a 4 percentage point rise compared to last year.

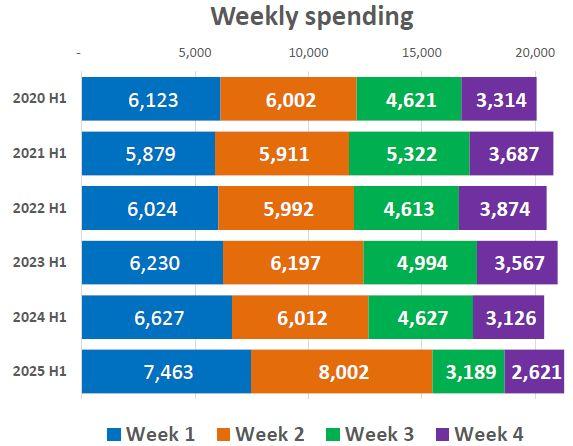

Nothing shows how much money consumers have got saved more clearly than the balance of their monthly spending. While in 2020 each week accounted for 20-25% of total spending, today about 75% of monthly spending is realised in the first two weeks. In 2025 the average basket value of HUF 7,400 in the first week or HUF 8,000 in the second week is only HUF 2,600 in the last week of the month. The introduction of price caps kept many shoppers at domestic chains, because the price cut meant that it would have been unnecessary for them to go to a store 500 meters away for purchasing certain categories.

Tobacco shops: a HUF 200bn channel in a new role

When it comes to tobacco shops, we are talking about a channel that has been declining for the second year in a row. The network used to grow at a double-digit rate in the previous 4-5 years, but recently it has suffered a little due to inflation and various product listing changes in terms of both value and volume. There is no reason to cry though, as it is still a HUF 200bn channel – the tenth largest “chain” in Hungary – with enormous potential. Prices in tobacco shops rose more slowly than those in domestic chains (e.g. by 13% in 2022 vs. 19% in domestic chains), which attracted many new customers and impulse buyers in the first two years of the study. The volume of purchases is beginning to decrease here as well, mainly because the price gap with classic grocery stores has begun to close.

Related news

There is a slice for everyone

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

The Store of the Future opens again at the SIRHA Budapest exhibition! (Part 1)

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Cheese-cocoa-peach jam: these are the most popular cookie flavors

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >