The FMCG retailer ranking for 2020 is out – Lidl has reached the No.1 spot!

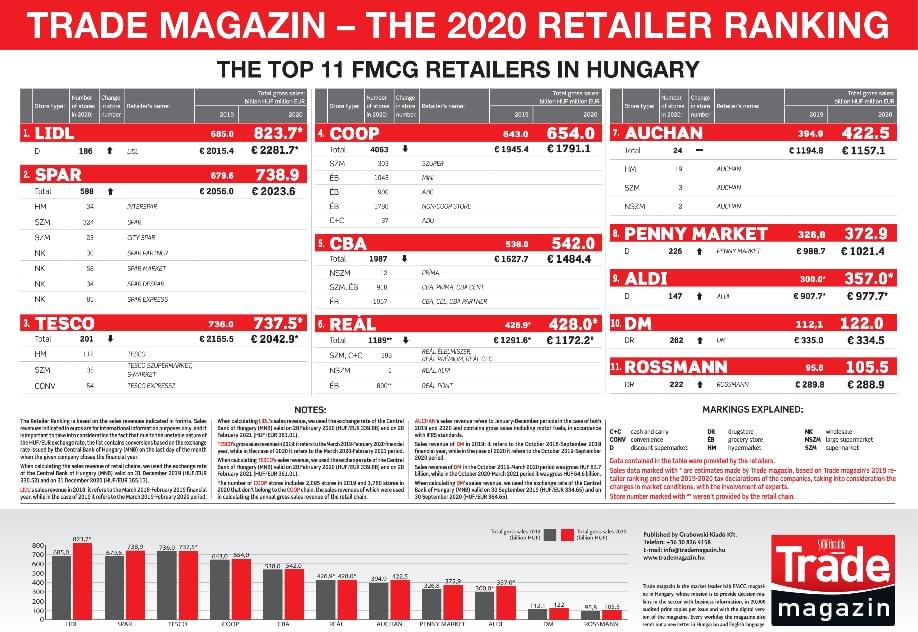

There is always a reason why it is worth waiting for Trade magazin’s FMCG retailer ranking every year, sometimes one or two surprises are revealed, while at other times a suspicion is proven to be right – well, this year’s ranking belongs to the latter category. Many asked the question already last year: Will Lidl overtake Tesco in 2020? Yes, Lidl did occupy the No.1 spot!

For the first time the ranking also contains the changes in the number of stores. This indicates that the combination of organic growth and expansion works best – although from an efficiency perspective the closure of shops that don’t perform well is an important strategic step, too.

Lidl beat everyone in 2020 and irrespective of the fact whether one likes the discounter channel or not, the business results and the successful strategy need to be appreciated. One year earlier it was already visible how dynamically Lidl was going forward, but back than 12 months weren’t enough. This time Lidl has taken the 1st place in the ranking with a significant advantage. It must also be mentioned that Lidl isn’t only the first in Trade magazin’s retailer ranking, but also in GfK’s market share report, with a nearly 15-percent share. None of the retail channels was able to grow as much in 12 months as discount supermarkets, and GfK says the channel’s market share has already exceeded 30 percent in Hungary – this makes discounters the No.1 retail channel today.

It is important to underline the fact that the No.2 spot also went to a different retailer than last time, as for the first time SPAR won the silver medal. In SPAR’s case we can also talk about a good business strategy, as the company has been successfully working on bringing out the most in the market for years by following a well-made plan. Then retailer keeps investing a lot of money in expansion, development, serving customers and improving the shopping experience, and this hard work finally bore fruit. What is more, they managed to achieve this result in an environment where the hypermarket channel has been losing market share for years – and this was also true for last year. This makes it even more important that SPAR has been paying special attention to the expansion of various small-size store formats too, the number of which increased greatly last year, as it is indicated by this year’s retailer ranking.

Unfortunately the difficulties of former years continued for Tesco and the Covid-19 pandemic only made matters worse for hypermarkets, so practically there was no change in Tesco’s sales turnover and in the light of the channel’s 2-3 percent contraction, it would also be a good result if sales declined by 1-2 percent, but our estimation was a little bit more positive than this.

As for the ‘trios’ of discounters, Hungarian-owned retail chains and drugstores, the market shares and rankings didn’t change within the channels, so the ranking is only different in the trio of hypermarkets.

Small corner shops that could change their product selections quickly as a reaction to the new conditions saw their opportunities grow last year, because during the pandemic shoppers didn’t want to visit large stores and they didn’t wish to spend a lot of time with shopping. Due to the fewer store visits, shoppers opted for a larger size in several product categories and they also purchased bigger quantities.

‘I think that the actual data isn’t necessarily the most important information in the ranking – although the numbers matter too – as the list makes the various trends visible, especially if we check out the rankings of the last few years too’ – stressed Zsuzsanna Hermann, managing director and editor-in-chief of Trade magazin. ‘Last year we already made an illustrative animation for this, which shows in just a few seconds which retailer lost speed and which one stepped on the gas.’

Ms Zsuzsanna Hermann, managing director and editor-in-chief of Trade magazin

Below you can see the results up until 2020:

‘It is noteworthy that retailers which followed a successful strategy in the last few years managed to perform well in the pandemic year too. However, the sales boom of March and April slowed down later in the year, and with the impact of the inflation the positive results became more modest. By the middle of the year the high hopes about HoReCa sales migrating to retail trade went up in smoke. Changing conditions transformed shopping habits too and the big question now is how these new habits will stabilise after the slow reopening, when the processes of the new normal are developing’ – summarised Trade magazin’s editor-in-chief. ‘We are just leaving the third wave of Covid-19 behind and the work processes are changing again, as a combination of home office and office life is being born. This is important from the perspective that the stores which counted on winning back their customers when they return to office work can now see that this won’t happen as much as they hoped. Consequently, these retailers must restructure their operations at those points of sale where they used to work in a completely different system in 2019 than they do now. Luckily there are always new opportunities, as we know that only one thing is constant in life: change. A good retailer is always ready to jump on the opportunity and adapt to the new situation the best they can.’

Trade magazin will analyse all of these things one year from now, showing how retail chains – which already realised sales above HUF 100 billion – performed in this transformed environment.

You can read in detail about the performance of the FMCG market in 2020, the new conditions, how retailers were able to adapt to this transformed environment and the new opportunities in issue 6-7 of Trade magazin, plus you can read how the representatives of retailers summarise their 2020 and share their plans for 2021.

Related news

Nestlé cuts jobs at Czech factory amid falling demand for plant-based meat

Nestlé is to cut 80 jobs from its Krupka plant…

Read more >New Product Launches In Spain Hit New Low, Study Finds

Innovation in Spain’s FMCG sector is at a record low,…

Read more >Schwarz Group acquires Romanian big box operator La Cocoș

In a market shaped by hypermarket contraction and discount dominance,…

Read more >Related news

Temu has already targeted the European food market

The Chinese-rooted Temu is posing an increasingly serious threat to…

Read more >Irrigation water resources equivalent to one-third of Lake Balaton are available

Despite the extraordinary drought and lack of precipitation, we can…

Read more >Free irrigation water provided to farmers is a key element in the fight against drought

Free irrigation water provided to farmers is a key element…

Read more >