Retailers are opening clinics

As retailers seek to make greater inroads into healthcare, many of them have unveiled aggressive plans to launch dozens — if not hundreds — of their own primary care clinics over the coming years.

Last week, Walgreens announced that it will invest $1 billion in debt and equity over the next three years into VillageMD, which operates a chain of primary care clinics. As part of the deal, VillageMD will open 500 to primary care clinics in Walgreens stores over the next five years.

Business modell

The new types of healthcare clinics that these retailers are unveiling are very different from the pharmacies that they’ve traditionally crammed into the back of their stores. These retailers are investing more into healthcare for a couple of reasons. One, is that the amount of money Americans spend on healthcare continues to rise, so retailers want to get a bigger share of this increasingly lucrative part of consumers’ wallet. Second, as more shopping moves online, retailers need to add new services to figure out how to get more customers come to their stores more frequently.

Walmart has started

Walmart plans opening several standalone primary care clinics over the past year. The first standalone clinic that Walmart launched last year in Calhoun, Georgia allowed patients to see doctors for routine checkups and treatment of chronic conditions, even if they lacked health insurance. The cost for an annual physical at the clinic is $30, while the cost for a dental exam is $25.

With the hope that customers will eventually turn to Walmart for their primary care needs, the company is also looking at making great inroads into other medical services. In June, the company announced that it acquired the tech and intellectual property of CareZone, an app that helps people manage and schedule deliveries for multiple prescriptions. It was also reported this week that Walmart registered its own insurance business.

CVS chose an other way

CVS has the biggest head start, given its merger two years ago with insurance giant Aetna. That’s allowed CVS to justify more expensive investments, like remodeling its stores and turning them into HealthHubs, because adding more primary care services should, in theory, bring down insurance costs for Aetna. CVS announced plans to turn 1,500 of its more than 9,000 stores into “HealthHubs” which will have a larger clinic, offer access to a greater range of diagnostic tests, as well as wellness rooms for activities like yoga.

Walgreens is for partnering

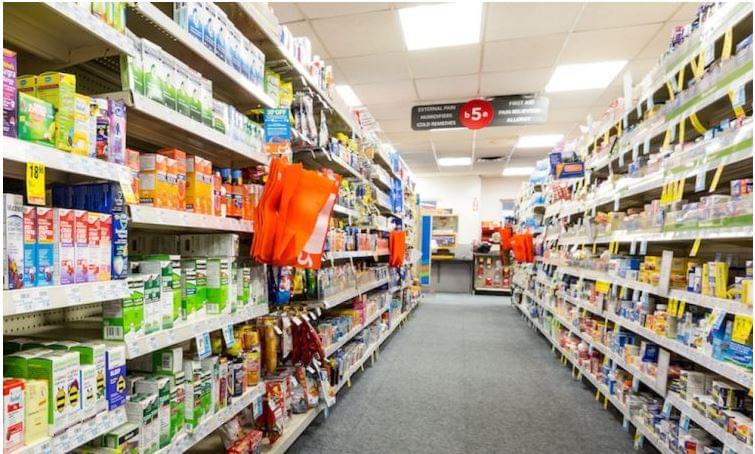

Walgreens’ strategy, meanwhile has not been to build its own insurance companies or primary care clinics, but rather to partner with other companies on its healthcare initiatives. In addition to the VillageMD partnership, the company also previously tested an in-store primary care clinic designed for seniors in partnership with Humana, and secured a partnership with testing provider LabCorp to roll out diagnostic services to hundreds of stores within the next two years. The clinics’ proximity to Walgreens’ drug stores could allow doctors and pharmacists to communicate better with one another. That could allow the pharmacist to say, encourage the doctor to prescribe a lower-cost medication.

Related news

The BioTechUSA group of companies welcomes applications from domestic healthcare institutions

Three categories, audience prize, HUF 18 million in total prize…

Read more >According to ELTE researchers, a special absorption of iron takes place inside the head of cabbage

The iron absorption mechanism of chromophores in the absence of…

Read more >Uber Health expands to offer grocery and over-the-counter delivery

Uber Health, the healthcare arm of Uber, has expanded to…

Read more >Related news

After a subdued year, the holiday season is strong

74% of online shoppers, around 3.1 million people, are preparing…

Read more >Lidl has published its 3rd sustainability report

Lidl Hungary’s sustainability report for the 2022/2023 business years has…

Read more >The majority of Hungarians spend less than 50 thousand forints on Christmas gifts, sustainability is an important aspect, but not the primary one

Gift-giving is an essential holiday tradition, but what really matters…

Read more >