Overall satisfaction with retailers falls

Overall customer satisfaction with large grocery chains dropped significantly in 2020, according to the latest Retail and Consumer Shipping Report from the American Customer Satisfaction Index (ACSI), released 2nd of March. The winner is Trader Joe’s. Amazon and Walmart are at the bottom.

The American Customer Satisfaction Index Retail and Consumer Shipping Report 2020-2021 is based on interviews with 70,767 customers, chosen at random and contacted via email between January 13, 2020, and December 27, 2020.

General downgrading

While much of the Retail sector anticipates a turnaround in 2021, customer satisfaction is not heading in the right direction.

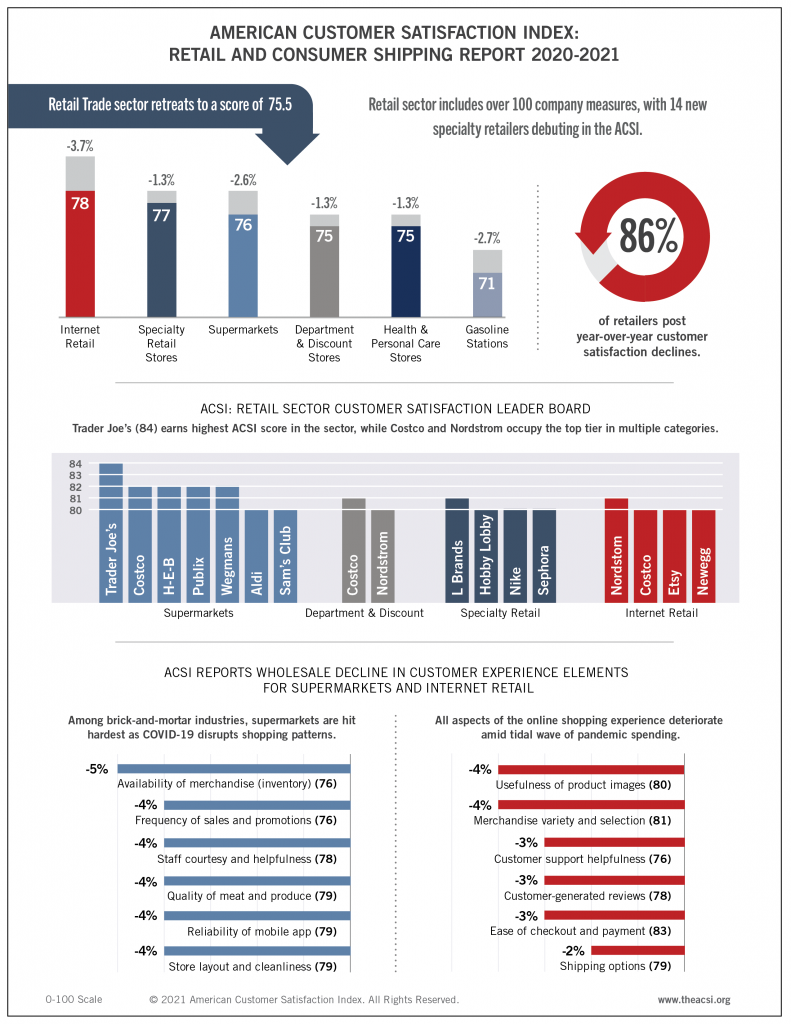

Overall, the Retail sector declines 2.3% to a score of 75.5 (out of 100), according to the American Customer Satisfaction Index (ACSI®) Retail and Consumer Shipping Report 2020-2021.

Overall, the Retail sector declines 2.3% to a score of 75.5 (out of 100), according to the American Customer Satisfaction Index (ACSI®) Retail and Consumer Shipping Report 2020-2021.

“2020 sent waves of disruption across the Retail sector,” says David VanAmburg, Managing Director at the ACSI. “From mandatory closures that halted in-person shopping to stock shortages caused by panic buying, retailers experienced anything but business as usual. Deliveries from online retailers were delayed, and customers were frustrated when high-demand items sold out. And it shows, as 86% of the retailers measured suffer downturns in customer satisfaction year over year.”

This report covers six retail industries — department and discount stores, specialty retail stores, health and personal care stores, supermarkets, internet retail, and gas stations — as well as consumer shipping and the U.S. Postal Service. Among the six retail categories, not one escapes the trend of declining customer satisfaction in 2020.

Trader Joe’s tops supermarket industry and Retail sector

After four years of near-stable customer satisfaction, the supermarket industry plunges 2.6% to 76, with 17 of 20 major grocers posting lower scores year over year.

Trader Joe’s tops the supermarket industry – and the entire Retail sector – with a stable score of 84. Four companies tie for second place with scores of 82: Costco (down 1%), H-E-B (down 2%), Publix (down 1%), and Wegmans (down 2%). The remaining top-tier performer from 2019, Aldi, slips 4% to tie with a stable Sam’s Club at 80.

At the low end of the industry, a group of big decliners languish further behind the industry average than they did in 2019. Southeastern Grocers slides 4% to 73, while Giant Eagle plummets 5% to 72. Albertsons Companies also shows a steep ACSI drop, losing 5% to 71, tying for last place with Walmart, which declines 3%.

Nordstrom now wears the internet retail crown

For 2020, online retail loses the most ground among all retail categories, tumbling 3.7% to an ACSI score of 78.

Nordstrom captures the industry lead despite retreating 1% to 81. In second place, Costco (down 1%), Etsy (down 2%), and Newegg (down 1%) are all deadlocked at 80. Former industry leader Amazon tumbles 5% to an all-time low score of 79.

With a stable score of 78, Target is the only e-commerce retailer to buck the downward ACSI trend. Most of the industry scores below the average of 78. Macy’s and Wayfair both tumble 4% to scores of 77, tied with eBay (down 3%). Along with Amazon, smaller sites show the steepest decline in the category, plunging 5% to 75. Another big-tech name, Apple, retreats 4% to 75.

Walmart and Sears remain the industry bottom dwellers. Walmart inches back 1% to 73, while Sears fizzles 1% to 72.

Costco’s lead shrinks among department and discount stores

Following two years of customer satisfaction stability, the department and discount store industry retreats 1.3% to an ACSI score of 75. While two companies eke out small gains, 13 of 19 major store chains suffer customer satisfaction declines year over year.

Costco remains in first place for a fifth straight year, despite declining 2% to a score of 81. Its lead is also shrinking.

Nordstrom (which includes Nordstrom Rack) is second, up 1% to 80, while Dillard’s is third, up 1% to a score of 79. Kohl’s and TJX (Marshalls and TJ Maxx) are next in line, both slipping 1% to scores of 78, while BJ’s Wholesale Club (down 3%) and Macy’s (down 1%) follow closely behind at 77 each.

Six retailers tie at 76: Smaller stores (down 4%), Belk (down 3%), Burlington (unchanged) JCPenney (down 3%), Ross Stores (unchanged), and Target (down 3%).

Among the low-end performers, Dollar Tree stumbles 4% to an all-time low of 74. Rival Dollar General also loses ground with customers in 2020, falling 3% to share the bottom of the category with Walmart (unchanged) at 71.

L Brands faces stiff competition from debut specialty retail stores

Customer satisfaction with specialty retail stores recedes 1.3% to an ACSI score of 77, marking the industry’s lowest point since 2015.

L Brands sits atop the specialty retail store industry for a seventh straight year, yet slips 1% to an ACSI score of 81. Hobby Lobby and Nike both debut in second place at 80 apiece. They’re joined by Sephora (unchanged).

Newcomer Pet Retail Brands comes in at 79, the same as TJX’s HomeGoods banner, another first-time entrant. HomeGoods scores slightly ahead of brick-and-mortar competitor Bed Bath & Beyond (78) and online home specialist Wayfair (77).

Several retailers new to the ACSI are clustered at or within a point of the industry average. Famous Footwear and PVH (Calvin Klein, Tommy Hilfiger) score 78. Apple and Discount Tire match the industry average of 77, while American Eagle Outfitters and H&M earn ratings of 76. Another mall-oriented retailer, Signet Jewelers, debuts at 76.

Among the biggest decliners, Ascena’s ACSI score plunges 5% to 76, while customer satisfaction uniformly sinks 4% for the three major home improvement retailers: Menards (77), Home Depot (75), and Lowe’s (75). J.Crew receives a first-time ACSI score of 75, the lowest among apparel chains, while Ace Hardware enters the Index at 74.

At the bottom of the industry, Williams-Sonoma scores 73 in its debut ACSI appearance. GameStop continues to rank last among all specialty retailers, plummeting 4% to an all-time low score of 72.

Smaller drug stores losing their grip over the competition

For a third year, customer satisfaction with the health and personal care (drug) store industry weakens, dropping 1.3% to an ACSI score of 75.

The group of smaller drug stores remains the industry leader, albeit with a lower score, down 4% to 79. CVS is next, steady at 77 for the third straight year, followed by Kroger, which slides 3% to a score of 76.

Walgreens stays below the industry average, inching back 1% to 74. Walmart is next, slipping 1% to 73. Rite Aid shares the bottom of the industry with Albertsons Companies, both tumbling 4% to 72.

Consumer shipping falls to all-time industry low

Despite handling more packages than ever before, customer satisfaction with consumer shipping slides just 1.3% to an ACSI score of 76. However, this represents an all-time industry low.

FedEx remains in the lead despite declining 3% to 78. Customer satisfaction with UPS fades for a third straight year, dipping 1% to 75. The U.S. Postal Service’s (USPS) Express and Priority Mail manages to gain a point to 73.

Related news

Hungarian SMEs need more information on ESG requirements

A recent research by Billingo has found that 67% of…

Read more >Most online shoppers are fed up with unpredictable parcel delivery times

According to a recent Ipsos survey commissioned by DODO, it…

Read more >Consumers have reached the limits of their capacity

In August 2024 RRD came out with its Awareness-to-Action Study…

Read more >Related news

DélKerTÉSZ: record quantities of Hungarian vegetables in supermarkets

DélKerTÉSZ sold a record volume of Hungarian vegetables to domestic…

Read more >Anora Group’s expansion in the Baltic region

In order to strengthen its position in the Baltics, premium…

Read more >Prices rose by 3.7% in November

Following a 3.2% year-on-year increase in October, consumer prices in…

Read more >