Amazon develops private label brands

Amazon has unveiled Aplenty, a new private label food brand set to eventually include hundreds of products across a variety of center store categories.

Amazon is expanding its lineup of house brands amid a deepening focus by food retailers on private label products, which promise larger profit margins than items carrying name brands according to Grocery Dive.

Aplenty – the trendy snack

The brand, which is available online and at Amazon’s Fresh grocery stores, launched with items including twice-baked parmesan, garlic and herbs pita chips; slow-baked cornbread crackers; and salted caramel chip mini cookies.

Amazon said it plans to roll out hundreds of Aplenty-branded products, including sweets, cookies, salty snacks, frozen foods, baking mixes and pantry staples, over the next year. Products carrying the brand will not have artificial flavors, synthetic colors or high fructose corn syrup, according to the company.

Omnichannel focus

The addition of Aplenty builds on a private label grocery assortment that Amazon has quickly — and quietly — built as it has focused more on omnichannel retailing. The retailer now sells milk, frozen vegetables and spices under its Happy Belly brand; baked goods emblazoned with the Amazon Fresh name; and heat-and-eat meals and meal accompaniments sporting its Amazon Kitchen brand.

The company offers products for children, including clothes and baby food, under its Mama Bear brand. It also sells a wide assortment of non-food items, including technology gear, kitchen equipment and pet supplies, under its Amazon Basics label.

Growing share

Amazon’s launch of Aplenty comes as rival Target ramps up Favorite Day, a private label line of food and beverages built around snacks and sweets that the retailer rolled out in early March and said would become available to shoppers on April 5.

Private label products have emerged as significant sales drivers for retailers in recent years. In a reflection of that trend, Kroger plans to launch 660 new private label items in 2021, the majority of which will be under its Simple Truth and Private Selection lines, Stuart Aitken, Kroger’s chief merchant, told investors on March 31.

Also in March, Albertson CEO Vivek Sankaran said the grocer has seen penetration of its own brands rise to 25%, about where it had been before the pandemic started, and hopes to see that rate increase to 30%, he said.

According to IRI, private label boosted its share of wallet over name brands in 2020 and accounted for nearly a fifth of the sales growth CPG products experienced.

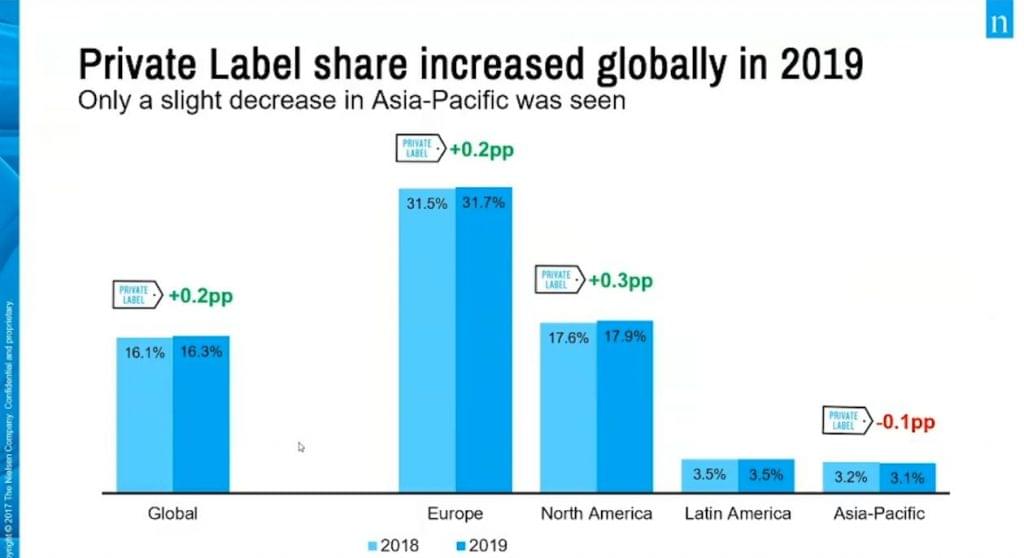

For comparison general market share of private label in 2020 was 16,3%. Europe is the highest with 31,7% share, then comes North America with 17,9%, Latin America with 3,5% and Asia-Pacific with 3,1% share according to Nielsen presentation on PLMA online Trade Show last December.

Related news

Conscious consumers, digital transformation: lessons learned on the FMCG market in 2024

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Private Labels Are Quietly Winning Europe’s Grocery Shelves

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Hétéves növekedési stratégiát jelentett be az Auchan

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >