As you haven’t yet thought about investments for energy efficiency purposes: a means of tax reduction

Due to the energy crisis affecting the whole of Europe and the resulting rise in energy prices, more and more Hungarian businesses are thinking about making investments and renovations aimed at energy efficiency while reducing their long-term costs.

(Photo: Pixabay)

According to Grant Thornton, from the point of view of the return on the investment cost, it is worth being aware that increasing energy efficiency is a goal that is also supported by the Hungarian legislator, moreover in the form of a corporate tax discount – so not only our energy costs, but also our tax costs can be reduced. The specialists of the tax consulting company summarized the most important rules.

What is an energy efficiency investment?

Within the conceptual framework of Hungarian corporate taxation, an investment or renovation is considered to be for energy efficiency purposes, which results in the given company being able to produce more products using the amount of energy before the investment/renovation, or after the investment/renovation can produce the same number of products with less energy than before produce. There is no regulation as to how much – for example, by how many percent or by which unit of measure – the energy consumption must be reduced, moreover, the energy to be reduced can be anything: natural gas, propane-butane (PB) gas, gasoline, diesel, district heat, electricity, etc. . However, the energy saved as a result of the investment/renovation must be supported either by estimation/calculation or by measurement. In practice, an investment/renovation for the purpose of energy efficiency can be, among other things, the thermal insulation of a building, the replacement of an existing, outdated gas boiler or air conditioning system (e.g. with a heat pump cooling-heating system), or the replacement of a production equipment operating with high energy consumption with a low consumption one.

The tax side of energy efficiency

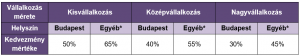

According to the Hungarian corporate tax law, a company can use a corporate tax discount in the case of the commissioning and operation of an investment or renovation for energy efficiency purposes in the tax year following the commissioning of the investment or renovation – or, at its discretion, in the tax year of the commissioning of the investment or renovation – and in the following five tax years. – emphasizes József Vizer, head of the Grant Thornton tax consulting business. The discount can be used for all eligible costs of the investment/renovation (including any state aid) (subject to the conditions below), but there is a (relative) upper limit of 2, which depends on the geographical location of the investment/renovation, and on the tax discount also from the size of the customer company: Size of the company Small company Medium company Large company Location Budapest Other* Budapest Other* Budapest Other* Discount rate 50% 65% 40% 55% 30% 45% *: Under “Other” are Northern Hungary, Northern Great Plains, We mean the Southern Great Plain, Southern Transdanubia, Central Transdanubia, Western Transdanubia and Pest planning and statistical regions. In addition, there is an absolute upper limit: regardless of the above percentages, the amount of support cannot exceed the HUF equivalent of 15 million euros. The tax benefit in question, the corporate tax reduced by the development tax benefit, can be used up to a maximum of 70%.

Tax details

The tax discount for investment/renovation for energy efficiency purposes on the one hand gives the opportunity to reclaim corporate tax (if the company concerned previously paid a higher amount in advance than the actual corporate tax reduced by the tax credit), on the other hand, the lower corporate tax liability entails a lower advance payment, since the actual corporate tax is 4 or 12 by dividing it into installments, the corporate tax advance to be paid in the future is determined. In other words, this corporate tax discount option is primarily recommended for companies that are expected to operate profitably in the year the investment/renovation is put into operation, or in the following 5-6 years, and are therefore liable to pay corporate tax.

What does this mean in practice?

This tax benefit can therefore be used after the eligible costs. Such a cost is the cost of tangible assets that help to achieve a higher level of energy efficiency or directly serve energy efficiency goals. It should be emphasized that the tax discount can only be applied to the full cost of an investment/renovation aimed at achieving a higher level of energy efficiency, in all other cases, only the additional cost that was necessary for the planned investment to achieve higher energy efficiency can be counted on. For example, if a company were to expand its production line anyway, but chooses a more expensive solution among the available options because it will be able to save energy with that machine, then the more expensive machine you can take advantage of the tax discount in question with regard to your additional costs.

We also need an energy expert

Determining what constitutes a fully recoverable cost and what is merely an additional cost in the case of an investment is not easy for laymen. It is precisely for this reason that it is definitely worth using the help of an energy expert in order to decide which category the investment/renovation falls into. In the event of an incorrect determination of the eligible cost, a serious corporate tax shortfall can be expected during the subsequent NAV investigation. The condition for taking advantage of the discount is that the company concerned – no later than by the time of submitting the corporate tax return for the first tax year of the tax discount – must have a certificate according to the related government decree, which supports that its investment or renovation is classified as an investment or renovation for energy efficiency purposes. Such a certificate can be issued by an energy auditor or an energy audit organization listed in the list maintained by the Hungarian Energy and Utilities Regulatory Office. It should be emphasized that the condition assessment or the initial energy level must be determined by the energy auditor before the start of the investment or renovation. Failure to do so may pose a risk during a tax audit, so special attention must not only be paid to hiring an expert with appropriate certification, but the timing of the assignment is also an important aspect when planning the investment/renovation.

Conditions

In the case of an investment aimed at the use of energy obtained from a renewable energy source, a restriction in the case of renovation that the tax discount can only be used if the investment/renovation involves an increase in energy efficiency. An additional condition for the use of the tax discount is that the concerned company puts into use all the assets that are part of the investment/renovation and operates and uses them in accordance with the provisions of the valid, valid license for at least five years after commissioning (“mandatory operating period”). In order to monitor the above and be able to check it afterwards, the company concerned must keep a separate register, which includes the date, location and cost value of the related devices being put into operation (or, as the case may be, their removal from stock). However, the tax discount cannot be claimed for all investments/renovations related to energy efficiency. It cannot be used, among other things, if the company concerned carries out the development in order to comply with EU standards already adopted at the time of the start of the investment/renovation, or if the object of the investment is a passenger car (excluding passenger cars with a large loading space). Furthermore, we cannot count on this even if the business concerned wishes to benefit from (or has benefited from) a development tax discount in connection with the same investment. Particular attention must be paid to the observance of the rules, as the fulfillment of the conditions of the tax benefit is verified by the NAV ex officio at least once by the end of the third tax year following the first use of the tax benefit.

Related news

MFB: you can now apply for the interest-free, EU-funded investment loan

From Tuesday, enterprises can apply for the interest-free investment loan…

Read more >Burger King is allocating $300 million to modernize its restaurants

Burger King and its parent company, Restaurant Brands International, announced…

Read more >GKI is more pessimistic than the government about growth, inflation and public finances

GKI hasn’t changed its 2-2.5% growth forecast for 2024. However,…

Read more >Related news

OECD: Food price inflation fell sharply in most countries

The Paris-based Organization for Economic Cooperation and Development, the OECD,…

Read more >Nébih experts examined the cheapest foods

In order to protect consumers, the National Food Chain Safety…

Read more >Szentkirályi Magyarország’s deposit-fee PET bottles are already on store shelves

Szentkirályi Hungary was one of the first to start the…

Read more >