Magazine: VAT rules in Hungary and abroad

The Guild of Hungarian Restaurateurs (MVI) and the Guild of Hungarian Confectioners have prepared a joint recommendation for changing the VAT regulation of the hospitality sector. MVI member Károly Zerényi is the author of the document, which also includes international examples. This reveals that in most European Union member states there is a preferential VAT rate applied in the hospitality sector, typically for serving food and alcohol-free drinks. In most EU countries the regulation doesn’t differentiate between alcohol-free drinks prepared on site or somewhere else in advance, and between food eaten on site or bought as take-away.

Related news

Related news

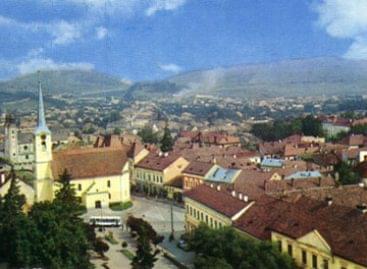

The Székely counties will present themselves with a joint stand at the 48th Travel Exhibition

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >(HU) Pszeudopulykasült – A nap videója

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >