Magazine: Europe is a stronghold of private label products

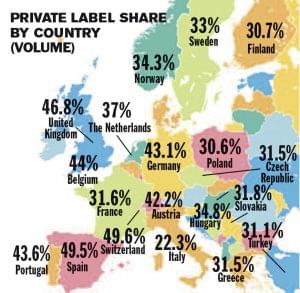

Nielsen has prepared a study for the Private Labels Manufacturers Association (PLMA) yearbook, titled 2020 International Private Label Yearbook, according to which the market share of private label (PL) products grew in 14 from 19 European countries. In all countries but one analysed by Nielsen, the market share of PL products was above 30 percent. In the United Kingdom and Germany this share was higher than 40 percent. As for Central Europe, Austria has retained its 40-percent share for PL products, while this share is above the 30-percent threshold in Hungary, the Czech Republic and Slovakia. It is noteworthy that in Switzerland more than 50 percent of FMCG sales are realised by PL products.

Nielsen has prepared a study for the Private Labels Manufacturers Association (PLMA) yearbook, titled 2020 International Private Label Yearbook, according to which the market share of private label (PL) products grew in 14 from 19 European countries. In all countries but one analysed by Nielsen, the market share of PL products was above 30 percent. In the United Kingdom and Germany this share was higher than 40 percent. As for Central Europe, Austria has retained its 40-percent share for PL products, while this share is above the 30-percent threshold in Hungary, the Czech Republic and Slovakia. It is noteworthy that in Switzerland more than 50 percent of FMCG sales are realised by PL products.

According to Peggy Davies, the new president of PLMA, the numbers indicate that shoppers now already give priority to private labels when it comes to buying FMCG products. What is more, the coronavirus pandemic only strengthened the positions of these products further. She revealed that in the United States PL is already the biggest brand – Nielsen has found that sales are worth USD 136 billion per year.

This year the World of Private Label International Trade Show in Amsterdam will take place on 2-3 December, and its title will be ‘Life is good in Private Label’.

PLMA Excellence Awards, the international trade show of the best private labels//

Market trends of private label products

Krisztina Bakonyi-Kovács

senior product consultant

GfK Consumer Panel

In Central and Eastern Europe there is a direct connection between the market share of private label (PL) FMCG products and the level of retail concentration. In Central European countries PL products’ share is relatively high at 22-33 percent and the combined FMCG share of the 10 biggest retail chains is above 70 percent; on the contrary, in Bulgaria and Russia, where PL products’ market share is the lowest in the region, the combined FMCG share of the Top 10 retailers is below 50 percent.

PL products have pushing forward strongly in the region in recent years. Their share is especially high in the discount supermarket channel: last year it was 61 percent in Hungary. However, in line with international trends, PL products’ share dropped 1 percent at discounters in Hungary last year. The Top 10 PL categories in Hungary include frozen food, dairy products and cotton wool, while PL products have the lowest in mainly the drug categories, ready-to-cook meals and chewing gum.

In the last 12 months the market share of PL products increased the fastest in the following categories: 1. Sugar (42-percent share for PLs in the first half of 2020), 2. Instant coffee mix (6 percent), 3. Suntan lotion (53 percent), 4. Carpet cleaner (23 percent), 5. Colour-preserving washing additives (28 percent). Shopping habits have changed during the lockdown induced by the Covid-19 pandemic, but the market share of PL products remained the same in the FMCG category. //

PL sales are developing more dynamically than manufacturer brands in Hungary, too

According to Nielsen’s annual Shopper Trends survey, Hungarian consumers like to choose private label (PL) products because of their price and good price-value ratio. Nearly half of consumers (45 percent) opine that PL products offer the same quality as manufacturer brands. Nielsen reported that grocery value sales were up 7 percent in 2019 in comparison with 2018. Private label sales rose by 10 percent, while manufacturer brands increased sales by 6 percent; PL products’ value share was 30 percent. PL products’ share is the highest in the dog food category at 59 percent, followed by cheese with 46 percent and sour cream at 42 percent.

In 2019 drug product sales augmented by 6 percent in value: sales were up 8 percent in the PL category and manufacturer brands improved their performance by nearly 6 percent; PL products share in the drug category is 18 percent. Value sales of PL products are the highest in the discount supermarket channel: it is above 60 percent. //

Related news

Related news

Lidl is building a new administrative and logistics centre in Straubing

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >High-value shopping basket and more conscious shoppers: growing demand for domestic and healthy products

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >From the shopfloor: What the Mere format reveals about retail concentration

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >