The financial situation of the population also favours discount chains

Over the past year, the epidemic has brought many changes to the lives of the Hungarian population, but the change in the financial situation has affected all areas. In its latest online survey of 550 respondents, NMS Hungary looked at how the population has changed its spending habits and how they are covering higher expenses against a backdrop of declining or stagnating income.

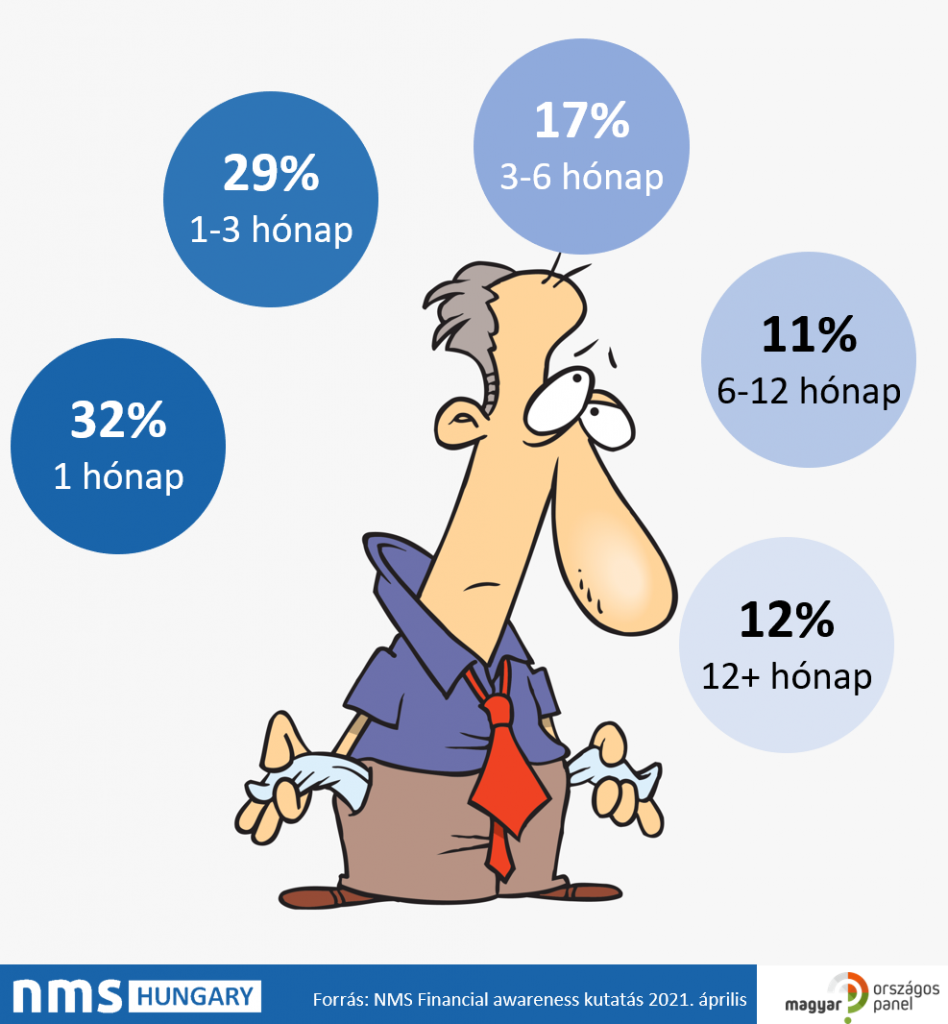

Half of the respondents have seen their regular income fall to a greater or lesser extent, or even disappear completely, in the past year. Revenues remained stable for 44% and only 6% realised an increase. This is also strongly reflected in the spending plans of the population, which can be described as rather cautious. One third have not saved at all in the past year, 24% have saved less than before the epidemic and only 9% have increased their savings. A third of the population would be in a tight spot at the end of the first month if the main breadwinner lost their job, and a further 29% would have a maximum of 3 months’ reserves.

One in four respondents would try to compensate for falling incomes by cutting their expenditure or working second jobs or overtime. 17% would start to use up their savings, expecting that the fall in their income would not last long, and one in six would sell something of greater value. 5% would borrow from friends or relatives but only 3% would take a bank loan.

One in four respondents would try to compensate for falling incomes by cutting their expenditure or working second jobs or overtime. 17% would start to use up their savings, expecting that the fall in their income would not last long, and one in six would sell something of greater value. 5% would borrow from friends or relatives but only 3% would take a bank loan.

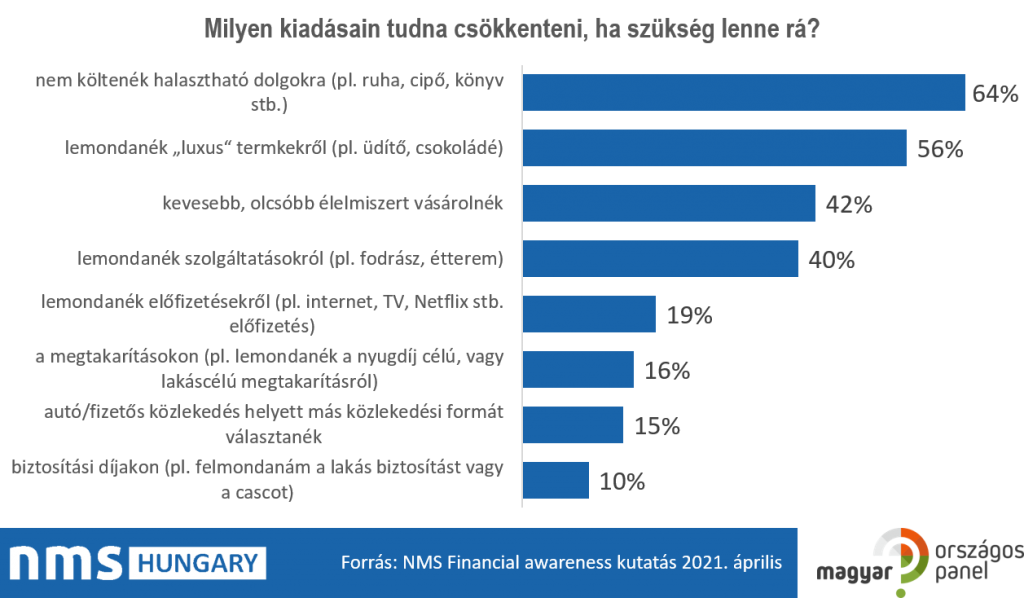

Fears of an unpredictable future are also prompting those whose income situation has not changed during the epidemic to rethink their spending. Most people would start by cutting back on non-urgent items such as clothes, shoes, and books, followed by indulgences such as soft drinks, chocolate and more expensive food products. They would then replace the usual products with cheaper ones, or forgo services such as hairdressing or beauty treatments.

If that were not enough, they could make further savings by cancelling non-essential overhead services such as TV or internet, by cancelling regular savings for retirement or housing, and by not paying insurance fees.

As the rise of discount chains and own branded products shows, this process has already begun, with purchases changing significantly over the past year. More and more people are planning their shopping in advance and writing shopping lists so that they only buy the products they need, and the proportion of smaller shops within the shopping destinations is also increasing. Whereas before the epidemic many people chose hypermarkets for day-to-day grocery shopping, nowadays most people go to discount chains for such small trips.

The research shows that working from home is only a minor contributor to the decline in the popularity of hypermarkets. In the capital, where the proportion of people working in a home office is the highest at 26%, 65% said that being at home did not affect where they regularly shopped. The reason for this shift is likely to be that one in three shoppers now shop less often and in fewer stores than before, meaning that they are less likely to shop in a hypermarket as well as their favourite discount chain.

Related news

Penny’s ‘Markthalle’ discount concept in Germany

Penny’s marketplace concept in Germany is an evolutionary step towards…

Read more >Online and discount grocery to experience fastest growth in next 5 years

Online and discount grocery channels are set to experience the…

Read more >Sustainability on the shelf: what do shoppers think about packaging and the environment?

This article is available for reading in Trade magazin 2024/11…

Read more >Related news

Most major grocery chains will keep their stores open until noon on December 24th

Most of the large grocery chains will keep their stores…

Read more >Viktor Orbán: Economic recovery and historic opportunities for 2025

On Friday morning, Prime Minister Viktor Orbán presented the Hungarian…

Read more >Recognition of Consumer Protection Excellence: Honoring the Best of 2024

This year’s outstanding consumer protection officers and special award recipients…

Read more >