Sainsbury’s wants to rise to the next level

New three-year strategy puts market share growth, loyalty and retail media capabilities as well as billion-pound cost savings program in focus.

Sainsbury’s, the UK’s number two grocery retailer, is looking to strengthen its market position at a time when German discounters Lidl and Aldi are posting double-digit sales growth month after month. Under the motto ‘Next Level Sainsbury’s’, the multi-format retailer has committed on a three-year strategy that contains eight key objectives. To be able to expand its market share, one major focus is on developing its Nectar loyalty platform and retail media capabilities. Sainsbury’s also aims to reduce costs by 1 billion British pounds to free up financial resources for, among other things, upgrading its technology platform and for process automation.

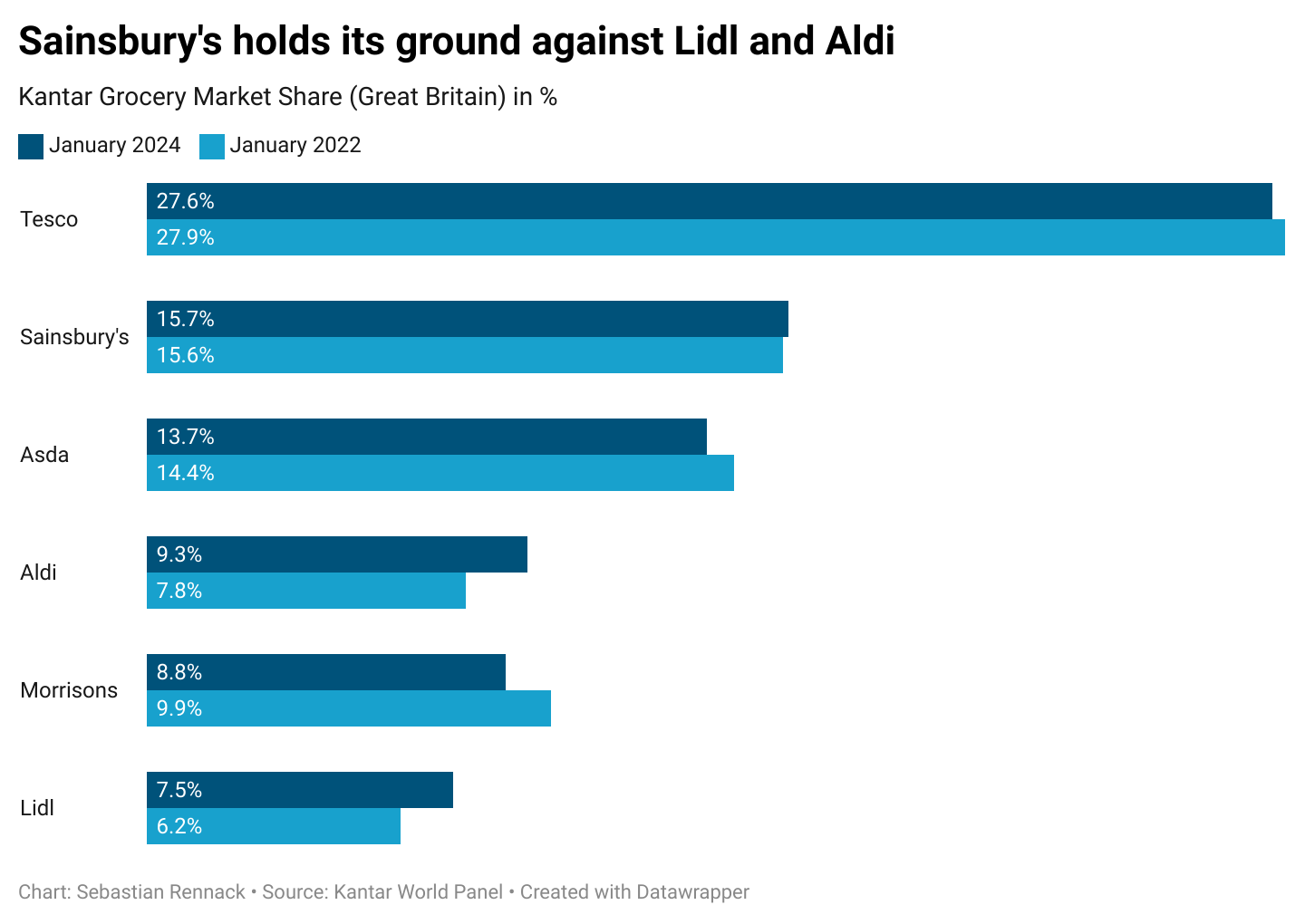

Sainsbury’s has effectively countered the rapid expansion of Aldi (South) and Lidl in the UK. The retailer is the only one of the UK’s former ‘Big Four’ grocers to have maintained its market position since the onset of inflation. According to Kantar World Panel, Sainsbury’s from January 2022 until January 2024 was the only full-range retailer to increase its market share by 0.1% from 15.6% to 15.7%. All other British supermarket operators saw their position erode (see chart). Falling purchasing power has driven consumers en masse into the arms of discounters Lidl and Aldi. Both have made big gains in market share over the period, with Aldi up 1.5 percentage points from 7.8% to 9.3% and Lidl hot on its heels, up 1.3 percentage points from 6.2% to 7.5%.

Shopper research shows that price currently is of paramount importance for the inflation-plagued British consumer. But Sainsbury’s shelf prices seem to be far away from being competitive with the discounters‘ prices, even though Sainsbury’s matches over 550 of its products with Aldi prices. Sainsbury’s regularly comes fourth or fifth in the monthly price comparisons of the seven largest grocery players plus the online pure player Ocado, carried out by the UK’s Consumers‘ Association Which?.

It is not necessarily standard shelf prices, the basis of Which?‘s price comparisons, that have given the supermarket a positive price image. It is rather Sainsbury’s digital loyalty program ‚Nectar‘ launched in April last year that has become a competitive advantage in the market. As Tesco has done for years with its Clubcard program, Nectar offers exclusive discounts on 6,000 items for its 16 million subscribers.

Over the past two years Sainsbury’s has invested more than 560 million British pounds in its prices. For the current year the retailer has allocated a further 220 million British pounds. In order to finance the price investment, the retailer has been selling off non-essential assets. In April last year the company announced to dispose of non-food banner Argos in Ireland and only a couple of weeks ago its banking arm was put up for sale.

An essential part of funding the ongoing price war will be the evolution of the loyalty program and the retailer’s use of retail media. Analysts estimate the potential income from selling customer data generated by the Nectar card program to TV and consumer goods manufacturers at around 300 million British pounds per year. At the same time Sainsbury’s plans to strengthen its financial resilience by buying back its own shares for 200 million pounds over the course of the next financial year.

Related news

CAFE FREI developed ALDI’s new own-brand coffees

ALDI Hungary further expanded its cooperation and product development with…

Read more >Absolute Live: a trendsetter among Hungarian sports drinks for 16 years

Absolute Live, produced by R-Water in Akasztó, has been a…

Read more >Getir to leave Western Europe

Quick commerce company Getir is preparing to leave all the…

Read more >Related news

BH AgrárTrend Index: the outlook for the Hungarian food industry has stabilized

The assessment of the situation of the actors of the…

Read more >GVH: The postponement of certain amendments to the Competition Act is justified

The Economic Competition Authority (GVH) agrees with the postponement of…

Read more >We can drink from these RevoCups this year

More than 400 works were submitted to the VÍZió graphics…

Read more >