RetailZoom: Do weekends still influence our shopping behavior?

Introduction of the mandatory quarantine for people, hundreds of thousands of employees are now doing their jobs remotely from home, moreover, the closing of schools has also staggered the number of people “stuck” in a household daily. As such, families no longer differentiate between Weekdays and Weekends, since they are at home all the time. This and panic were the reason behind people undergoing a “stocking syndrome” and filling their shelves and fridges. However, we are now slowly but surely decelerating down and realizing we can not consume 40-80% additional food. Parallel, the shortening of shopping hours, the mandatory legislations for our elders and the change in our basket content also means we are now spending less time in the stores and shopping less frequently.

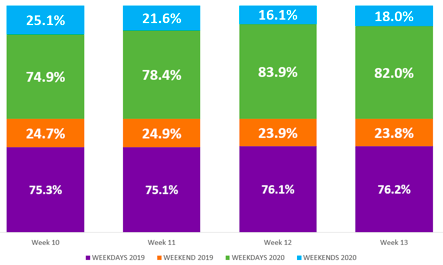

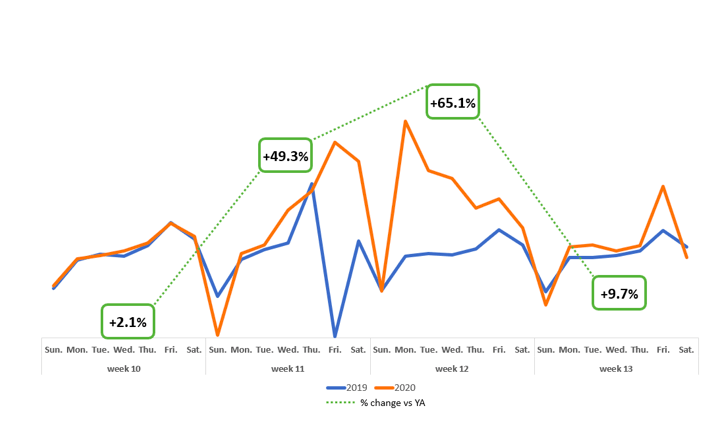

But how are all these circumstances changing our habits on when to visit the stores? Do we still fall under the magical spell of weekends? Well, relying on our March data, and analysing a sample of 30 days, it is obvious that the weight of the weekend purchases have decreased vs 2019: while weekend purchases accounted for approximately 25% last year, this March it has fallen below 19%, emphasizing that weekends and weekdays are now blended as one. While the extreme growth in Sales value in March’s 2nd & 3rd week seems to end, the balancing of our purchases is likely to remain with us while the fear of pandemic is still strong, and maybe even after.

Looking at the absolute changes in turnovers of the weekdays, we can see that they have increased by 39% in March vs 2019. Interesting development that the unit sales have only grown by 12%, meaning that – on top of the inflationary effect – sales have shifted heavily to bulk and multi-serve items, a common phenomenon during the pandemic period. Increase in spending in weekends have lagged that of weekdays, as it is well below 10% vs 2019. This is mainly due to customers going less frequently on an all days shopping spree with the help of car or public transport.

Of course, various product categories have been impacted differently by these changes: the weekend “share” of some impulse products (single-serve soft drinks, chocolate tablets, desserts, praline), alcoholic drinks (champagne, wines, beers) and certain basic food categories (potatoes, spices, etc) have performed at 20-25% share, meaning that these products are still very much part of the weekend shopping. Simply put, some habits are hard to shake, especially if we use these products for rewarding ourselves.

Related news

There is a slice for everyone

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >There is light at the end of the tunnel

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Tobacco shops: fewer products, concentrated sales and new growth paths

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

State compensation for the victims of Bászna Gabona Zrt. has been completed

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >MBH quick analysis: Tourism will continue to soar this year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >