ProWein 2013: Specialist Article on Sparkling Wine

In the run-up to ProWein 2013 experts on the global sparkling wine market see great challenges ahead. Increased raw material prices are the main concern negatively impacting the sector. Gratifyingly however, there is rising consumer demand for higher-quality products. And: customers have not lost their taste for sparkling wine and globally the drink is being forecast very good growth prospects.

Sparkling wine producers should be pleased: the increased willingness to spend amongst sparkling wine drinkers and the development of new markets will both increase future sales opportunities for sparkling wine without it needing to compete with other alcoholic drinks. This is the result of a worldwide survey on the sparkling wine sector on 17 markets – whose data was published by the London market research institute TNS in August 2012. This revealed that if demand from all Champagne and sparkling wine fans were fully met, the proportion of sparkling wine on the alcohol market would rise from 5.1% to 7.8%. The most significant growth – a quadrupling of market share for sparkling wine – could be seen in India and China. However, from this perspective more mature markets like Great Britain and the USA could also double their market share to 9.1% or 6.5% respectively.

Cava Producers looks to Exports

Commenting here Jan Hofmeyr, Chief Researcher in Behaviour Change at TNS, said: “Globally there is increasing wish to enjoy sparkling wine and Champagne, although many people are still put off by the prices. The drink is also seen as a luxury for special occasions. The good news for sparkling wine producers is that consumers feel that sparkling wine tastes better and is more enjoyable than other alcoholic drinks. Thus, the study does not reveal that consumers will increase their alcohol consumption overall but that they will wish to drink sparkling wine more often.” Spain with its sparkling wine share of 8.7% is the only country the study forecasts to decline – by 0.4%. However, experts believe this slight drop is unlikely to harm the export-oriented cava market in view of its worldwide growth. It is not least due to this that Dr Hans-Joachim Momm, Managing Director at Freixenet GmbH, will be presenting the cavas and wines of this Spanish company at ProWein 2013 in Düsseledorf: “The increasing internationalisation of ProWein offers an attractive platform for the Freixenet group of companies to present their strength and variety to a wide international audience,” he explains.

Germans’ predilection for ‘bubbly’ is no secret. Their per capita consumption in 2011 stood at 4.1 litres or five and a half bottles of sparkling wine per year – as reported by the German Wine Institute (Deutsche Weininstitut – DWI) on the basis of data from Germany’s Federal Statistical Office. With an estimated global sparkling wine market of a good two billion bottles a year, almost one bottle of sparkling wine in five is uncorked in Germany (22%). This puts Germany in pole position on the international stakes. TNS calculates the proportion of sparkling wine in Germany compared to related alcoholic drinks at 9.9% and the country’s growth forecast here stands at +1.9%.

Preference for Rosé crosses Borders

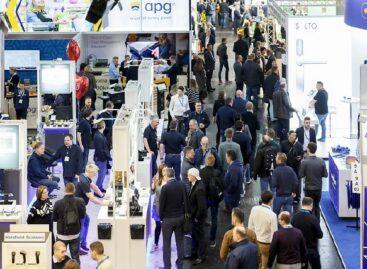

Providing an even more comprehensive impression of the international sparkling wine market than the survey is a visit to ProWein 2013 itself. “ProWein in Düsseldorf is the most important trade fair for wine, sparkling wine and spirits. As a wine and sparkling wine producer with a 170-year tradition we use ProWein to present our range and innovations to the interested trade audience,” says Benedikt Zacherl, Press Spokesman of Austrian wine and sparkling wine producer Schlumberger. Showcasing themselves at ProWein in the sparkling wine segment will be a total of 330 exhibitors from 26 countries, including “exotic” nations of origin such as New Zealand and Chile. “While our focus does lie on non-sparkling wine,” says Manager Mauricio Garrido in charge of sparkling wine production at the Chilean winery Vina San Pedro Tarapaca, “we would also like to prove we can hold our own in the sparkling wine segment with reasonable value for money.”

Growing for many years now, the preference for sparkling rosés unites customers from throughout the world. “We have also seen the rosé trend developing on the international market,” stressed Jan Rock, Press Spokesman for the high-exporting Wiesbaden sparkling wine producer Henkell & Co. And this applies to both sparkling wine and Champagne. Garrido can also confirm this trend in Chile.

With a market share of 77.6% (in terms of turnover) the German sparkling wine market may still be dominated by white sparkling wines. However, current IRI retail data from August 2012 points to sales increases for rosé of 7.5% and increases for sparkling red of 8.0%. The market share in turnover terms for sparkling rosé stands at 11.5% and for sparkling red wine at 3.0%.

Mild and Alcohol-Free Catch Up

Furthermore, an emerging global trend in sparkling wines is a focus on milder flavours. “According to current GfK market research findings, it is possible to reach more consumers – especially younger target groups aged 19 to 25 – with milder-tasting sparkling wines. The ‘mild sparkling wine’ segment already accounts for 9.1% of Germany’s entire sparkling wine market,” says Momm from Freixenet. Looking beyond Germany’s borders to the US, increased demand is even developing there for Moscato.

German producers are also launching milder-tasting sparkling wines onto the market. “The medium-dry and mild wines are gaining even more ground in Germany,” adds Barbara Hoffmann, Press Spokesperson for the sparkling wine producer Schloss Wachenheim (SSW). Furthermore, some producers have started successfully tapping into new target groups with flavoured sparkling wines or ready-to-drink variations of mixed drinks containing sparkling wine or indeed by advertising with new serving methods for their products. For instance, Schlumberger is advertising its ‘young’ Secco brands with the sparkling wine served over ice in a high-ball glass. And at Henkell, the inventor of the ‘Piccolo’ bottle, there is also an international trend for 0.2 l miniatures.

Even if the market share of alcohol-free sparkling wine is still relatively small, as suppliers insist, major European producers are virtually unanimous about the growth prospects of this market. The reasons for this are varied. For instance, at Schloss Wachenheim they are also observing a trend towards lower-alcohol wines and sparkling wines on export markets. “The reasons for this lie both in the duty on alcohol in individual countries and in the trend towards a healthier lifestyle,” says Hoffmann. So far this year Henkell has posted two-digit sales growth for alcohol-free sparkling wine.

Whether with or without alcohol: sparkling wine producers like to present their new products and flavours at the Düsseldorf show. “In our sector ProWein is a trade fair of world standing. Not only does it serve to foster and develop existing contacts with top-class partners from retail, the specialist trade and gastronomy but also to forge new national and international business contacts. Furthermore, ProWein is a highly recognised platform for the presentation of innovations in the sparkling wine, wine and spirits sector,” says Rock from Henkell.

High Raw Material Costs dampen the Mood

Despite encouraging sales opportunities, sparkling wine producers cannot look to the future entirely without concern. They are all uneasy about increased raw material prices on the one hand and increasing competition on the other. “The current strains on wine supply could lead to further price adjustments in 2013,” says Hoffmann from SSW. Add to this growing price pressures in some countries.

One issue seen as particularly price-driven are the sales opportunities in German food retail – a topic that also preoccupies foreign producers wishing to consolidate or develop their position on the large German sparkling wine market.

Branded sparkling wine producers like Henkell & Co. see excellent quality, design, brand communication and innovative offers as a way out of these downward-spiralling prices. “A tendency emerging on the sparkling wine and wine markets is the increased focus on origin and quality,” stresses Zacherl from Schlumberger. “As ever, there is an international trend towards higher-quality sparkling wines and this is also the case even in this unsteady economic climate,” adds Dr Momm from Freixenet.

Related news

Related news

This year, Trade magazine is asking its readers for their opinions on Christmas TV commercials! Vote for yourself!

The audience voting takes place between December 12 and 19,…

Read more >FRUIT LOGISTICA 2025: The exhibition awaits visitors with numerous innovations

Representatives of the international fruit and vegetable trade will meet…

Read more >EuroCIS 2025: Serious interest in the retail technology trade fair

Amazon and TikTok recently signed an agreement that will allow…

Read more >