Who pays the ferryman?

On 26 May the Hungarian government announced the biggest-ever sector specific taxes.

Guest writer:

László Hovánszky

president

Lánchíd Klub

Retail trade’s share is HUF 60bn from the HUF 800bn government wants to collect this way (another HUF 100bn is expected to come from other taxes), with the purpose of establishing a utility cost protection fund (HUF 700bn), and another fund for financing defence tasks (HUF 200bn). The big question is how the different sectors will react to this windfall tax. Wizz Air has already announced the introduction of a EUR 10 extra tax per passenger.

According to the government, the new tax is imposed on extra profits. Profits in the retail sector were between 2% and 4% after taxation in 2020. Energy prices are 3-4 times higher now than before, and this has a negative impact on the performance of retailers too, especially combined with higher salary costs, increased logistics expenses, the workforce shortage, etc. It is rather likely that the consumption growth will slow down in the current difficult economic climate – at times like these, consumers tend to start buying private label and first-price products. Obviously the government had to do something, but it would have been much better if they imposed the windfall tax on those sectors that really generate big extra profit. //

Related news

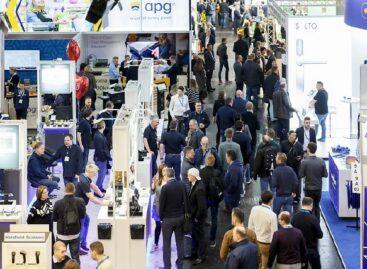

EuroCIS 2025: Serious interest in the retail technology trade fair

Amazon and TikTok recently signed an agreement that will allow…

Read more >KSH: retail turnover exceeded the same period of the previous year by 3.6 percent and the previous month by 1.2 percent

In October, the volume of retail trade turnover exceeded the…

Read more >Jumbo rolls out new private label range in the Netherlands and Belgium

Jumbo has introduced a new private label range called Jumbo’s…

Read more >Related news

Fruit and vegetables in the spotlight

Spring 2025 isn’t only important for the fruit and vegetable…

Read more >The future of the Hungarian food industry: sustainable innovation

Both as owner of Real Nature Kft. and as chairperson…

Read more >