Lidl’s international expansion stutters

Lidl has put the brakes on its international expansion. Selected investments in Poland and Spain to close the gap to market leaders.

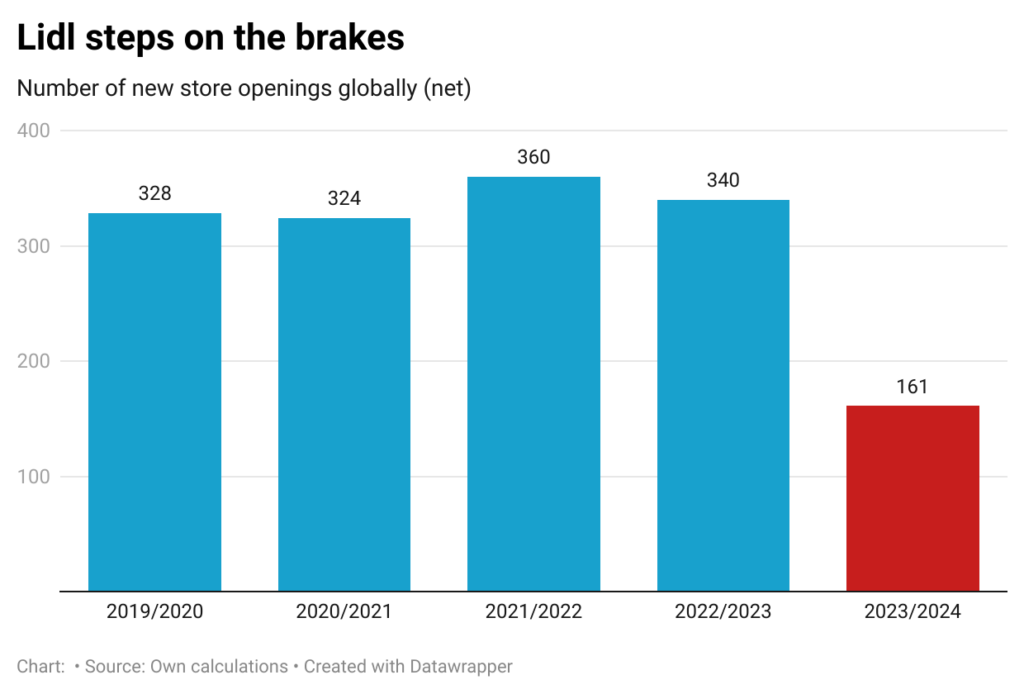

In the 2023/2024 financial year, which ended at the end of February, the discounter opened less than half as many stores globally as in previous years. While the retailer added an average of around 340 stores a year to its global estate over the past five years, it only added 161 new locations over the past 12 months (see chart). The discounter, which saw its net profit fall by €500 million to €1.6 billion in the last fiscal year 2022/2023, has since implemented strict austerity measures.

According to the author’s calculations, Lidl currently operates 9,102 or 74% of its global store estate of 12,358 stores outside its home market. The largest international market is France with 1,600 stores, followed by the UK with 1,005 and Poland with 892 locations. In the mature home market of Germany, the number of stores has not changed much and stands at 3,256, three more than 12 months ago.

The discounter’s biggest investments in its store opening program for the 2023/2024 financial year are in countries where it faces strong market leaders.

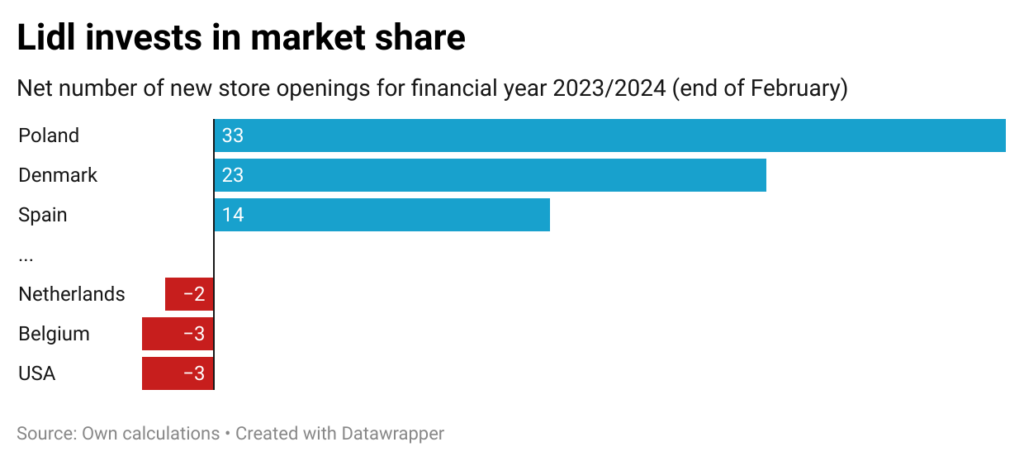

In Poland, Lidl’s percentage sales growth in recent years has been on par with local hero Biedronka, the undisputed market leader. And the gap between the discount leader and its follower has widened considerably. While at the end of 2019 Biedronka was €7.9bn ahead of the German discounter in terms of sales, according to balance sheet data, by the end of financial year 2022 the gap had already widened to €11.0bn. And although Lidl Polska is the frontrunner in the retailer’s international portfolio when it comes to new store openings, the expansion push in Poland over the past 12 months has been significantly weaker than in previous years. While Lidl opened between 40 and 50 new stores in Poland in the previous five years, the author estimates that it opened 33 stores in the last 12 months.

In Spain, too, Lidl faces a discount-driven market leader that is several times larger than the German discounter. According to Kantar Worldpanel data, discount-supermarket operator Mercadona currently holds a 26.1% share of the FMCG retail market, an increase of 0.7 percentage points in the calendar year 2023. Lidl, in third place in the national grocery rankings, improved its position by 0.4 percentage points to 6.3% of the market over the same period. The German retailer opened 14 stores in the past 12 months, bringing its total store count to 678.

In Denmark, Lidl benefited from the exit of competitor Aldi Nord. Thanks to the acquisition of some of Aldi’s stores, Lidl ended the year with 23 new locations and a total of 162 stores, significantly more than the 150 discounters the retailer had originally targeted still six months ago. In the Scandinavian country, Lidl has so far plays a minor role, ranking fifth among food retailers with a market share of less than 5% of total FMCG sales. At the same time, competition for Lidl is intensifying. Other discount competitors are also strengthening their market position. Norwegian Reitangruppen’s Danish discount banner Rema 1000 is in the process of converting 114 former Aldi Nord stores to its own brand and aims to reach 400 stores by the summer. Market leader Salling Group operates more than 520 Netto discount stores in its home country and is in the process of upgrading the store concept to the latest Netto 3.0 format.

At the lower end of the international expansion scale is Lidl’s venture into the United States. Here the retailer has reduced its footprint by an estimated 3 stores to 175 discount stores. In the summer of last year, US retail media reported that Lidl US planned to lay off 200 head office staff and close at least 5 stores. Arch-rival Aldi (Süd), on the other hand, has continued to expand its presence, opening more than 75 stores in the past 12 months, bringing its store network to 2,362 locations as of editorial deadline. European discount formats have so far played a minor role in the US market. Industry estimates put Aldi’s net sales in the US at $27 billion, representing a 2.1% share of the total retail grocery market. And although Aldi has maintained its pace of expansion, the discounter has not been able to expand its store network as quickly as originally planned. Still in spring last year Aldi announced plans to reach the store mark of 2,400 on national level by the end of 2023.

Similarly, Lidl’s store network is being optimised in the Benelux region. In the Netherlands, the retailer operated 439 stores at the time of writing, two fewer than a year ago. According to Statista data, Dutch Lidl was the third largest grocer in 2022 with a market share of 10.1%, behind Jumbo with 21.5% and market leader Albert Heijn (Ahold Delhaize) with 37.0%.

In neighbouring Belgium, the number of stores decreased by 3 to 308.

A slowdown in inflation rates and an expected drop in construction costs, however, might mean that Lidl this year will return to a higher pace of expansion. According to industry sources the discounter has continued exploring potential new store locations and has been waiting for building costs to fall back towards pre-inflation levels. Only recently German Lebensmittel Zeitung reported that Lidl in its home market wants to go on the offensive again and expand its footprint more actively. However, the stronger focus on financial returns also for expansion decisions is expected to remain a core criterium.

Related news

Market share of Chinese platforms in Spain reaches 34%

One in three (34 percent) of online purchases in the…

Read more >Kaufland To Join Buying Alliance AgeCore In 2025

German retail chain Kaufland is set to join the AgeCore…

Read more >Russian retail looks for growth options

Russian retailers are looking for new ways to increase their…

Read more >Related news

Valeo Foods Completes Acquisition Of Appalaches Nature

Valeo Foods Group has completed the acquisition of Appalaches Nature,…

Read more >Carrefour grows in France and Brazil, lags behind in rest of Europe

Carrefour says it is rather pleased with its financial results…

Read more >Food and beverage innovation plunges nearly 50% since 2007: Mintel

The market research firm said about a quarter of items…

Read more >