Once again about the service charge

The Guild of Hungarian Restaurateurs (MVI) has updated its information material on tipping and service charges, their handling and tax implications – in line with the current legislation.

This article is available for reading in Trade magazin 2025/4.

The summary includes a definition of tipping and service charges, the general rules on tipping, its forms and handling, and the gist of the rules on service charges. From 1 January the maximum service charge applied by a catering business can be 15% of the price of the products consumed, including the VAT. The service charge may be indicated on the menu in two ways: already included in the consumer prices or added to the final amount. Whichever form is used, the service charge must be listed separately on the invoice or receipt given to the consumer. //

Related news

(HU) Tudatos Vendéglátók Konferenciája 2026

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The first ball of the Gundel Palace conquered the stars with a full house

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Farewell from the president

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Group layoffs at Szallas Group, which operates Szallas.hu: the reorganization affects approximately 70 people

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

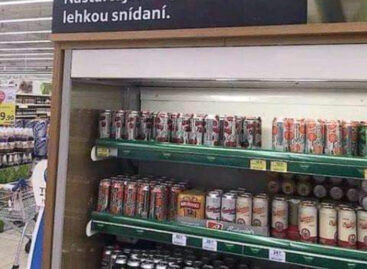

Read more >(HU) Cseh reggeli – A nap képe

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >