Tag "felszolgálási díj"

Reconsidered service charges

Date: 2024-12-03 13:37:59

Trade organisations welcomed the decision of the Ministry for National Economy to increase the maximum level of the service charge from to the previous proposal. This article is available for...

Read more

NAV position regarding the legal interpretation problems of the service fee

Date: 2023-01-24 08:59:44

The gross amount of the collected service fee can be reduced by the amount of VAT before distribution and payment to the employees, but it cannot be reduced by other...

Read more

Magazine: Service fee taxes

Date: 2020-05-14 07:21:08

According to information from the National Tax and Customs Administration (NAV), the service fee won’t be free from social contribution payment obligation if legislators don’t amend the relevant law. In...

Read more

Magazine: Building bridges

Date: 2020-04-27 07:26:14

In mid-February the representatives of the Guild of Hungarian Restaurateurs (MVI) and the National Tax and Customs Administration’s (NAV) met to discuss the most important matters related to possible forms...

Read more

Recommendations for solving problems

Date: 2020-03-18 10:43:43

The Guild of Hungarian Restaurateurs (MVI) recommends that the National Tax and Customs Administration’s (NAV) should compile a guide book that would contain practical advice for hospitality businesses in tax...

Read more

Magazine: Tip and service fee

Date: 2019-08-14 07:37:30

Károly Zerényi, a member of the body of representatives of the Guild of Hungarian Restaurateurs (MVI) has written a guide on the difference between a tip and a service fee,...

Read more

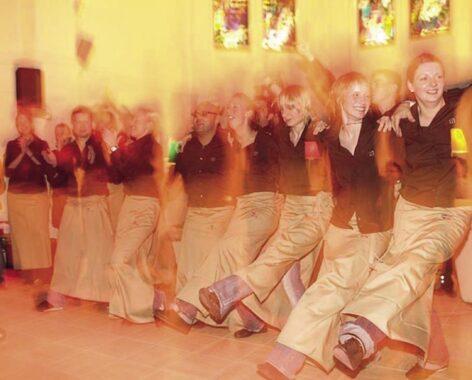

Magazine: Bridge building

Date: 2019-08-07 07:30:59

The Guild of Hungarian Restaurateurs (MVI) and National Tax and Customs Administration’s (NAV) Pest County directorate organised a conference together for the third time. On 29 May Dr Mihály Minya,...

Read more

Magazin: MVI-NAV talks

Date: 2018-11-26 07:23:32

On 26 September 2108 the representatives of the Guild of Hungarian Restaurateurs (MVI) and the Pest County Directorate of the National Tax and Customs Administration (NAV) met to discuss the...

Read more

Service fee related rules

Date: 2017-08-08 10:52:46

The service fee must be indicated on the bill or receipt that the guest receives, in a separate line. Those employees who do take part in serving the food must...

Read more