MBH AgrárTrend Index: Hungarian agriculture is at a height not seen for a long time

A slightly slower than expected, but definite positive turn is visible in the Hungarian food industry The favorable assessment of the situation of the actors of the Hungarian food industry continued to improve in the second three months of 2024, according to the MBH AgrarTrend Index, a quarterly analysis published by MBH Bank’s Agricultural and Food Business. The credit institute’s indicator, prepared by surveying agricultural market participants, increased slightly between March and June 2024 after more than a year of strengthening, and is now permanently above the level before the economic shock caused by the Russian-Ukrainian war. The faster-than-expected growth in consumption and the unfavorable weather conditions in some parts of the country are holding back the more vigorous improvement.

“The Hungarian food industry has once again proven that it can overcome difficult times. At the same time, there is still plenty to do in terms of increasing efficiency and competitiveness. The investment tenders opening this year are key to this. Since our accession to the European Union, every tender period like this, when thousands of billions of forints have flowed into agriculture and the food industry, has significantly increased the development and efficiency of the sector. Now an investment package of HUF 1,500 billion is being launched, which can generate approximately HUF 3,000 billion worth of development,” said Dávid Hollósi, Managing Director of MBH Bank’s Agriculture and Food Business, adding that applications can be submitted under more than sixty legal titles, and Non-refundable grants of 50 percent or more can be awarded. “The effective implementation of the developments will also require bank financing. And although it seems very likely that the era of cheap interest rates will not return for the time being, we are trying to help the sector with structures that make it possible to obtain the given investment loan. The expected system of interest subsidies will also play a key role in this. It is a sector of strategic importance, which is a historic opportunity and faces significant development in the coming years.”

The sector is close to a balanced growth level

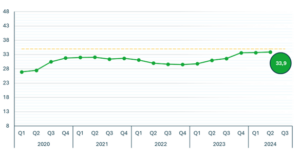

The value of the MBH AgrárTrend Index, an agri-food industry confidence indicator that is prepared based on the situation assessment of customers, interprofessional organizations and the bank’s analysts, and which precedes official statistics, strengthened to 33.9 points on the 48-point scale in the second quarter of 2024 – essentially for the harvest. The highest value so far was 33.7 points measured in the first three months of 2024. The current level surpasses the harvest period of the previous year by 2.9 points.

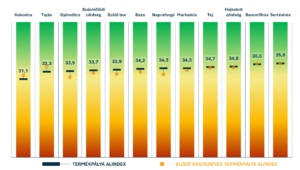

In the second quarter of this year, out of the 12 examined product areas, fruit, grape-wine, wheat and sunflower showed a more positive assessment of the situation than before, while a more marked weakening can be seen in the case of corn due to the drought, and in the case of eggs, due to this year’s hectic price conditions, the picture is less favorable. than before. “On the whole, we can say that the individual product lines show a much more uniform picture compared to each other, there are no outliers or sub-sectors that perform much worse than the others,” pointed out Csaba Héjja, strategic analyst of MBH Bank’s Agricultural and Food Business. The 35 points considered by the bank’s experts to be the equilibrium level – which represents a 3-5 percent growth path and stable price and income conditions at all points – is once again exceeded by pork and poultry, but several product paths came close to it. It will be profitable to grow crops in the field, but not through corn In the case of the arable sectors that produce the largest output of domestic agriculture, the harvest of barley and wheat has largely been completed, the yield averages are strong at the national level – 5.5-5.7 tons per hectare for both crops – but in the case of wheat, the proportion of mill quality that can be sold at a better price is low, 20 became around one percent. In addition, prices were also volatile, so the farms could generate additional income that could be measured by a price contracted at a good time. The same is true for sunflowers, which were adversely affected by the rain-free, long-lasting warm weather at the end of the growing season, but at the beginning of June, this year’s crop could still be booked with good profitability. Seeing the price volatility of the past period, many people are waiting to sell. In this regard, the impact of the American presidential election on the stock market can be decisive, which can affect crop markets through, among other things, changes in the price of oil. In the case of corn, according to current knowledge, a national average yield of 6-7 tons per hectare can be counted on, which is 15-20 percent lower than the ideally achievable one. However, the supply of raw materials for both feed manufacturers and industrial processors seems to be ensured in the domestic supply.

The barbecue season invigorates the domestic demand for animal products

As a continuation of recent trends, the assessment of the situation of livestock keepers and breeders is more positive than that of plant growers. The summer barbecue season traditionally has a positive effect on turnover, which is reflected in the domestic demand in the food industry, as well as in the export performance of the meat industry, including the production of preparations. In the case of poultry meat, a slight decrease can be seen in the MBH AgrárTrend Index. This can be seen primarily in the waterfowl market, as a result of the recovery of production volume in France after last year’s bird flu, which caused a build-up of stocks in Europe, and in addition, large quantities of duck meat arrived from China. This can also be evaluated as a market disrupting factor – pointed out Csaba Héjja. “In the chicken market, there is some price reduction visible at the producer level, but this is in the same direction and extent as the costs, so we can talk about a more balanced reorganization.” In the dairy sector, prices are improving, in the case of beef cattle breeders, due to mass feeding, the further development of the drought is a question, as the pastures also suffer from the currently experienced environmental stress. In the case of eggs, according to the market’s assessment, production is still profitable, but the hectic price conditions tend to reduce the profit remaining in the pockets of producers and traders. “The market players in the animal product fields are waiting for the opening of funds aimed at the development of livestock farms, so they can also start investing after the food industry and horticulture, and in this segment, the businesses may have more autonomy due to the better profitability of the last two years,” the bank emphasized expert.

Significant improvement for fruit growers, winemakers harvest at a record time

This year there was no significant frost damage, so the fruit yield will be better compared to previous years. In some places, the labor supply has also improved, and prices are also more favorable in the demand market that has developed as a result of frost damage in Poland, among others in the case of cherries. Thus, in the MBH AgrárTrend Index, after many quarters, fruit moved from the last place in the comparison of individual product paths. As a result of the dry, warm weather, the harvest starts earlier at the wineries everywhere this year, in Kunság, the early ripening varieties went to the processors already in the last two weeks of July. And due to the fact that catering and tourism are on the rise again, and the festival season is also underway, the demand for wine products is increasing. In addition, the previously intermittent supply of bottles is also continuous. The vineyards also had a lot of struggle with pests this year, but this year’s vintage promises to be good.

Food industry demand is showing signs of strengthening

According to the available data, the demand of the food industry as a whole already shows signs of strengthening, although neither food industry production nor store retail turnover will reach the level of 2021 yet. At the same time, the gradual increase in real incomes may further stimulate demand in the rest of the year, which will have a beneficial effect on the cost-income relationships of the entire food industry. This can be an excellent basis for the expected increase in investment volume from 2025. The first tenders are already available, additional legal titles will be opened by the end of the year, so the second half of the year will be about concrete planning – concluded the experts of MBH Bank’s Agricultural and Food Business Branch.

Related news

State compensation for the victims of Bászna Gabona Zrt. has been completed

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >József Viski: Adaptation and competitiveness are key for the horticultural sector

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >In 2025, FruitVeB considered the support and professional coordination of the TÉSZs as its priority task

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Innovations, success stories and awards on the same stage

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >NAV: Women’s Day inspections begin

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >