Lidl UK looks for outside funding

The discounter wants to raise around 90 mn GBP from investors to build 12 new stores

Lidl in the United Kingdom looks for new ways to finance its store network expansion. According to information published by the retail magazine The Grocer, the German discounter wants to raise more than 91 million British pounds from investors to finance 12 new locations. In an investor pitch the company allegedly offers the opportunity to finance the construction and acquire the freehold of 12 supermarkets. The retailer would then lease the locations from the investor. This would be the first time that Lidl resorts to the freehold instrument to expand its store network.

Lidl’s expansion on the island has almost come to a standstill over the past two years. According to the author’s estimations, since the end of the past business year in February 2023 Lidl in the UK has opened not more than a handful of new stores. As the retailer’s annual reports show, up to the year 2021 this figure was at more than 50 new shops per year. Still at the end of 2021 the discounter had announced plans to expand its store network to 1,100 objects by the end of 2025. Lidl currently operates 964 stores in Great Britain and 41 stores in Northern Ireland.

One reason for the slowdown might be that the discounter’s warehouse distribution structure has to catch up to the size of its store network and significantly rising sales volumes. Only in fall 2023 Lidl opened its so far largest warehouse in the world in Luton that according to the company can supply more than 150 stores.

The main reason, however, might be skyrocketing interest rates. The bank rate, the rate of interest which is charged by the Central Bank while lending loans to commercial banks, as published by the Bank of England for the years 2020 and 2021 was at 0.1%. By the end of 2022 it had exploded to 3.0% and for the past half year has stabilized at the historical high of 5.25%.

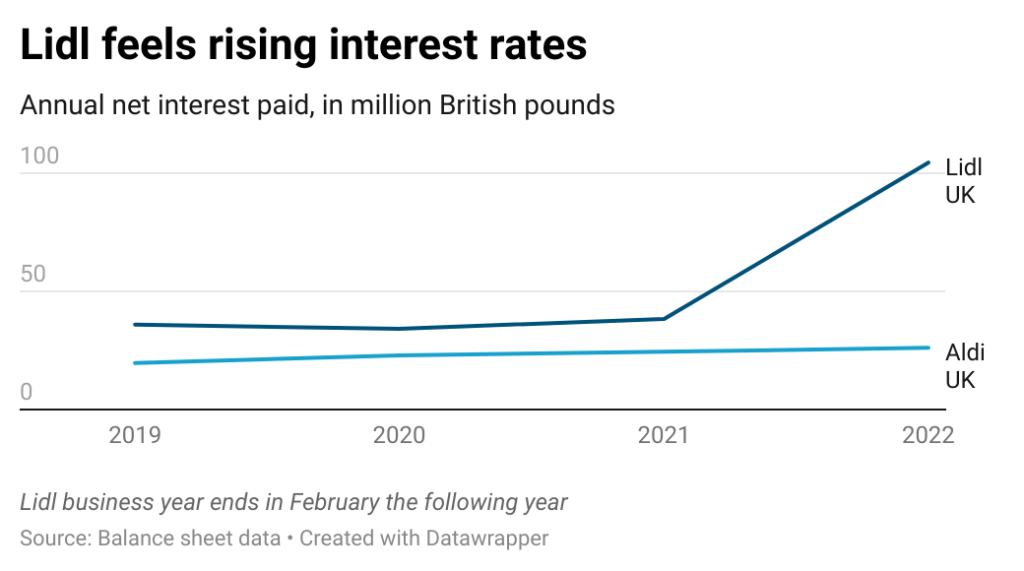

The effects on Lidl’s costs are drastic. Whereas in the past interest paid for financial liabilities came to in between 34 and 38 million British pounds for the UK retailer, these costs for the business year 2022/2023 have tripled to 105 million British pounds, as balance sheet data shows (see chart below).

In contrast to this, competitor Aldi’s net interest payments have increased only marginally from 23 million British pounds in 2020 to shortly above 26 million British pounds in 2022. This, although Aldi has only slightly slowed down its expansion activity, opening 43 stores in 2022 after around 50 the respective years before. Recently Aldi UK announced plans to invest more than 550 million British pounds in its store network on the island by the end of this year. As a long-term goal Aldi wants to reach a store count of 1,500 in the UK.

Aldi UK reached a group net revenue of 15.5 billion British pounds and a net profit of 109 million British pounds in 2022, translating into a net profit margin of 0.7%. Lidl UK, the follower, achieved a net revenue of 9.3 billion British pounds and declared losses of 73 million British pounds – a net profit margin of -0.8%.

Related news

Lidl invests £1.5bn in British beef production

Lidl is beefing up its sustainability commitments with the launch…

Read more >The GVH investigation launched against Aldi raises several questions

The Economic Competition Authority (GVH) launched an investigation against Aldi,…

Read more >Related news

Valeo Foods Completes Acquisition Of Appalaches Nature

Valeo Foods Group has completed the acquisition of Appalaches Nature,…

Read more >Carrefour grows in France and Brazil, lags behind in rest of Europe

Carrefour says it is rather pleased with its financial results…

Read more >Food and beverage innovation plunges nearly 50% since 2007: Mintel

The market research firm said about a quarter of items…

Read more >