László Krisán: Stabilisation is the first step, but new answers are needed to be competitive

László Krisán, the CEO of KAVOSZ Zrt. has assessed the current situation of businesses, the adaptation strategies of the FMCG sector and the new developments of the Széchenyi SME Card Programme.

This article is available for reading in Trade magazin 2025/6-7.

![]() How do you see the performances of different types of businesses in the light of their 2024results? Did the number of businesses grow or reduce over the past year?

How do you see the performances of different types of businesses in the light of their 2024results? Did the number of businesses grow or reduce over the past year?

László Krisán

CEO

KAVOSZ

-If I had to describe 2024 in one word from a business perspective, I would say stabilisation, but this couldn’t be felt equally everywhere. The number of micro-, small and medium-sized enterprises (SMEs) increased modestly – because of the momentum of sole traders – but this year didn’t bring a major breakthrough.

![]() How did companies in the FMCG sector perform in 2024?

How did companies in the FMCG sector perform in 2024?

– Once again the FMCG sector proved: when it comes to adapting quickly, it is the best sector. In 2024 the inflationary pressures eased a little, which stabilised purchasing power, but price-sensitivity remained high so competition intensified.

![]() What were the regulatory changes that affected the entrepreneurial sector last year?

What were the regulatory changes that affected the entrepreneurial sector last year?

– In 2024 legislators also kept entrepreneurs busy. The increase in the minimum wage and the guaranteed minimum wage affected everyone: in terms of wage costs, pricing and business planning. On the positive side, we made progress in the area of administration: more electronic administration options made everyday life easier for companies.

![]() What kind of new challenges are Hungarian businesses facing?

What kind of new challenges are Hungarian businesses facing?

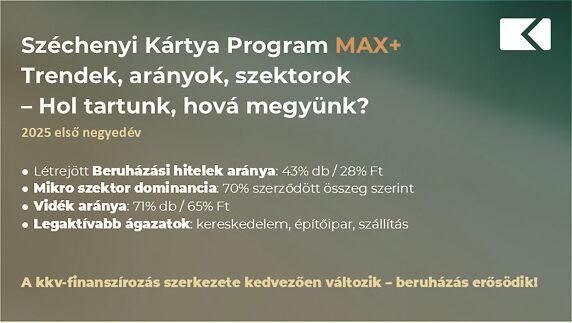

-2024 wasn’t an easy year: many businesses found themselves in a difficult situation owing to the fewer financing options. Although market loans remained expensive, the interest rate reduction under the Széchenyi Card Programme MAX+ provided tangible help. As part of the Demján Sándor Programme, in November 2024 we first cut the interest rates on our investment loans (Széchenyi Investment Loan MAX+, Agrár Széchenyi Investment Loan MAX+, Széchenyi Leasing MAX+, Széchenyi Microloan MAX+) from 5% to 3.5%, and then by another half a percent this year – not only for investment loans, but also for current account loans (Széchenyi Liquidity Loan MAX+, Széchenyi Card Current Account Loan MAX+, Széchenyi Tourism Card MAX+).

![]() What were the developments in the KAVOSZ Széchenyi Card Programme?

What were the developments in the KAVOSZ Széchenyi Card Programme?

-In 2024 we took a big step forward within the framework of Széchenyi Card Programme MAX+. It now features more financing objectives, the application process has been simplified and new green financing schemes have been introduced to support sustainable operations.

![]() In what other ways does KAVOSZ help to represent the interests of businesses?

In what other ways does KAVOSZ help to represent the interests of businesses?

– In 2024 we organised a nationwide roadshow, where thousands of entrepreneurs received first-hand information about the opportunities available to them. On 5-25 May 2025 we are hosting host a series of events in Veszprém, Pécs, Kecskemét, Szeged, Szolnok, Miskolc, Nyíregyháza, Győr and Székesfehérvár, in cooperation with Portfolio, the Ministry for National Economy, VOSZ, and MKIK.

![]() What are KAVOSZ’s long-term goals?

What are KAVOSZ’s long-term goals?

-Our goal has remained the same: we want to keep the Széchenyi Card Programme the number one financing tool in the Hungarian SME sector. We will coordinate a programme that is flexible, responds to changes quickly and helps to strengthen the Hungarian economy with more competitive, digital and sustainable businesses.

New board of directors at KAVOSZ Vállalkozásfejlesztési Zrt.

Members of the new board: László Krisán, Tamás Rátkai and Jenő Radetzky

The new members of the board of directors of KAVOSZ Vállalkozásfejlesztési Zrt. are Jenő Radetzky, László Krisán and Tamás Rátkai – the latter was elected chairman of the board of directors. The change may give new impetus to the company’s mission: to provide more efficient, faster and digitally based financing for micro-enterprises

Related news

Tuned to efficiency

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Inflation has dropped significantly, a cycle of interest rate cuts may begin, while gold soars

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Farewell day at the 60th anniversary EuroShop trade fair

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >NAV: Women’s Day inspections begin

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >