Retail consolidation in Central & South-Eastern Europe accelerates: Discounters and local heroes can increase the lead against other competitors

Over the past two years the emerging markets of Europe have gained in importance in the balance sheets of international retailers. However, in contrast to the past, market share growth will less and less come from crowding out traditional traders. Concentration will also increase through focused acquisitions of smaller players. Discounters leverage their cost advantage by forcing other players to invest in price. Investments in productivity initiatives will further increase the gap in profitability between retail players and speed up market consolidation.

Central & South-Eastern Europe in focus

The relevance of Central & South-Eastern Europe (CSEE) for international grocery retailers is growing. In the past above-average profit margins and a low level of consolidation made the region the retail Eldorado of Europe. Double-digit growth rates over the past two years for many markets make international retailers prioritize this region anew. Despite featuring the highest inflation rates on the continent, exchange rates for the largest economies in the area with local national currency have remained comparatively stable over the past two years.

Since the beginning of 2022 the Czech Koruna has lost 1.8% against the euro, although end of 2022 the food inflation in the country peaked at 25.5%. A similar picture emerges for Romania, where the Romanian Lei until today devaluated by only 0.4% with food inflation a year ago reaching its height of 22.1%. The Polish Zloty has returned to pre-pandemic levels and is now 6.1% stronger against the euro, in the comparable period food inflation came up to its maximum of 21.5% a year ago. Only the Hungarian forint is continuing its long-term downward trend and currently stands 8.0% weaker than before the onset of inflation. Generally, across the whole region from the Baltics down to the Adriatic, the FMCG markets in CSEE hold a noticeably bigger weight in the euro-based balance sheets of European grocers than before the pandemic.

Crowding out traditional trade

However, to achieve future growth will be much more difficult than in the past. So far organized retail could grow on the back of traditional trade, crowding out independent mom and pop stores. Presently double-digit growth rates have left fewer and fewer blank spaces on the respective national retail maps. According to the British Institute of Grocery Distribution IGD the traditional sales channel in the region’s largest economy Poland will make up only 15.6% of all FMCG sales in 2026. The respective value in 2021 was still at 25.9%. For the second-biggest country, Romania, the analysts forecast a drop to 31.0%, down from 37.9% in the same period. According to the methodology of the market researchers, the traditional trade segment also contains smaller regional chains. Having to win market share from other organized, in majority large international competitors with a high level of proficiency means a tangible acceleration in competitive dynamics.

Increased polarization

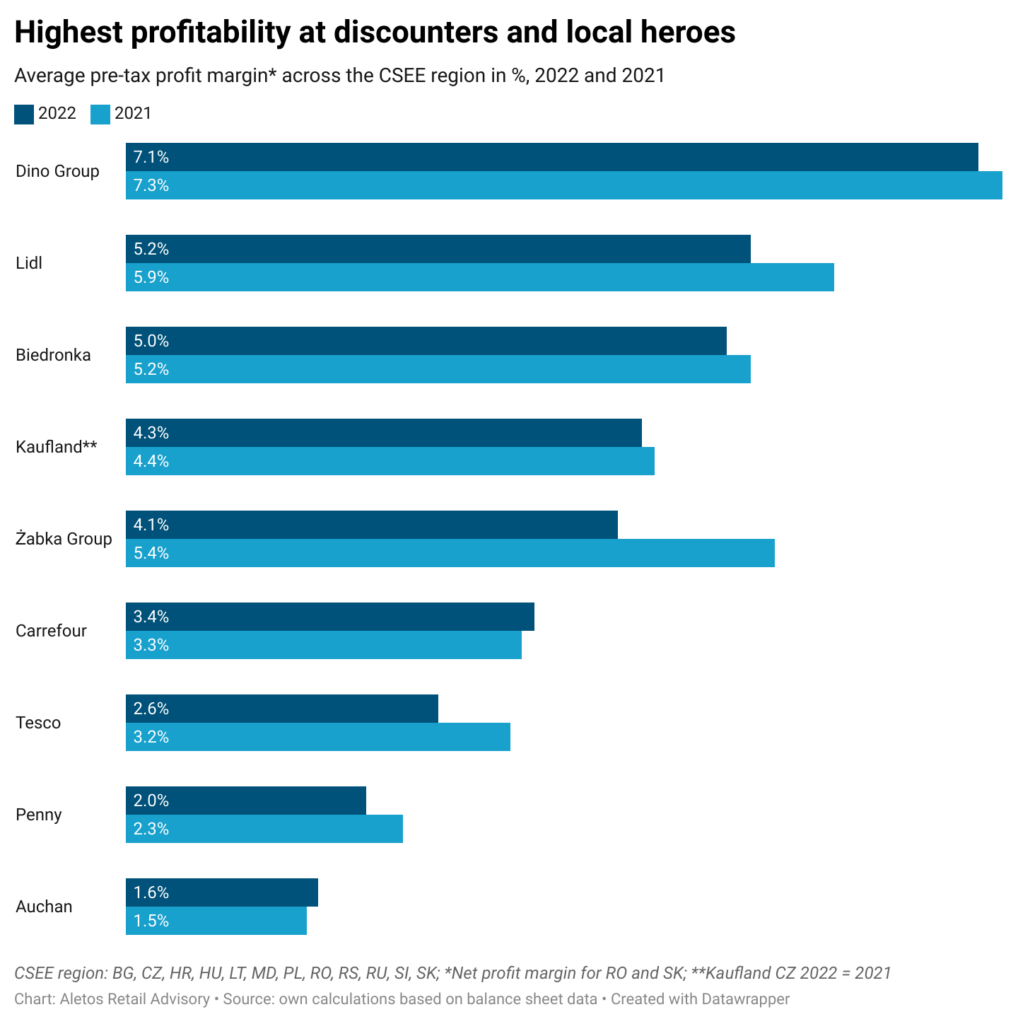

Higher inflation rates have not only led to above-average value growth in the CSEE grocery markets, but also put massive cost pressure on the different retailers’ operating models. It is no surprise that discounters and single-country local heroes occupying a niche are the winners of disrupted supply chains and skyrocketing costs. In the high-inflation year 2022, for which official financial data is available for all retailers, these two segments can grow noticeably above food inflation rates. Large-area legacy retailers find themselves at the lower end of the scale.

Discount increases the lead

According to local balance sheet data, Jeronimo Martins’ discount format Biedronka in Poland at flexible exchange rates increased its net revenue by 25.2% on euro-basis to 18.1 bn euros in 2022. Also for 2023 the retailer could continue the trend, growing its net revenue in euros by 22.3%. Lidl with ten countries of presence in 2022 grew by 20.6% to 23.0 bn euros. Balance sheet figures of Penny of German Rewe Group show a net revenue of plus 22.9% to 4.5 bn euros and Aldi figures add up to a plus of 19.8% to 2.3 bn euros – both with a presence in three countries.

Local heroes capitalize on niche strategies

Only local heroes that focus on market niches not directly in heads-on competition with the discounters could report better developments than the low-cost formats. Polish traditional grocer Dino grew its top line by 48.2% to 4.2 bn euros, while convenience leader Żabka noted a plus of 24.1% to 3.4 bn euros. Rural proximity operator Profi in Romania grew by 21.0% to 2.5 bn euros.

Legacy retailers at the lower end of the scale

All big format retailers fared at the lower end of the scale with superstore operator Kaufland at the top of this segment, reaching 12.3 bn euros (+12.1%), Tesco at 5.3 bn euros (+9.7%), Auchan (without Ukraine) came up to 7.9 bn euros (+7.4%) and Carrefour to 4.2 bn euros (+5.1%).

Strategic acquisitions drive market concentration

Market consolidation is also accelerated due to an increasing number of strategic acquisitions. French retailer Carrefour, number 4 grocer in Romania, in October last year finalized the takeover of the national number 10, large-area operator Cora. At the same time Ahold Delhaize’s Romanian local retail banner Mega Image announced a deal to acquire the third-biggest retailer Profi, statistically elevating the Dutch retailer’s local operations into the lead position.

Also in Southeast Europe smaller players leave the retail map. Slovenian market leader Mercator end of last year announced a deal to acquire the number 5 in the market, Tuš supermarkets. Already in the first half of last year the multi format retailer closed a similar deal with Montenegrin operator Franca supermarkets. Across the border in Croatia, local hero Studenac has snapped up half a dozen regional chains over the course of the past two years. In Poland it is Stokrotka, subsidiary of Lithuanian Maxima Group, who has acquired a dozen regional stores since the onset of inflation. Also, Polish discount operators Netto and Aldi are considering growth by strategic acquisitions.

Price wars intensify

Profitability for all retail operators is under pressure. It is the discounters as well as local heroes, whose war chests are well-equipped for price fights (see chart). Value is still top of mind for the majority of consumers, so that Lidl, Biedronka & Co. seem to seek to price the competition out of the market. Especially Lidl, who has earnings of more than 1 bn euro before taxes in the region, has started to go into the offensive with head-on price wars across several countries. In Poland, where the clash between the Schwarz-discounter and Biedronka at the top has been intensifying over the past weeks, members of smaller retail chains have accused both retail giants of unfair competition and turned to the Polish competition agency UOKiK.

Reduced leeway for strategic investments

The strategic rationale behind the undeterred value focus might go beyond the obvious aim at market share increase. The more money the competition must invest to keep up on price, the less budget will remain for strategic long-term investments into technology. Discounters are also stepping up medium-term productivity measures such as the introduction of self-service cash desks and electronic shelf labels, as well as automated ordering. These initiatives will all help boost profitability in the near future and further build financial staying power. The gap between the ‘haves’ and the ‘have nots’ will widen even further.

Related news

Mother’s Day gifts on sale from Tesco

In Hungary, we celebrate Mother’s Day on May 5 this…

Read more >PENNY and Munch’s food rescue initiative is a success

Since February 2024, Munch surprise packages have been available in…

Read more >Back to the Roots – The Renaissance of the hard-discounter

The time is ripe for a renaissance of the hard…

Read more >Related news

Euro zone inflation was 2.4 percent in April as well after March

In line with analysts’ expectations, annual inflation in the euro…

Read more >Gergely Suppan: the recession is clearly over in Hungary

The recession is clearly over in Hungary, from now on…

Read more >K&H: the inflation anomaly is clearly visible, but customers perceive it differently

Although inflation has slowed down a lot, according to the…

Read more >