Inflation’s impact on the food shopping of households

Analysing per capita spending data from the Central Statistical Office (KSH), published in 2021, what we see is that in 2020 Hungarian households spent the most on buying food (26.1%) and non-alcoholic drinks (24.4%).

Guest writer:

Dr. Róbert Sándor Szűcs

associate professor

University of Debrecen

Institute of Marketing and Trade

Guest writer:

Krisztina Kovács

university student

University of Debrecen

Food and drink prices started rising in July 2021, but back then the inflation rate was only 4.6%; by September 2022 this increased to 20.1%. Growing food prices affect households with the lowest income the most. KSH reported that 12.7% of the population (727,000) belonged to the relatively poor category, 8.3% (390,000) were very poor and 3.7% (113,000) were characterised by low work intensity in 2020.

Methodology and complex reactions

We prepared an online questionnaire with 18 statements, and 1,130 people (all of them actively participate in food shopping in their households) filled it out, in September-October 2022. Respondents could express their level of agreement from 1 to 5 on a Likert scale – 5 indicated that they strongly agree with a given statement, and 1 meant the lowest level of agreement.

It can be seen clearly from the table that low-income households suffer from the growing food prices much more than high-income families. As a reaction to the inflation, households with a flexible income cut down on buying luxury foods, shoppers pay closer attention to price tags and discounts, they search for cheaper substitute products, plan buying quantity with greater care, and started visiting stores where prices are lower. Households with the lowest income have begun to purchase less meat and fruit, and they also try to economise when buying certain products for children.

Stockpiling isn’t common

Food products becoming more expensive don’t drive shoppers to the local marketplaces, so the conquest of multinational and discounter chains is likely to continue. People aren’t really stockpiling food at the moment, as there is no point in buying a lot from certain products if the inflation lasts for a long time. We were surprised to learn from the answers that consumers don’t concentrate more on using the loyalty cars or applications of retailers, and there has been no major increase in private label sales either. //

This article is available for reading in Trade magazin 2022.12-01.

Related news

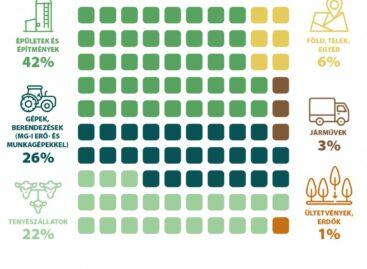

42 percent of agricultural investments were spent on buildings and structures in 2024

According to preliminary data from the Central Statistical Office, the…

Read more >Low sour cherry harvest expected across Europe this year

Experts are predicting significant crop losses in sour cherry producing…

Read more >KSH: industrial producer prices decreased by 0.7 percent in May 2025 compared to the previous month, and increased by an average of 6.9 percent compared to a year earlier

In May 2025, industrial producer prices were 6.9 percent higher…

Read more >Related news

Temu has already targeted the European food market

The Chinese-rooted Temu is posing an increasingly serious threat to…

Read more >Irrigation water resources equivalent to one-third of Lake Balaton are available

Despite the extraordinary drought and lack of precipitation, we can…

Read more >Free irrigation water provided to farmers is a key element in the fight against drought

Free irrigation water provided to farmers is a key element…

Read more >