Europe is a Private Label Fortress

The trend is clear from the latest Nielsen data compiled for PLMA’s 2020 International Private Label Yearbook which shows private label gaining market share last year in 14 of the 19 countries surveyed.

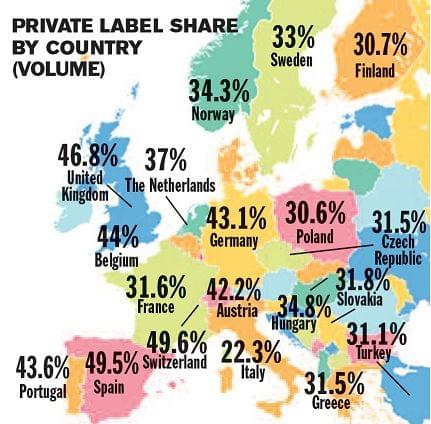

Marketshare above 30% – except for Italy

Market share for retailer brands was greater than 30% in all but one of the countries monitored by Nielsen. In Europe’s largest retail markets, private label share stayed above 40% in the United Kingdom and Germany, and now accounts for nearly one of every three products sold in France. In Italy, market share climbed by more than 2 points, its biggest gain ever.

One of the biggest increases was posted in The Netherlands, where share was up more than 7 points to 37%. The unusually large gain came as sales from Aldi with its extensive private label program, were counted by Nielsen for the first time. In nearby Belgium, market share for retailer brands climbed to 44%.

In France, Nielsen’s statistics gave private label a unit share of 31% and value share of 25% but the figures do not include sales at Lidl and Aldi, which makes true market share closer to 41% in units and 35% in value. Spain and Portugal remained very strong markets for private label. Half of all products sold in Spain were retailer brands, while market share in Portugal climbed nearly 3 points to over 43%.

Austria is leading the region

In central and eastern Europe, market share stayed above 42% in Austria and above 30% in Poland, Hungary, Czech Republic and Slovakia. The biggest increase was in Czech Republic, which advanced more than one point. Private label again accounted for half the products sold in Switzerland.

Norway led the way in Scandinavia, with market share climbing 2 points to more than 34%. Sweden increased to 33%, while Finland stayed above 30%.

In the Mediterranean, market share was above 31% in both Turkey and Greece. Turkey showed a big increase, gaining more than 2 points, climbing above 30% for the first time.

PLMA President Brian Sharoff called the gains “a signal that shoppers now choose the retailers brands first when it comes to making everyday grocery decisions.” Sharoff continued. “When Nielsen calculates its first quarter 2020 results, I think everyone will see how strong private label has become.”

Related news

Private Label Share Consolidates Its Strong Position in Europe

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >PLMA Live: record-breaking private labels

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >PLMA 2025: private labels draw on the power of surprise

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Sentix: investor sentiment in the eurozone deteriorated in March

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Research: Coupons don’t determine which brands we stay loyal to

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >New trend in online shopping: Hungarians pay later

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >