Climate technology investments have increased fiftyfold in Central and Eastern Europe in the last 8 years

Climate technology as an emerging asset class is showing strong growth worldwide, but Central and Eastern Europe has attracted less than one percent of global investment. Between 2013 and the first half of 2021, more than 1.76 billion dollars were invested in climate technology in the region, but the investments were highly concentrated: startups based in Estonia and Lithuania are at the top, and the most popular sectors are mobility and transport.

(Photo: PIxabay)

According to a joint analysis by PwC and Wolves Summit, climate technology investments in the region have increased from $10.6 million in 2013 to $398 million by 2020 and to more than $502 million in the first half of 2021.

There is still plenty of room for growth and diversification in the region

According to the study, investments in climate technology are constantly increasing, with more than 1.76 billion dollars invested in eight years. This growth is primarily driven by an increase in mega-deals (deals worth more than $100 million) in sectors such as mobility and transportation, as well as industrial, manufacturing and resource management.

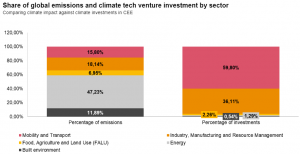

The Central and Eastern European region as a whole accounts for around 3.73% of global greenhouse gas emissions, but at the same time, the region’s share of global climate technology investments is only 0.79%. Given that many CEE countries are experiencing positive economic growth, it is crucial that more funding flows into the deployment of decarbonisation technologies in the region. Climate technology investments within the region are largely concentrated in the mobility and transport sector (59.8%) and startup companies based in Estonia and Lithuania (74.8%). Tallinn (Estonia), Vilnius (Lithuania) and Sveta Nedelja (Croatia) are the first three most active climate technology investment centers.

Underfunded areas

The study also provides insight into the most underfunded areas. Between 2013 and the first half of 2021, startups in the food, agriculture and land use sectors received only 2.26% of all funding, and only 1.29% in the energy sector. Although Poland has the largest economy in the region and serves as a strategic hub for some industries, startups in Poland have secured only 4.65% of the total climate technology funding in CEE.

Climate technology startups are still in an early stage of development

In addition to an in-depth presentation of venture capital investment data, the study also describes 50 climate technology startups based in Central and Eastern Europe. PwC ESG experts evaluated these companies based on a number of indicators in three categories – maturity level, scalability, climate impact. Most of the presented companies operate in Poland (14) and Estonia (13). In terms of sectors, the food industry, agriculture and land use (12) were the most represented, followed by the energy industry (10), the built environment (9) and industry, manufacturing and resource management (9). If you look at the profile of the average startup, it is clear that most of them are in the early stages of their development. Only 20% of startups have obtained Series A/B funding. The remaining 80% operate either on their own, or with seed funding or support. 40% of Future50 startups report that they have limited awareness of the emissions reduction potential of their technology.

“Startups should consider early stage impact assessment methods to support their value proposition. Investors increasingly expect to know the climate impact of their portfolios, and this area should not be ignored for future funding and stakeholder support,” said José Miguel Salazar Hernández, PwC CEE ESG Hub Manager.

According to the study, the climate technology ecosystem in Central and Eastern Europe is still in its infancy, especially compared to more advanced climate technology hubs – or other startup hubs in general. The results show that the right investor group for the climate technology ecosystem in Central and Eastern Europe is currently made up of early-stage venture capitalists who are actively looking for investment opportunities in seed, growth and early-stage companies.

Related news

What makes us add the product to the cart – research

The latest joint research by PwC and Publicis Groupe Hungary…

Read more >Rossmann has exploded onto the e-commerce top list

Rossmann is included for the first time in the 2024…

Read more >Omnichannel or nothing – a new direction in e-commerce

Norbert Madar, the leader of PwC’s digital commerce team gave…

Read more >Related news

What makes us add the product to the cart – research

The latest joint research by PwC and Publicis Groupe Hungary…

Read more >Energy drinks are now legal: what every shopkeeper should know

New regulations on the sale of energy drinks came into…

Read more >Tens of millions with one opening tab – the biggest prize draw in XIXO history has started

This summer, XIXO is preparing for a bigger launch than…

Read more >