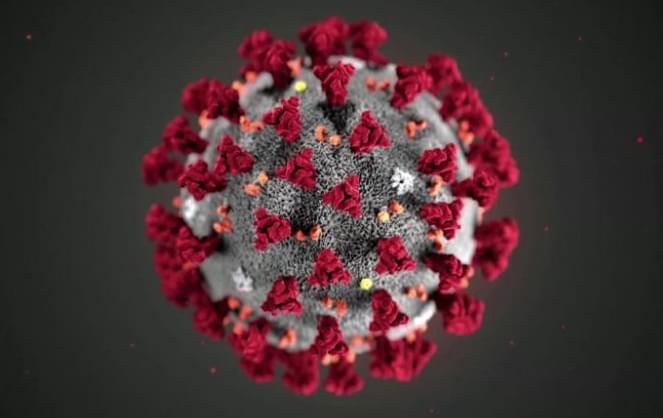

The coronavirus has also affected acquisitions and mergers badly

The acquisition and merger activity was also affected by the coronavirus pandemic, with the U.S. reporting a 83 percent drop in the value of reported transactions in the second quarter, compared to a year before, according to Refinitiv data.

In the United States, 2,064 M&A transactions were announced for the quarter ended June 30, in a total value of 106.4 billion USD. In contrast, there were 2,895 transactions in the second quarter of 2019, with a total value of 622.9 billion USD.

Globally, the value of transactions decreased by 52 percent in the second quarter to 516.6 billion USD, coming from 9,129 transactions. (portfolio.hu, Marketwatch)

Related news

Proposed new US dietary guidelines may prioritise plant proteins

The US Department of Health and Human Services (HHS) and…

Read more >American retail sales expanded more significantly than expected in July

Retail sales in the United States expanded more significantly than…

Read more >The spread of bluetongue has accelerated in the Netherlands

The number of cases of bluetongue, which attacks ruminant animals,…

Read more >Related news

ESG – about sustainability standards, from a legal perspective

Since December 2023 several pieces of legislation have been published…

Read more >DairyX makes a breakthrough in dairy-free casein production

Israeli start-up DairyX Foods has made great progress in the…

Read more >Co-op uses AI to fight GBP 40m losses in the UK

British supermarket chain Co-op is using AI technology to detect…

Read more >