DHL’s Global Trade Atlas analyses data from 173 countries

DHL and NYU Stern School of Business have published the new DHL Trade Growth Atlas, which maps the most important trends and prospects of global trade in goods. The report covers 173 countries, providing valuable business intelligence for policymakers and industry leaders. It shines a positive light on the resilience of global trade – despite recent shocks and market pessimism.

The DHL Trade Growth Atlas examines global trade growth trends, geographic shifts, the mix of products traded, and broader changes in the business environment

The DHL Trade Growth Atlas also measures changes in countries’ and regions’ shares of world trade.

Among the key take-aways:

- The Covid-19 pandemic has not been the major setback for global trade that many anticipated: International trade in goods has surged as high as 10% above pre-pandemic levels, even in the face of significant supply bottlenecks that constrained further growth.

- Prospects for future trade growth remain surprisingly positive: Due to the war in Ukraine, trade growth forecasts have been downgraded, but they still call for trade to grow slightly faster in 2022 and 2023 than it did over the preceding decade.

- E-commerce sales boomed during the pandemic and forecasts point to strong cross-border e-commerce growth continuing.

- New poles of trade growth are identified in Southeast and South Asia, and trade growth is expected to accelerate dramatically in Sub-Saharan Africa.

- Trade growth is spread across a wider variety of countries: China accounted for a quarter of trade growth in recent years and is predicted to continue to have the largest growth, but its share is likely to fall by half, to 13%.

- Viet Nam, India, and the Philippines stand out on both speed and scale of projected trade growth through 2026. All three have potential to benefit from efforts by many companies to diversify China-centric production and sourcing strategies.

- While emerging economies increased their shares of world trade from 24 to 40% between 2000 and 2012, with half of the increase driven by China alone, these shares have barely changed over the past decade.

- However, emerging economies continue to race forward on measures of connectivity, innovation, and leading companies. They are becoming more important exporters of sophisticated manufactured products, and increasingly compete not only on low costs, but also on innovation and quality.

Hungary

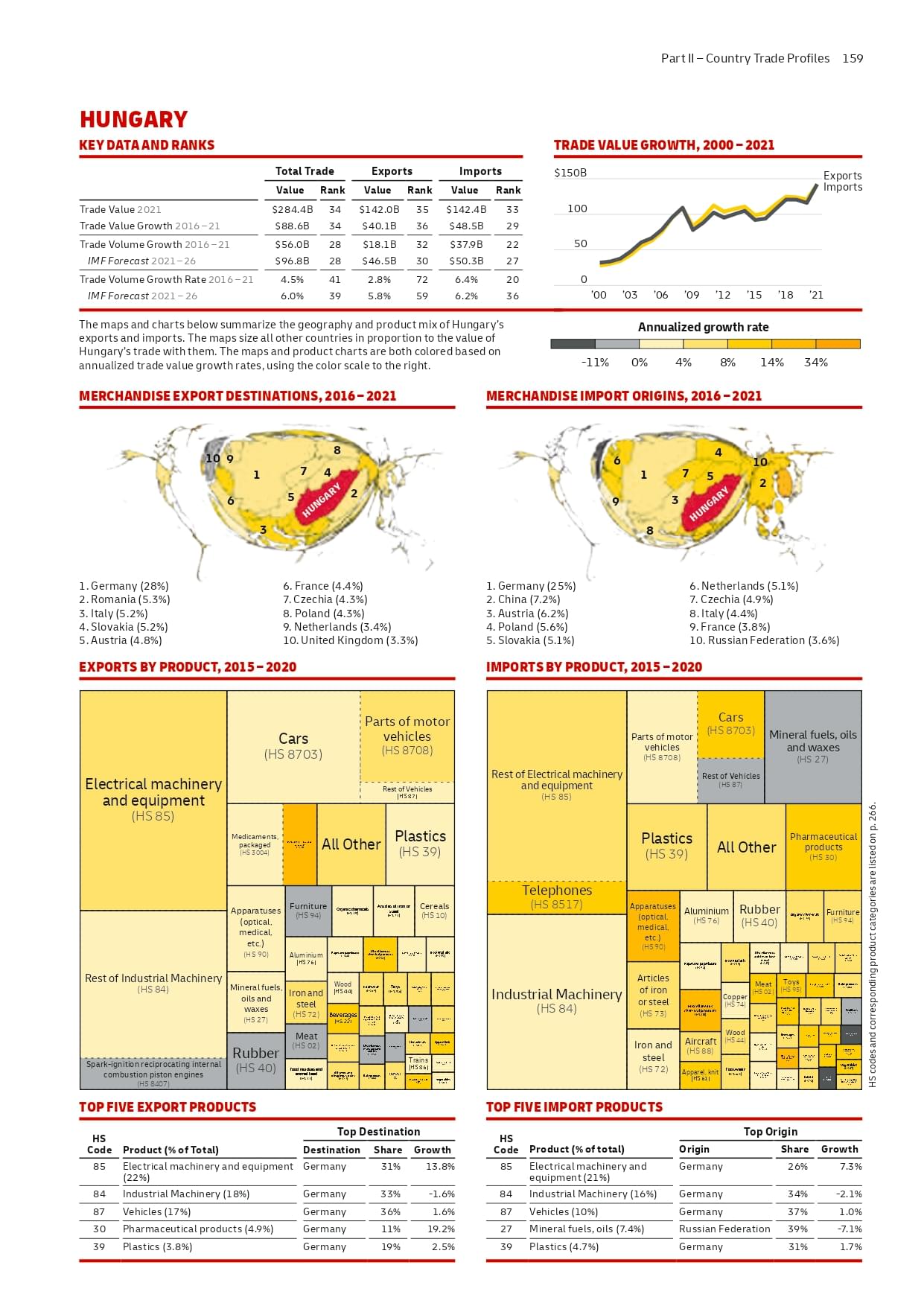

The DHL Trade Growth Atlas summarises data on the volume of Hungarian exports and imports. The report shows that export-import trade volumes will increase in 2020-21, placing Hungary 34th in the world trade rankings. Germany continues to be the primary export destination, accounting for 28% of Hungary’s total foreign trade volume. Our top export product is electronic goods, which account for 22% of our export volume. Germany also accounts for 25% of our imported goods, and the electronics market is also our main export destination. The second largest product group in both exports and imports is industrial technical equipment and machinery, and the third largest is motor vehicles.

Related news

SPAR Netherlands expands convenience offering with smart parcel lockers

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Shopify upgrades fulfillment capabilities

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

GDP growth in OECD member countries slowed to 0.3 percent in the last quarter of last year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >