Industrial production increased by 9.4% in May

Exceeding expectations, industrial production increased by 9.4% in May, while adjusted for the effect of working days, production increased by 3.4%, as there were two more working days in May. In the first five months, industrial production increased by 5.9%.

By October 2020, industrial production had fully recovered from the crisis caused by the epidemic, according to Hungarian Bankholding’s analysis

Gergely Suppan, Senior Analyst of Hungarian Bankholding revelas: based on seasonally and working day-adjusted data, industrial output increased by 1.4% compared to the previous month, which may reflect supply difficulties, but returning production following the temporary shutdown of the Easter holidays in April may also have played a role.

Gergely Suppan, Senior Analyst – Hungarian Bankholding

By October 2020, industrial production had fully recovered from the crisis caused by the epidemic, however, further rapid growth was hampered by the lack of chips, so industrial production fluctuated close to the pre-epidemic level, slightly exceeding it, from which it took a definite boost at the beginning of this year. In May, compared to the low point in April 2020, industrial production increased by 69.8%. Compared to the 2015 average, industrial production increased by 24.5%, while it exceeded the 2010 average production level by 52.2%. Last year, industrial production expanded by a total of 9.6%.

According to the announcement of the KSH, the majority of manufacturing sub-sectors contributed to the expansion. The heaviest vehicle production is smaller, while the production of computers, electronics and optical products, as well as the production of food, beverages and tobacco products has increased to a greater extent. In the previous month, eight of the 13 manufacturing industry subsectors showed growth.

In October 2020, the production of car factories already exceeded the pre-pandemic level, but it fell behind by an average of 20% last year, thus reducing the volume of industrial production by about 5-6 percentage points.

Despite the lack of chips, however, it is encouraging that new orders and the order backlog of vehicle manufacturing are persistently outstanding, exceeding the level of a year ago by 29.1% in April. In the short term, due to limited supplier capacities, car manufacturers mainly fulfill orders for more expensive models with a higher profit margin, however, they expect an improvement from the second half of the year, according to some reports and economic surveys (Ifo, purchasing manager index), the easing of supply problems was already felt at the beginning of the year . However, the war in Ukraine significantly worsens the outlook, which is already reflected by the purchasing manager indices after the Ifo and ZEW indices, even though growth is still predicted. As a result of the war in Ukraine and strict Chinese lockdowns against Covid, the disruption of supply chains has been brought up again, but the outlook is worsened to a significantly greater extent by the skyrocketing inflation and cost of living, and the ever-tightening monetary policies, which are already increasing recession concerns. However, the curtailment of Russian gas deliveries could force major German industrial sectors to shut down, which could have very serious consequences.

German industrial order stocks are still at a fairly high level, so the easing of supplier problems could immediately result in a sharp rebound. In recent years, the performance of the domestic industry has sharply diverged from that of the German industry due to the many capacity increases in recent years, the inflow of a record amount of working capital and the economic policy of the government that specifically supports investments.

In the coming months, industrial production could return to growth, however, the Russian-Ukrainian war could pose many risks. Audi – like other members of the VW concern – has already announced that it will have to cut back on production due to problems with Ukrainian suppliers, but for the time being only the third shift has been affected in domestic production, just like in the case of Mercedes’ domestic factory, while for the rest of the industry the consequences are currently unforeseeable. Although the semiconductor shortage may persist for a long time, a gradual improvement can be expected, as the demand for technical goods has decreased recently. Supply chain disruptions may still pose a significant risk, as can energy price volatility, but some commodities, especially industrial metals, have already fallen sharply on recessionary concerns. External demand can be worsened by the inflation-driven increase in food and energy prices through a decrease in purchasing power. At the same time, the very high order book – in April it was 28.3% higher than a year ago – can continue to stimulate the industry, as well as the replenishment of stocks, so we expect a gradual recovery in industrial production in addition to temporary fluctuations during the year, which is new – mainly the anticipated commissioning of capacities related to battery production and the automotive industry, as well as the food industry, the chemical industry, and the defense industry can also be supported. Due to the freezing of domestic fuel prices, the domestic oil refinery is operating at full capacity, which can somewhat offset the weaker performance of other sectors. In the medium term, the domestic economy can benefit significantly from the development of defense industrial capacities, as a significant increase in military industry expenditures is expected in the coming years. This year, due to base effects and the commissioning of new capacities, but with significant uncertainties, we expect a growth of around 5-6%, after last year’s 9.6%.

Hungarian Bankholding

Related news

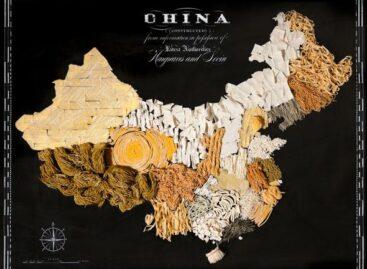

China’s industrial production and retail sales continued to grow in May

China’s industrial output continued to grow in May, but at…

Read more >Industrial production fell by 5.0 percent in April

In April 2025, the volume of industrial production fell by…

Read more >German industrial production fell in April

Industrial production in Germany fell more than expected in April,…

Read more >Related news

Corporate leaders’ commitment to sustainability at record level

According to the latest data from the K&H Sustainability Index,…

Read more >FAO food price index rose slightly in June due to higher prices of meat, dairy products and vegetable oils

The Food and Agriculture Organization of the United Nations (FAO)…

Read more >What can cause the price of a wine to increase tenfold?

There are fewer of them worldwide than the number of…

Read more >