The states would reduce the corporate income tax worldwide

The corporate income tax rate has declined by nearly a third in recent decades globally, according to the latest international analysis by the Tax Foundation covering 208 countries.

On average, in Europe, this tax is the lowest, while in Hungary it provides one of the most favorable investment environments in the region with its 9 percent ratio.

For nearly 40 years, the weighted average corporate tax rate has been steadily declining. According to the Tax Foundation’s analysis, it dropped from 38.8 percent in 1980 to 26.5 percent by 2018

Related news

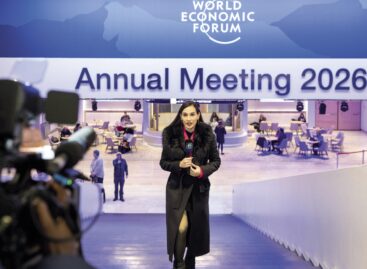

The keys to corporate growth in 2026: AI, acquisitions and rapid transformation

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Lidl guarantees fairer prices for cocoa farmers

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >(HU) METRO Gasztro Fesztivál a SIRHA Budapesten – Élmény, inspiráció és valódi megoldások a HoReCa-szakmának

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >