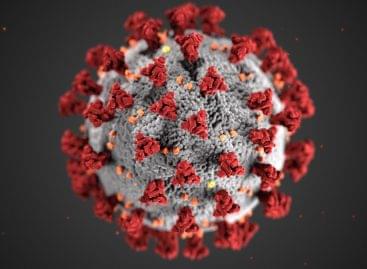

Consumers after COVID-19

The extreme lockdown of today will be eased at some point. However, shoppers will be different. Fear, suspicion remain so all contactless solutions, self-service kiosk or cashless payment stay popular.

Stores selling non-essential items around the world have closed or become depopulated, not meeting their customers in recent weeks. Mask-clad shoppers with covered faces, even in stores selling grocery, pack their baskets almost like zombies. The shopping experience is increasingly provided online.

The questions are, first, how long will the virus actually be here? And then, how long will it be in people’s psyches? The longer the impact, the more lingering the fear and the more evolution there will be of consumer processes.

On- and offline challanges

Most stores are closed now. Those stores that are open are limiting their hours and how many customers go in at a time. Meanwhile e-commerce has had its own struggles with fulfillment and delivery issues. All the energy of retailers active on both fronts is captured by efficient operation. However, behind closed boards, many are already planning reopening opportunities, rearrangements, concept or design changes, digital developments, real omnichannel action. Whoever hits the preferences of post-epidemic shoppers best can expect great success.

The less is more

Although subdued need will emerge as intense demand in the post-epidemic period, restrictions and the crisis will force shoppers into prudent consumption.

„There’s likely to be pent-up demand, but possibly tempered by a new appreciation for consuming less, especially as a recession bears down. “I think that a lot of people are going to realize that they don’t need as much. We have missed an entire month already that we’re never going to get back. And people are pressured financially because they’re losing their jobs and preparing for a recession. On the other hand, the social distancing and deprivation is really intense — perhaps the restaurants and bars will be the first to recover.” says Thomai Serdari, a professor of luxury marketing and branding at New York University’s Stern School of Business.

Cleanliness, disinfection and visibility

Cleaning and regular disinfection come to the fore, as well as built-in, automatic solutions that spectacularly ensure virus and bacteria clearance and a sense of cleanliness. Recent research shows that 87% of U.S. shoppers prefer contactless and self-service solutions when shopping. Many people don’t want to touch the touch screen and devices that others may have touched before them, so it’s a good idea to unload a disinfectant wipe or provide voice control. The drive-tru, curbside pickup, pickup points and other forms of receipt introduced under the restrictions are likely to enjoy unbroken popularity. These solutions can dispel fears and reassure customers, so shopping will once again be a source of experience and joy.

Brands are calling

Even when the shops are closed, you have to look for contact with consumers, the brand has to live. We are seeing more and more examples around the world where brands are launching live online concerts, support esports, amateur art appearances, quiz games, online style advice, charitable activity and similar engagement initiatives.

Health is wealth

If shoppers come out of their houses expecting more from retailers and brands, that will still include sustainability. Be good for body, soul, environment, producers, distributors and consumers, the product and the whole process.

Wellness categories can still be expected to be very popular, of growing interest, and a guarantee of everyday luxury and well-being.

Kátai Ildikó

Related news

This is how Hungarian researchers model epidemics

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Strict regulations and measures remain in place due to the COVID-19 virus

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The eradication of colonies infected with RSZKF disease has been completed

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Emotions, stories, authenticity – these were the deciding factors in 2025

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Cleaner than clean

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Nestlé, Planet A Foods team up for cocoa-free brand launch in Germany

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >