Migration between channels

The question “Are we going to have a bad year?” was subject to lively debate at the meeting of Trade Marketing Klub. Krisztina Kovács Consumer Tracking manager of Gfk, spoke about the analysis which showed that modern sales channels continued to improve their position in 2006. Hyper markets, discount chains, supermarkets and C+C increased their combined market share by 1,9 per cent. Supermarkets and discount stores increased their sales by 1,5 per cent, while hyper markets showed stagnation with growth of only 0,1 per cent. Average spending per store visit was HUF 1699 in 2006, compared to HUF 1630 in 2005. A lot of purchasing power flowed away from hyper markets into other modern channels. Supermarkets profited most from this trend. Supermarkets also succeeded in taking away purchasing power from chains of small stores. The main driving force behind the growth of discount stores was the expansion in the total volume of sales as a result of more frequent visits (54 times per year, compared to 52 in 2005) and of more money spent during shopping. In general, a lot of purchasing power is drained from small stores by modern stores, while chains of small stores also take a lot of sales from independent stores. Weekend shopping (Fridays and Saturdays) still dominates and its proportion shows increase. Three out of four shopping visits take place before 12.00, accounting for 54 per cent of daily sales. Bank cards were used for payment in 13 per cent of all purchases, showing an increase of 1 per cent compared to 2005. Éva Nevihostényi, marketing director of Nielsen, pointed out that consumers are becoming more sensitive to promotions. Most consumers prefer to buy everything they can in two or three stores. Only one out of four consumers go into stores they see impulsively to buy something. Ease of access and a good price/value ratio is a major consideration for most consumers. According to the Nielsen Shopper Trends survey, practically all consumers are aware of the existence of private labels and three-quarters of them have purchased such products during the month before the survey was prepared. The percentage of consumers who keep changing stores on the basis of promotions has grown to 15 per cent. 53 per cent actively look for promotions. Only 10 per cent said that they are not influenced by promotional activities. 31 per cent of consumers spend most of their money in hyper markets and another 31 per cent in super markets . Traditional small stores still hold 23 per cent of the market. The percentage of people spending most of their money in discount stores has also risen from 9 to 11 per cent.

Related news

Related news

This year, Trade magazine is asking its readers for their opinions on Christmas TV commercials! Vote for yourself!

The audience voting takes place between December 12 and 19,…

Read more >FRUIT LOGISTICA 2025: The exhibition awaits visitors with numerous innovations

Representatives of the international fruit and vegetable trade will meet…

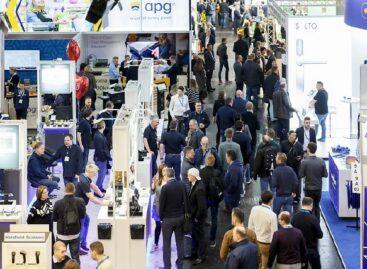

Read more >EuroCIS 2025: Serious interest in the retail technology trade fair

Amazon and TikTok recently signed an agreement that will allow…

Read more >