Saving money, searching online, hunting for deals – this is how Europe will shop in 2025

58% of European shoppers still don’t expect their purchasing power to improve – reveals a recent study by Shopfully conducted across eight European countries. The economic sentiment remains cautious, with purchasing decisions increasingly influenced by online information (82%) and promotions (90%). Two-thirds of Hungarian consumers actively hunt for deals – placing them among the most price-sensitive shoppers in Europe.

István Zsatkulák (Photo: Shopfully)

The majority of European consumers remain pessimistic about their purchasing power. According to the survey, 58% expect no improvement in their financial situation, while an additional 36% believe their purchasing power may improve, but they still feel compelled to save. The most pessimistic respondents are in France (71%), Hungary (64%), and Germany (63%). Despite falling inflation, economic uncertainty continues to weigh more heavily on consumer sentiment than positive macroeconomic indicators.

Value for money is the top priority for consumers. 70% of respondents cite quality and 65% cite price as their primary brand selection criteria. Hungarian shoppers are even more price-sensitive: 67% prioritise price over quality, which 62% still consider important.

Shoppers are more sensitive to promotions but spend less overall

“The study highlights a major shift in shopping habits toward awareness and frugality due to economic conditions. Promotions play a key role: nine out of ten Hungarian consumers say these significantly influence their decisions.”

– said István Zsatkulák, country manager at Shopfully Hungary and expert in digital flyer distribution.

More than half of European consumers (54%) are now more actively seeking discounts than a year ago, while 34% claim they shop more consciously overall. In Hungary, these figures are even higher: 66% of respondents pay closer attention to promotions, and 44% are spending less but more thoughtfully.

According to Shopfully, Hungarian consumers plan to cut back spending in several areas in 2025: 43% will spend less on home furnishings, 42% on electronics, 39% on clothing, and 37% on DIY products.

Digital presence has become the entry point to purchasing

The survey found that eight out of ten Hungarian shoppers (79%) search for information online before visiting a physical store. Among the most popular tools are digital catalogues, regularly used by 68% of respondents. This behaviour is known as ROPO (Research Online, Purchase Offline).

“Most people don’t even realise they’re following this pattern, yet the shopping process increasingly works this way. Retailers without a digital presence are simply falling behind – they won’t even enter the consumer’s consideration set, even if their store is across the street.”

– explained István Zsatkulák.

Hungarians lead Europe in self-checkout adoption

While retail technology is expanding – from chatbots and virtual fitting rooms to shopping assistants – European consumers remain slow to embrace it. Only 22% use such tools while shopping, and just 11% are open to trying them. The reason is simple: many don’t understand how these tools provide value.

“Hungarian figures may seem encouraging at first glance: 39% claim to use shopping technology. However, this figure is skewed by the exceptionally high 76% rate of self-checkout usage in Hungary, compared to the EU average of 69%.”

– said Shopfully’s expert, István Zsatkulák.

Consumer expectations are shaping the future of retail tech – the greatest impact is expected in price-driven areas. According to 67% of Hungarian respondents, the most valuable future solution will be one that helps identify the best offers in real time.

Personalisation is an opportunity – but trust remains a barrier

The survey found that 37% of Hungarian consumers believe store and online ads help them compare prices, and 36% use them to discover new products and offers.

However, personalised advertising still faces scepticism: despite its potential, acceptance remains low. 60% are wary of such content, most commonly citing the abundance of irrelevant ads (53%) as a concern.

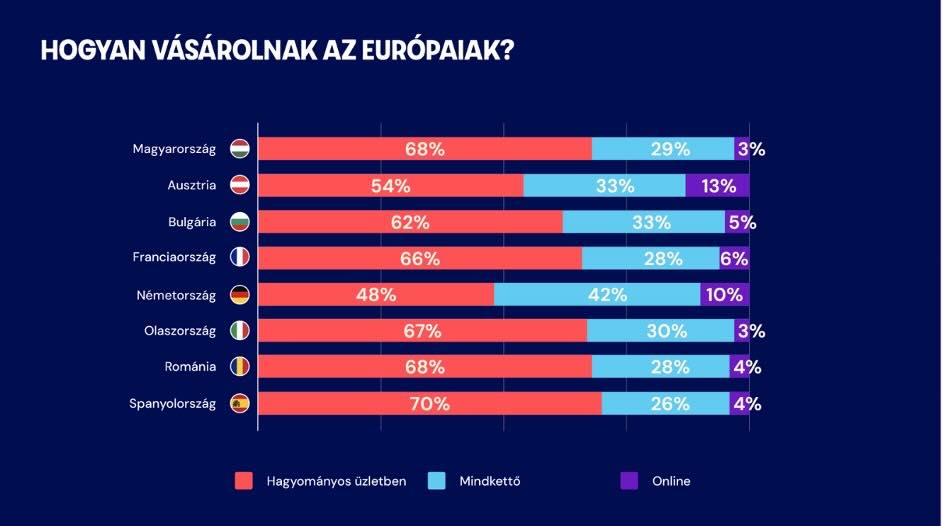

The future is omnichannel

“The research confirms: the line between online and offline channels has permanently blurred. The real question is no longer where consumers shop, but how they make their decisions – and the first step is increasingly online.”

– concluded István Zsatkulák.

Shoppers are seeking a combination of efficiency and personal experience, making omnichannel strategies essential for retailers. Success lies in highlighting value for money, prioritising promotions, and rebuilding consumer trust through relevant personalisation.

Related news

Related news

EY Businessman of the Year: Tibor Veres is the grand prize winner, six special awards were also given out

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Storck Hungária: new sales manager has arrived

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >