Nothing is certain in the world, except taxes – or are they not even certain anymore?

Coping with a dynamic and often unpredictable economic environment, effectively applying generative artificial intelligence in tax, and developing tax teams – these are the three key tasks facing tax leaders in the future. In its analysis Navigating the Forces of Change in Tax, KPMG summarizes the related research findings and trends and helps stakeholders prepare their companies for the future while complying with the constantly changing regulatory environment.

The global tax environment today is affected by both external and internal factors, which force companies to continuously adapt. Among the external challenges, the reduction in the tax base due to demographic changes, the weakening of trust in governments and tax systems, and the intensification of global tax competition, which reduces the willingness of countries to cooperate, play a decisive role.

The global tax environment today is affected by both external and internal factors, which force companies to continuously adapt. Among the external challenges, the reduction in the tax base due to demographic changes, the weakening of trust in governments and tax systems, and the intensification of global tax competition, which reduces the willingness of countries to cooperate, play a decisive role.

According to KPMG, tax leaders in companies are also under internal pressure. In the midst of ongoing financial transformation, cost efficiency is becoming increasingly important, which is complicated by the rapid pace of digitalization and the lack of tax expertise. Together, these factors pose a significant challenge to the efficient operation of tax functions.

Regulatory upheavals and geopolitical risks

The rapid pace of regulatory change is increasingly forcing adaptation. According to the KPMG 2024 CEO Outlook survey, 79 percent of respondents saw the introduction of trade regulations as having a negative impact on their company’s operations in the next three years. “Rising energy prices, the frequency of trade tariffs and the instability of local and international tax systems are forcing companies to rethink their global presence and supply chains. Tariff increases could not only lead to a slowdown in global trade, but could also reduce global economic growth and living standards in the long term,” says Zsolt Srankó, Partner at KPMG, Head of Tax and Legal.

There is also a lack of consensus on international tax policy. Many elements of the OECD BEPS (Base Erosion and Profit Shifting) initiative have not yet been implemented uniformly. While there has been agreement on a global minimum tax, there are still serious disputes on other issues. Meanwhile, the UN is also taking an active role in shaping international taxation, with particular regard to the interests of developing countries, such as the taxation of cross-border services.

Related news

MKIK seeks partnerships with businesses and government

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Eurozone economic growth accelerated in February

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

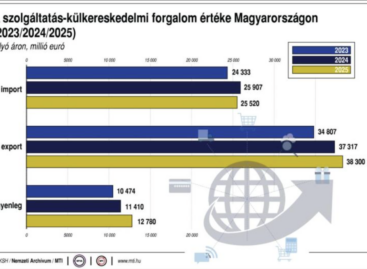

Read more >KSH: The foreign trade surplus in services was 3.1 billion euros in the fourth quarter of last year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Emotions, stories, authenticity – these were the deciding factors in 2025

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Dreher prepared messages from fathers for Women’s Day

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >IVSZ and WiTH are looking for female role models in the digital profession again this year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >